Region:Middle East

Author(s):Shubham

Product Code:KRAD1001

Pages:90

Published On:November 2025

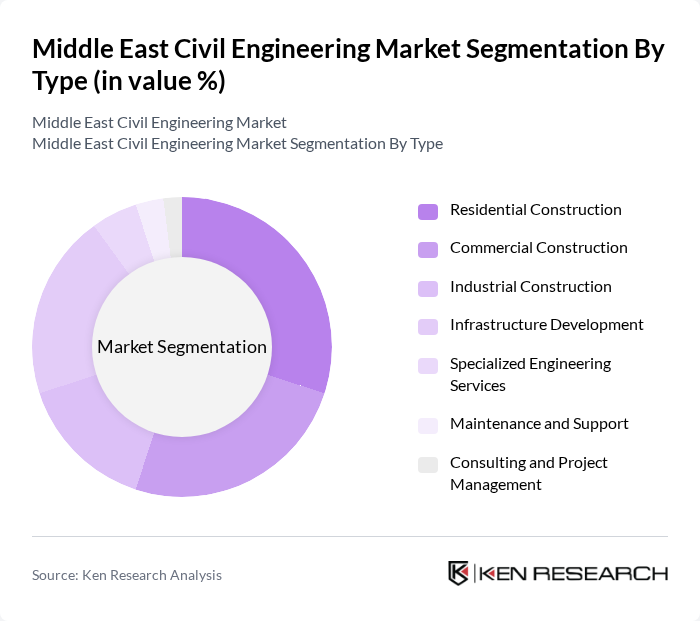

By Type:The civil engineering market can be segmented into various types, includingResidential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Specialized Engineering Services, Maintenance and Support, and Consulting and Project Management. Each of these segments plays a crucial role in the overall market dynamics, with specific trends and consumer behaviors influencing their growth. Residential and infrastructure development segments are particularly influenced by government housing programs, urban migration, and smart city initiatives, while specialized engineering services are driven by demand for advanced technical solutions and project management expertise.

TheResidential Constructionsegment is currently dominating the market due to the increasing demand for housing driven by population growth and urban migration. This segment has seen a significant rise in investment as governments and private developers focus on building affordable housing to meet the needs of a growing population. Additionally, the trend towards smart homes and sustainable living is further propelling this segment's growth, as consumers seek modern amenities and energy-efficient solutions.

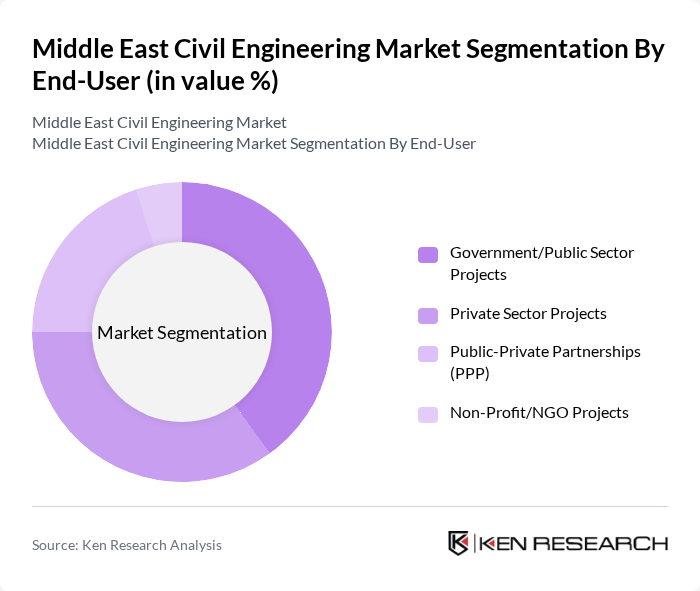

By End-User:The market can also be segmented by end-user categories, includingGovernment/Public Sector Projects, Private Sector Projects, Public-Private Partnerships (PPP), and Non-Profit/NGO Projects. Each of these categories has distinct funding sources and project scopes, influencing their respective market dynamics. Government and public sector projects continue to lead due to sovereign funding, long-term planning, and national infrastructure priorities, while PPPs are expanding in utilities and digital infrastructure.

TheGovernment/Public Sector Projectssegment leads the market due to substantial government funding and initiatives aimed at enhancing infrastructure and public services. This segment benefits from long-term planning and large-scale projects, such as transportation networks and public facilities, which are essential for national development. The focus on improving public infrastructure and services continues to drive investments in this segment, making it a key player in the civil engineering market.

The Middle East Civil Engineering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabtec Construction LLC, ACC (Arabian Construction Company), Saudi Binladin Group, El Seif Engineering Contracting Company, Consolidated Contractors Company (CCC), Strabag SE, Al Habtoor Group, Drake & Scull International PJSC, KEO International Consultants, Hill International, Bechtel Corporation, Parsons Corporation, Hassan Allam Holding, Nesma & Partners Contracting Co. Ltd., ACWA Power, Webuild S.p.A., Samsung C&T Corporation, Vinci Construction, Bouygues Construction, AECOM, WSP Global Inc., Turner Construction Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East civil engineering market appears promising, driven by ongoing urbanization and substantial government investments in infrastructure. As cities expand and modernize, the demand for innovative construction solutions will increase. Additionally, the integration of smart technologies and sustainable practices will shape the industry, enhancing efficiency and environmental responsibility. The focus on public-private partnerships will further facilitate project financing, enabling the realization of ambitious infrastructure goals across the region, thus fostering long-term growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial Construction Industrial Construction Infrastructure Development Specialized Engineering Services Maintenance and Support Consulting and Project Management |

| By End-User | Government/Public Sector Projects Private Sector Projects Public-Private Partnerships (PPP) Non-Profit/NGO Projects |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Other Middle East Countries (Iran, Israel, Turkey, Yemen) |

| By Technology | Traditional Construction Methods Advanced Construction Technologies (BIM, 3D Printing, Robotics) Sustainable/Green Construction Technologies Prefabricated and Modular Construction |

| By Application | Transportation Infrastructure (Roads, Bridges, Railways, Airports, Ports) Utilities Infrastructure (Water, Power, Gas, Telecom) Social Infrastructure (Schools, Hospitals, Defense, Public Buildings) Industrial and Energy Projects (Oil & Gas, Industrial Parks, Refineries) |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Policy Support | Subsidies for Sustainable Practices Tax Incentives Regulatory Support for Innovation Export Credit and Risk Mitigation Tools |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 120 | Project Managers, Civil Engineers |

| Residential Construction Sector | 90 | Architects, Construction Supervisors |

| Commercial Building Projects | 70 | Real Estate Developers, Urban Planners |

| Public Works and Utilities | 60 | Government Officials, Infrastructure Analysts |

| Green Building Initiatives | 50 | Sustainability Consultants, Environmental Engineers |

The Middle East Civil Engineering Market is valued at approximately USD 205 billion, driven by rapid urbanization, government infrastructure investments, and a surge in construction activities across the region.