Region:Middle East

Author(s):Shubham

Product Code:KRAB8639

Pages:100

Published On:October 2025

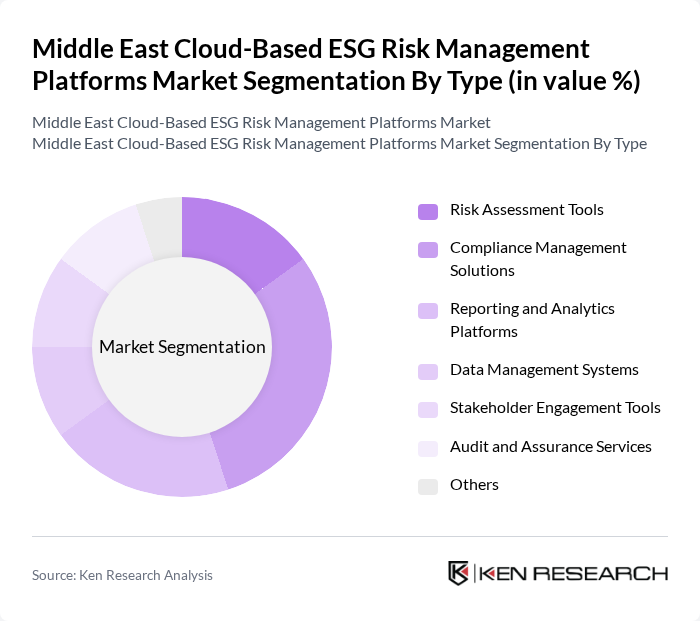

By Type:The market is segmented into various types of platforms that cater to different aspects of ESG risk management. The subsegments include Risk Assessment Tools, Compliance Management Solutions, Reporting and Analytics Platforms, Data Management Systems, Stakeholder Engagement Tools, Audit and Assurance Services, and Others. Among these, Compliance Management Solutions are currently leading the market due to the increasing regulatory requirements and the need for organizations to ensure adherence to ESG standards.

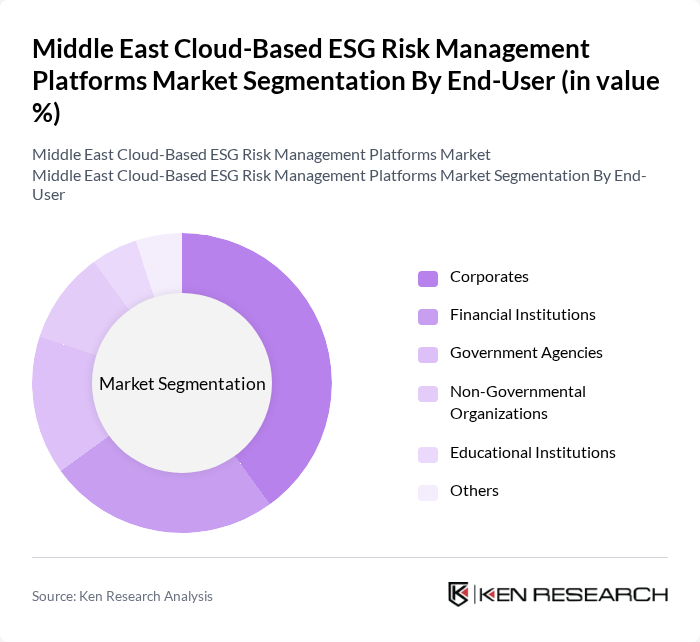

By End-User:The end-user segmentation includes Corporates, Financial Institutions, Government Agencies, Non-Governmental Organizations, Educational Institutions, and Others. Corporates are the dominant end-user segment, driven by the increasing need for businesses to manage their ESG risks and comply with regulatory requirements. The growing emphasis on corporate social responsibility (CSR) is also pushing companies to adopt ESG risk management platforms.

The Middle East Cloud-Based ESG Risk Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Enablon (Wolters Kluwer), Sphera Solutions, Inc., EcoVadis, Diligent Corporation, Gensuite LLC, Measurabl, Inc., Sustainalytics, Verisk Analytics, Inc., Schneider Electric, Carbon Trust, Trucost (S&P Global) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East cloud-based ESG risk management platforms market appears promising, driven by increasing regulatory demands and a growing emphasis on sustainability. As companies strive to enhance their ESG performance, the integration of advanced technologies like AI and machine learning will become more prevalent. Additionally, the collaboration between businesses and financial institutions is expected to foster innovation, leading to the development of tailored solutions that address specific regional challenges and enhance overall compliance.

| Segment | Sub-Segments |

|---|---|

| By Type | Risk Assessment Tools Compliance Management Solutions Reporting and Analytics Platforms Data Management Systems Stakeholder Engagement Tools Audit and Assurance Services Others |

| By End-User | Corporates Financial Institutions Government Agencies Non-Governmental Organizations Educational Institutions Others |

| By Industry Vertical | Energy and Utilities Manufacturing Financial Services Healthcare Transportation and Logistics Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Geographic Presence | GCC Countries Levant Region North Africa Others |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services ESG Integration | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Sustainability Practices | 80 | Healthcare Administrators, Sustainability Officers |

| Manufacturing Industry Risk Management | 70 | Operations Managers, Environmental Compliance Specialists |

| Energy Sector Cloud Solutions | 90 | IT Managers, ESG Analysts |

| Retail Sector ESG Reporting | 75 | Supply Chain Managers, Corporate Social Responsibility Heads |

The Middle East Cloud-Based ESG Risk Management Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by regulatory pressures and the increasing need for effective ESG risk management among businesses in the region.