Region:Middle East

Author(s):Shubham

Product Code:KRAD6691

Pages:91

Published On:December 2025

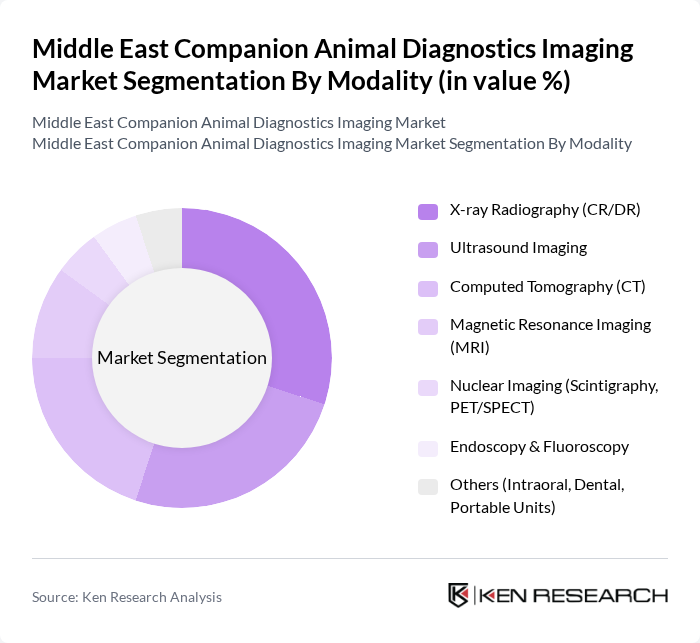

By Modality:The modalities in the companion animal diagnostics imaging market include various imaging techniques that are essential for accurate diagnosis and treatment of pets. The leading modalities are X-ray Radiography, Ultrasound Imaging, and Computed Tomography (CT), which are widely used due to their effectiveness and reliability in diagnosing various conditions in animals.

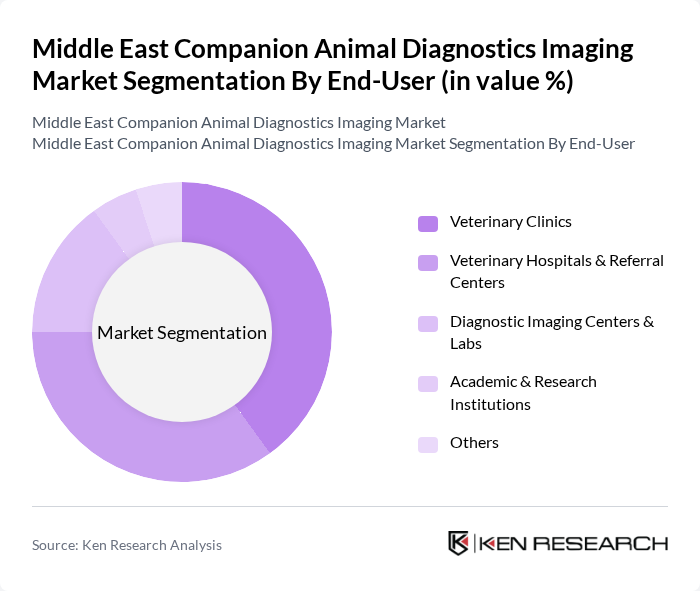

By End-User:The end-users of companion animal diagnostics imaging include various veterinary facilities that utilize imaging technologies for diagnosis and treatment. The primary end-users are veterinary clinics and hospitals, which are increasingly adopting advanced imaging modalities to enhance their diagnostic capabilities and improve patient outcomes.

The Middle East Companion Animal Diagnostics Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as IDEXX Laboratories, Inc., Heska Corporation (Antech Diagnostics), Agfa-Gevaert Group, Siemens Healthineers AG, Canon Medical Systems Corporation, FUJIFILM Holdings Corporation, GE HealthCare Technologies Inc., Mindray Bio-Medical Electronics Co., Ltd., Carestream Health, Inc., Hallmarq Veterinary Imaging Ltd, Esaote S.p.A., SOUND Technologies (VCA Inc.), VetRay Technology by Sedecal, Shenzhen Wisonic Medical Technology Co., Ltd., BCF Technology Ltd (IMV Imaging) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East companion animal diagnostics imaging market appears promising, driven by technological advancements and increasing pet ownership. The integration of artificial intelligence in diagnostic imaging is expected to enhance accuracy and efficiency, while the expansion of telemedicine for pets will improve access to veterinary care. As pet owners continue to prioritize animal health, the demand for innovative diagnostic solutions will likely grow, fostering a more robust market environment in future.

| Segment | Sub-Segments |

|---|---|

| By Modality | X-ray Radiography (CR/DR) Ultrasound Imaging Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Nuclear Imaging (Scintigraphy, PET/SPECT) Endoscopy & Fluoroscopy Others (Intraoral, Dental, Portable Units) |

| By End-User | Veterinary Clinics Veterinary Hospitals & Referral Centers Diagnostic Imaging Centers & Labs Academic & Research Institutions Others |

| By Animal Type | Dogs Cats Equine Other Companion Animals (Rabbits, Birds, Exotic Pets) |

| By Clinical Application | Orthopedic & Musculoskeletal Oncology Cardiology Neurology Dentistry Others (Abdominal, Reproductive, Soft Tissue) |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Israel Rest of Middle East |

| By Technology | Digital Imaging (DR/Flat Panel Detectors) Computed Radiography Analog/Film-based Imaging D & Advanced Imaging (4D, Cone-beam CT) |

| By Distribution Channel | Direct Sales to End-Users Regional Distributors & Dealers OEM Partnerships & System Integrators Online & E-commerce Channels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Offering Imaging Services | 120 | Veterinarians, Clinic Managers |

| Pet Owners Utilizing Diagnostic Imaging | 100 | Pet Owners, Animal Caregivers |

| Diagnostic Imaging Equipment Suppliers | 40 | Sales Representatives, Product Managers |

| Veterinary Associations and Regulatory Bodies | 50 | Policy Makers, Industry Experts |

| Animal Health Researchers and Academics | 60 | Researchers, University Professors |

The Middle East Companion Animal Diagnostics Imaging Market is valued at approximately USD 45 million, reflecting a significant growth driven by increased pet ownership, heightened awareness of animal health, and advancements in diagnostic imaging technologies.