Region:Middle East

Author(s):Geetanshi

Product Code:KRAA5958

Pages:89

Published On:January 2026

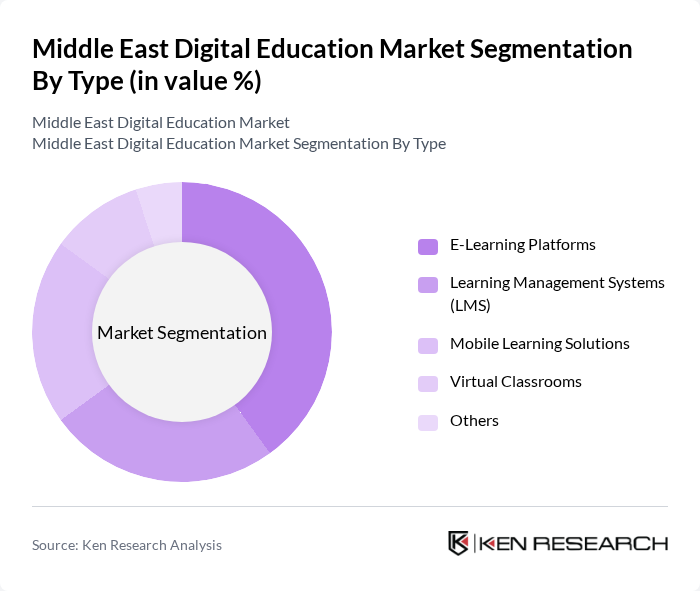

By Type:The digital education market is segmented into various types, including Online Courses, Learning Management Systems (LMS), Virtual Classrooms, Educational Apps, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, catering to diverse learning needs. The demand for LMS has also surged as educational institutions seek to streamline their administrative processes and enhance student engagement through integrated platforms.

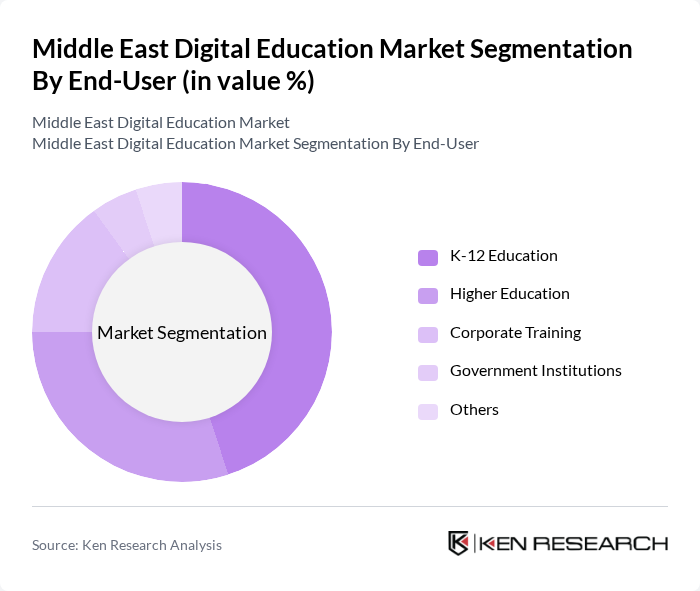

By End-User:The market is further segmented by end-users, including K-12 Schools, Higher Education Institutions, Corporate Training, Government Programs, and Others. K-12 Schools dominate this segment as they increasingly adopt digital solutions to enhance learning experiences and improve educational outcomes. Higher Education Institutions are also significant players, leveraging digital tools to facilitate remote learning and expand their reach to a broader audience.

The Middle East Digital Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udacity, Edraak, FutureLearn, Khan Academy, Blackboard, Skillshare, LinkedIn Learning, Duolingo, Pluralsight, Teachable, Moodle, Google Classroom, Microsoft Teams for Education, and Edmodo contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East digital education market is poised for significant transformation driven by technological advancements and increasing internet penetration. With internet access projected to reach 82.35% in MENA in future, educational platforms will likely expand their reach. Additionally, the rapid growth of data centre capacity and cloud services will facilitate the deployment of innovative educational technologies, including AI-driven personalized learning solutions, enhancing the overall learning experience for students across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Learning Management Systems (LMS) Virtual Classrooms Educational Apps Others |

| By End-User | K-12 Schools Higher Education Institutions Corporate Training Government Programs Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology | Cloud-Based Solutions Mobile Learning Technologies Artificial Intelligence Tools Augmented Reality/Virtual Reality Others |

| By Application | Skill Development Professional Certification Language Learning Test Preparation Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Educational Grants Tax Incentives for EdTech Companies Subsidies for Digital Learning Tools Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 150 | University Administrators, IT Directors |

| K-12 Schools | 100 | School Principals, Curriculum Coordinators |

| EdTech Companies | 80 | Product Managers, Business Development Executives |

| Government Education Departments | 60 | Policy Makers, Education Analysts |

| Students and Parents | 120 | High School Students, Parents of K-12 Students |

The Middle East Digital Education Market is valued at approximately USD 11 billion, driven by government digital transformation initiatives, increased internet and smartphone penetration, and a growing demand for personalized, AI-driven learning solutions across various educational sectors.