Region:Middle East

Author(s):Rebecca

Product Code:KRAD6219

Pages:98

Published On:December 2025

Market.png)

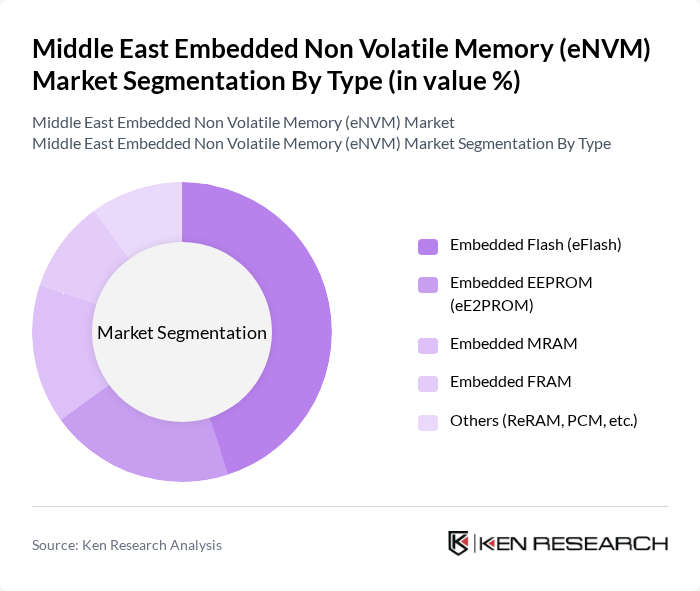

By Type:The eNVM market can be segmented into various types, including Embedded Flash (eFlash), Embedded EEPROM (eE2PROM), Embedded MRAM, Embedded FRAM, and Others (ReRAM, PCM, etc.). This structure aligns with global embedded non-volatile memory categorization, where eFlash is used extensively for code storage and data logging, eE2PROM for configuration and small data blocks, FRAM for fast-write and high endurance, MRAM for high-speed and radiation-resistant applications, and ReRAM/PCM as emerging next-generation options. Among these, Embedded Flash (eFlash) is the leading sub-segment due to its widespread use in consumer electronics, microcontrollers, and automotive applications, where high-speed data access, firmware storage, and reliability are critical. The increasing adoption of smart devices and the Internet of Things (IoT), which rely heavily on embedded MCUs with integrated flash and other eNVM blocks, further bolsters the demand for eFlash solutions in the Middle East.

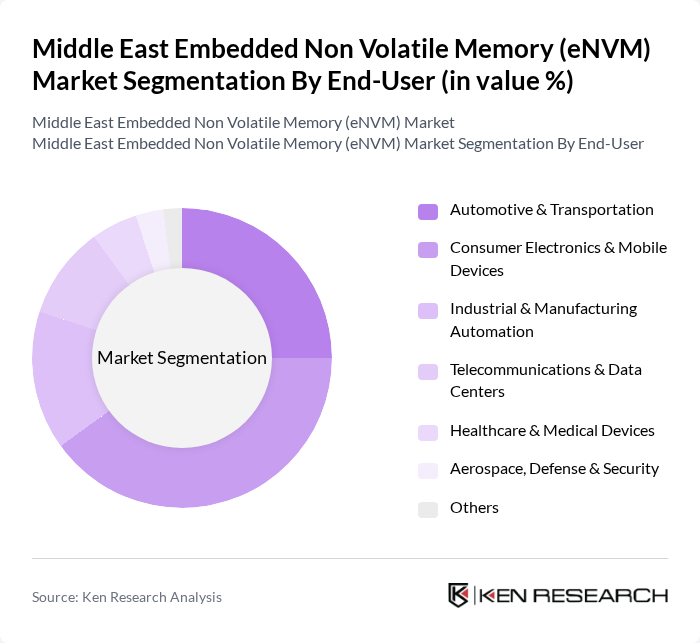

By End-User:The eNVM market is segmented by end-user applications, including Automotive & Transportation, Consumer Electronics & Mobile Devices, Industrial & Manufacturing Automation, Telecommunications & Data Centers, Healthcare & Medical Devices, Aerospace, Defense & Security, and Others. This end-use structure reflects the global deployment of embedded non-volatile memory in automotive ECUs and ADAS, consumer devices, factory automation controllers, base stations, servers, medical electronics, and mission-critical defense systems. The Consumer Electronics & Mobile Devices segment holds the largest share, driven by the increasing demand for smartphones, tablets, wearables, smart home devices, and connected consumer products that require efficient and reliable on-chip memory solutions. The automotive sector is also witnessing significant growth due to the rise of electric vehicles, advanced driver-assistance systems (ADAS), digital cockpits, and over-the-air updatable control units, all of which depend on high-reliability eNVM technologies.

The Middle East Embedded Non Volatile Memory (eNVM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Micron Technology, Inc., Samsung Electronics Co., Ltd., SK hynix Inc., Intel Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Texas Instruments Incorporated, Infineon Technologies AG, Renesas Electronics Corporation, Microchip Technology Inc. (incl. former Atmel eNVM portfolio), Cypress Semiconductor (Infineon Technologies AG), Western Digital Corporation, Kioxia Corporation, Tower Semiconductor Ltd., G42 Cloud (UAE) – Regional Data Center & Semiconductor Ecosystem Player contribute to innovation, geographic expansion, and service delivery in this space.

The future of the eNVM market in the Middle East appears promising, driven by technological advancements and increasing demand across various sectors. As consumer electronics and automotive industries continue to evolve, the integration of eNVM solutions will become more prevalent. Additionally, the rise of smart city initiatives and IoT applications will further propel the market. Companies that invest in innovative technologies and adapt to changing consumer needs will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Embedded Flash (eFlash) Embedded EEPROM (eE2PROM) Embedded MRAM Embedded FRAM Others (ReRAM, PCM, etc.) |

| By End-User | Automotive & Transportation Consumer Electronics & Mobile Devices Industrial & Manufacturing Automation Telecommunications & Data Centers Healthcare & Medical Devices Aerospace, Defense & Security Others |

| By Application | Microcontrollers & SoCs IoT & Edge Devices Automotive ADAS & Powertrain Control Smart Cards, Identification & Secure Elements Wearables & Smart Consumer Devices Others |

| By Distribution Channel | Direct Sales to OEMs Authorized Distributors Online Semiconductor Distributors Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology Node | ?90 nm nm – 40 nm nm – 22 nm <22 nm |

| By Policy Support | Government Grants & Subsidies Tax Incentives & Customs Relief R&D and Innovation Funding Local Manufacturing & Talent Development Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Supply Chain Analysts |

| Automotive Electronics Suppliers | 90 | Engineering Managers, Procurement Specialists |

| Industrial Automation Firms | 80 | Operations Managers, Technology Directors |

| Research Institutions and Universities | 60 | Academic Researchers, Technology Transfer Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Middle East Embedded Non Volatile Memory (eNVM) Market is valued at approximately USD 1.1 billion, driven by the increasing demand for high-performance memory solutions across various sectors, including consumer electronics, automotive applications, and IoT devices.