Region:Middle East

Author(s):Geetanshi

Product Code:KRAE5586

Pages:90

Published On:December 2025

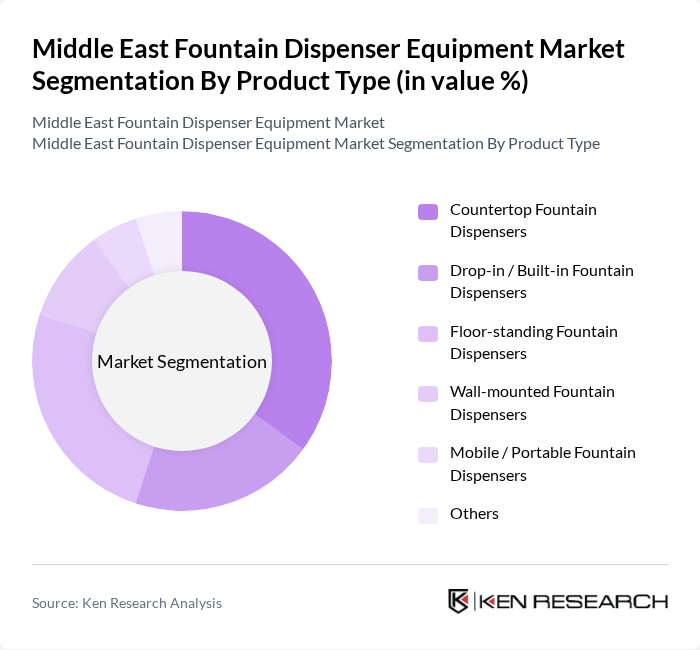

By Product Type:The product type segmentation includes various categories of fountain dispensers that cater to different consumer needs and preferences. The dominant sub-segment in this category is the Countertop Fountain Dispensers, which are favored for their compact design and ease of use in limited spaces. These dispensers are widely used in quick-service restaurants and cafes, where space optimization is crucial. Other notable sub-segments include Floor-standing and Wall-mounted Fountain Dispensers, which are popular in larger venues due to their capacity and visibility.

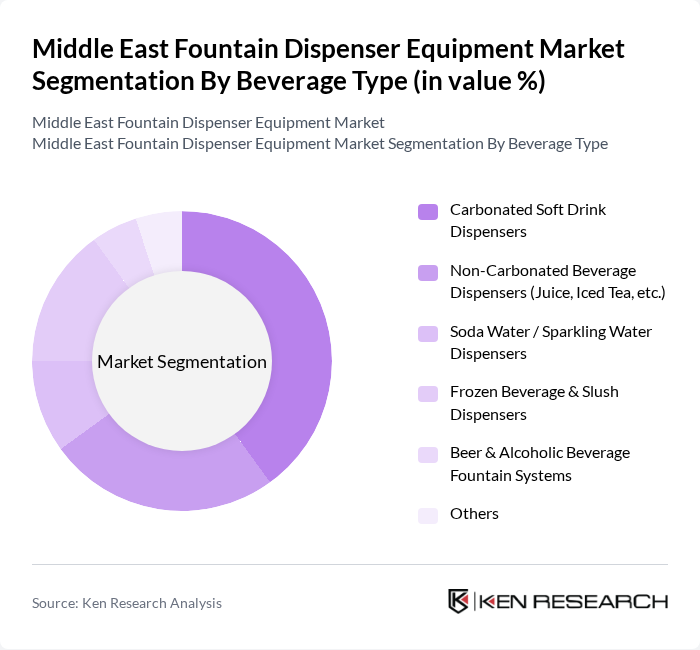

By Beverage Type:The beverage type segmentation encompasses a variety of dispensing solutions tailored to different beverage categories. Carbonated Soft Drink Dispensers lead this segment, driven by the high demand for soft drinks in fast-food outlets and entertainment venues. Non-Carbonated Beverage Dispensers, including juice and iced tea options, are also gaining traction as consumer preferences shift towards healthier choices. The Frozen Beverage & Slush Dispensers are popular in warmer climates, while Beer & Alcoholic Beverage Fountain Systems cater to the growing nightlife and hospitality sectors.

The Middle East Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lancer Corporation, Cornelius, Inc., Manitowoc Beverage Systems, PepsiCo, Inc. (foodservice fountain operations), The Coca-Cola Company (fountain equipment & dispensing solutions), Middleby Corporation, Hoshizaki Corporation, ITW Food Equipment Group, Ali Group S.r.l., FETCO, Wilbur Curtis Company, Franke Group, Tetra Pak (Beverage Dispensing Solutions), regional stainless steel fabrication & dispensing OEMs, selected local Middle East fountain equipment integrators & service providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East fountain dispenser equipment market appears promising, driven by ongoing technological innovations and a shift towards automated solutions. As consumer preferences evolve, businesses are likely to invest in smart dispensers that offer customization and personalization. Furthermore, the increasing focus on sustainability will push manufacturers to develop eco-friendly solutions, aligning with regional environmental goals. The hospitality sector's growth will also create new opportunities for market expansion, particularly in untapped areas.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Countertop Fountain Dispensers Drop-in / Built-in Fountain Dispensers Floor-standing Fountain Dispensers Wall-mounted Fountain Dispensers Mobile / Portable Fountain Dispensers Others |

| By Beverage Type | Carbonated Soft Drink Dispensers Non-Carbonated Beverage Dispensers (Juice, Iced Tea, etc.) Soda Water / Sparkling Water Dispensers Frozen Beverage & Slush Dispensers Beer & Alcoholic Beverage Fountain Systems Others |

| By End-User | Quick Service Restaurants (QSRs) & Fast Food Chains Full-Service Restaurants & Cafes Cinemas, Entertainment & Leisure Venues Hotels, Resorts & Catering Services Corporate & Institutional (Offices, Education, Healthcare) Others |

| By Technology | Manual / Mechanical Fountain Dispensers Semi-Automatic Fountain Dispensers Fully Automatic Fountain Dispensers Smart / IoT-Enabled Fountain Dispensers Energy-Efficient & Eco-Design Systems Others |

| By Distribution Channel | Direct Sales (OEM to End-User) Distributors & Dealers Online (E-commerce & OEM Portals) Specialized Equipment Retailers Others |

| By Installation Environment | Indoor Installations Outdoor Installations Drive-Thru & On-the-Go Formats Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Rest of Middle East & North Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fountain Dispenser Usage | 110 | Facility Managers, Procurement Officers |

| Residential Fountain Dispenser Adoption | 85 | Homeowners, Property Managers |

| Institutional Fountain Dispenser Insights | 75 | School Administrators, Hospital Facility Managers |

| Market Trends in Hospitality Sector | 95 | Hotel Managers, Catering Service Providers |

| Regulatory Impact on Fountain Dispenser Market | 65 | Environmental Compliance Officers, Policy Makers |

The Middle East Fountain Dispenser Equipment Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for beverage dispensing solutions in the foodservice sector, particularly in quick-service restaurants and cafes.