Region:Middle East

Author(s):Rebecca

Product Code:KRAC2615

Pages:99

Published On:October 2025

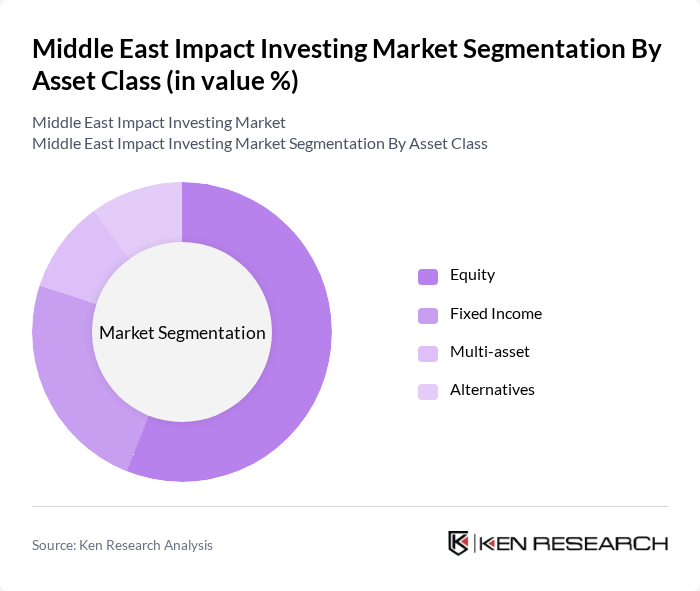

By Asset Class:

The asset class segmentation of the Middle East Impact Investing Market includes Equity, Fixed Income, Multi-asset, and Alternatives. Equity investments continue to lead the market, reflecting investor preference for higher returns and direct influence over corporate sustainability practices. The growing integration of environmental, social, and governance (ESG) criteria into investment strategies is driving increased allocations to equity, while Fixed Income is also gaining traction as investors seek stable returns with positive impact .

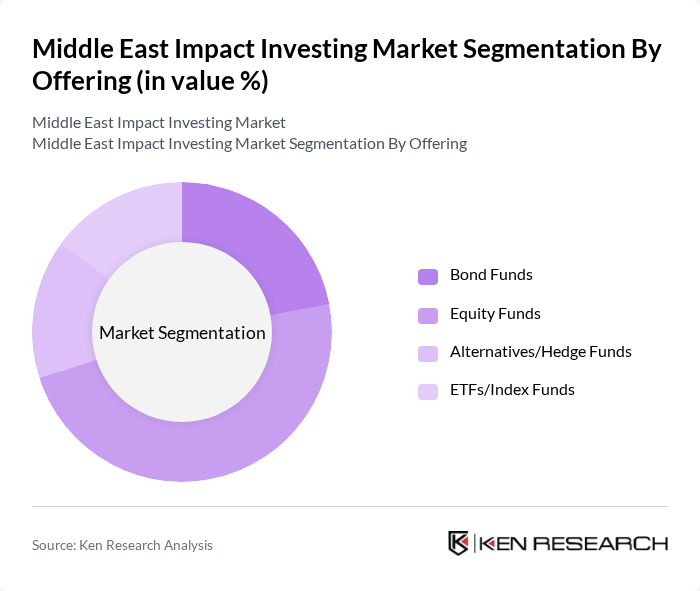

By Offering:

The offering segmentation includes Bond Funds, Equity Funds, Alternatives/Hedge Funds, and ETFs/Index Funds. Equity Funds remain the most prominent offering in the market, reflecting the region’s appetite for investments that combine financial performance with measurable social and environmental impact. The proliferation of impact-focused equity funds and the introduction of new sustainable bond products indicate a broadening range of options for impact-oriented investors .

The Middle East Impact Investing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Dubai Investments PJSC, Gulf Capital, Wamda Capital, Impact Hub Beirut, Alfanar, LeapFrog Investments, Vital Capital, Community Investment Management, Catalyst Partners Middle East, Qardy, The Rockefeller Foundation, The World Bank, The European Investment Bank, and United Nations Development Programme contribute to innovation, geographic expansion, and service delivery in this space.

The future of impact investing in the Middle East appears promising, driven by increasing collaboration between governments and private sectors. As awareness of social and environmental issues grows, more investors are likely to seek opportunities that align with their values. Additionally, advancements in technology will facilitate better impact measurement, enhancing transparency and accountability. The integration of ESG factors into investment strategies will further solidify the region's position as a leader in sustainable finance, attracting global investors and fostering innovation.

| Segment | Sub-Segments |

|---|---|

| By Asset Class | Equity Fixed Income Multi-asset Alternatives |

| By Offering | Bond Funds Equity Funds Alternatives/Hedge Funds ETFs/Index Funds |

| By Investment Style | Active Passive |

| By Investor Type | Retail Investors Institutional Investors |

| By End-Use Sector | Renewable Energy Sustainable Agriculture Micro-finance & MSME Lending Healthcare Ed-Tech & Vocational Training Sustainable Infrastructure |

| By Geography | GCC Countries Levant North Africa Cross-Border Initiatives |

| By Impact Measurement Methodology | Quantitative Metrics Qualitative Assessments Hybrid Approaches |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Impact Investment Funds | 100 | Fund Managers, Investment Analysts |

| Social Enterprises | 60 | Founders, Operations Managers |

| Institutional Investors | 50 | Portfolio Managers, Investment Directors |

| Government Agencies | 40 | Policy Makers, Economic Advisors |

| Beneficiaries of Impact Investments | 70 | Community Leaders, Program Participants |

The Middle East Impact Investing Market is valued at approximately USD 2.3 billion, reflecting a significant growth trend driven by increased awareness of social and environmental challenges and a rising demand for sustainable investment options.