Region:Middle East

Author(s):Rebecca

Product Code:KRAD4276

Pages:99

Published On:December 2025

Market.png)

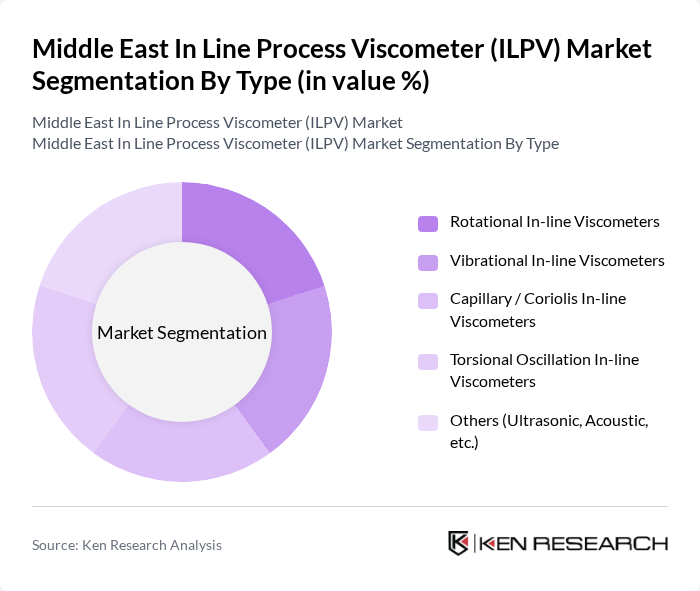

By Type:The market is segmented into various types of in-line viscometers, including Rotational In-line Viscometers, Vibrational In-line Viscometers, Capillary / Coriolis In-line Viscometers, Torsional Oscillation In-line Viscometers, and Others (Ultrasonic, Acoustic, etc.). Among these, Rotational In-line Viscometers are among the widely used technologies due to their versatility and accuracy in measuring a wide range of fluid viscosities. The increasing demand for precise viscosity control in industries such as oil and gas and food processing drives the growth of this segment.

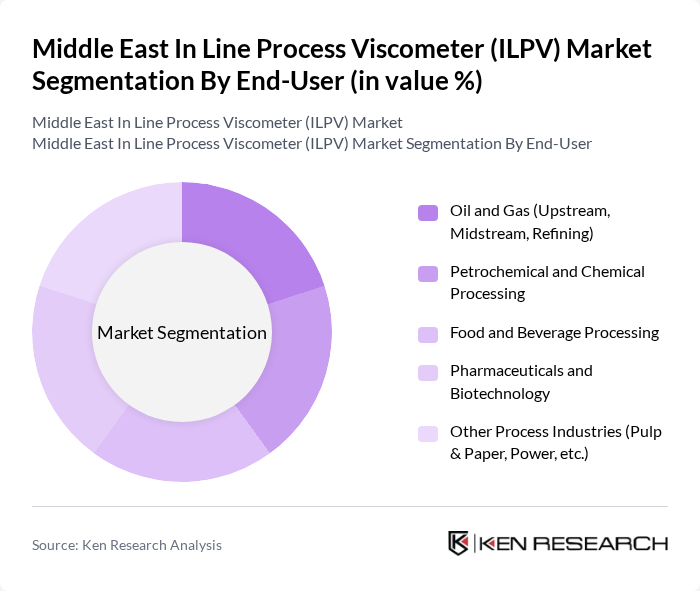

By End-User:The end-user segmentation includes Oil and Gas (Upstream, Midstream, Refining), Petrochemical and Chemical Processing, Food and Beverage Processing, Pharmaceuticals and Biotechnology, and Other Process Industries (Pulp & Paper, Power, etc.). The Oil and Gas sector is the leading end-user of ILPVs, driven by the need for accurate viscosity measurements in various processes, including refining and transportation. The increasing focus on efficiency and safety in this sector further enhances the demand for advanced viscometer technologies.

The Middle East In Line Process Viscometer (ILPV) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co., Endress+Hauser AG, KROHNE Messtechnik GmbH (KROHNE Group), Yokogawa Electric Corporation, ABB Ltd., Anton Paar GmbH, Rheology Solutions Pty Ltd (Regional Channel Partners where applicable), AMETEK, Inc. (Including Brookfield Technical Segment), Parker Hannifin Corporation (Including In-line Fluid Sensing Solutions), VAF Instruments B.V., PROTEGO (Elaflex Hiby Group) – Process Measurement & Control Solutions, Brookfield (Ametek Brookfield), Cambridge Viscosity, Inc. (A PAC LP Company), Sofraser (Anais Instruments Group), Viscotek / Malvern Panalytical Ltd. (Relevant In-line Rheology Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East ILPV market appears promising, driven by technological advancements and increasing industrial automation. As industries prioritize efficiency and quality, the integration of smart technologies, including IoT and AI, is expected to enhance the functionality of viscometers. Furthermore, the ongoing expansion of the oil and gas sector, coupled with rising investments in R&D, will likely create a conducive environment for innovation and growth, positioning ILPVs as essential tools in various manufacturing processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotational In-line Viscometers Vibrational In-line Viscometers Capillary / Coriolis In-line Viscometers Torsional Oscillation In-line Viscometers Others (Ultrasonic, Acoustic, etc.) |

| By End-User | Oil and Gas (Upstream, Midstream, Refining) Petrochemical and Chemical Processing Food and Beverage Processing Pharmaceuticals and Biotechnology Other Process Industries (Pulp & Paper, Power, etc.) |

| By Industry Application | Petroleum & Refining (Crude, Fuel Oils, Bitumen) Petrochemicals & Polymers Paints, Coatings & Inks Industrial Oils, Lubricants & Adhesives Food, Beverages & Dairy Fluids |

| By Measurement Range | Low Viscosity Fluids Medium Viscosity Fluids High Viscosity Fluids Extreme / Highly Viscous Fluids |

| By Technology | Digital In-line Viscometers Smart / IoT-enabled In-line Viscometers Conventional Analog In-line Viscometers Hybrid & Integrated Multivariable Systems |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, etc.) Rest of Middle East (Iran, Israel, Others) North Africa (Egypt and Other Countries) |

| By Customer Type | OEMs (Process Equipment & Skid Builders) End-Users (Refineries, Plants, Mills) Engineering, Procurement & Construction (EPC) Contractors Distributors & System Integrators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Applications | 120 | Process Engineers, Operations Managers |

| Chemical Manufacturing Processes | 90 | Quality Control Managers, R&D Directors |

| Food and Beverage Industry | 70 | Production Supervisors, Compliance Officers |

| Pharmaceutical Applications | 60 | Laboratory Technicians, Regulatory Affairs Specialists |

| Research and Development Facilities | 80 | Research Scientists, Technical Directors |

The Middle East In Line Process Viscometer (ILPV) Market is valued at approximately USD 30 million, based on historical analysis and market estimates. This value reflects the region's share within the broader Middle East & Africa market, which is projected to grow further.