Region:Middle East

Author(s):Shubham

Product Code:KRAB7837

Pages:82

Published On:October 2025

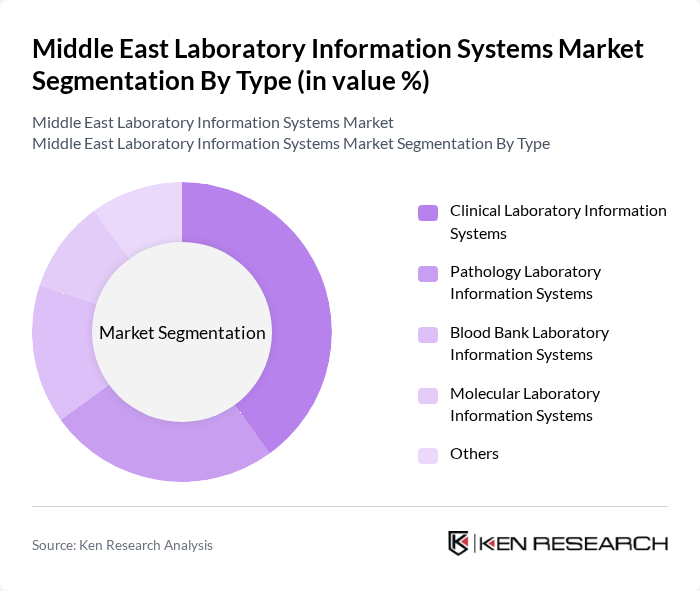

By Type:The market is segmented into various types, including Clinical Laboratory Information Systems, Pathology Laboratory Information Systems, Blood Bank Laboratory Information Systems, Molecular Laboratory Information Systems, and Others. Among these, Clinical Laboratory Information Systems are leading due to their widespread adoption in hospitals and diagnostic centers, driven by the need for efficient patient management and data accuracy.

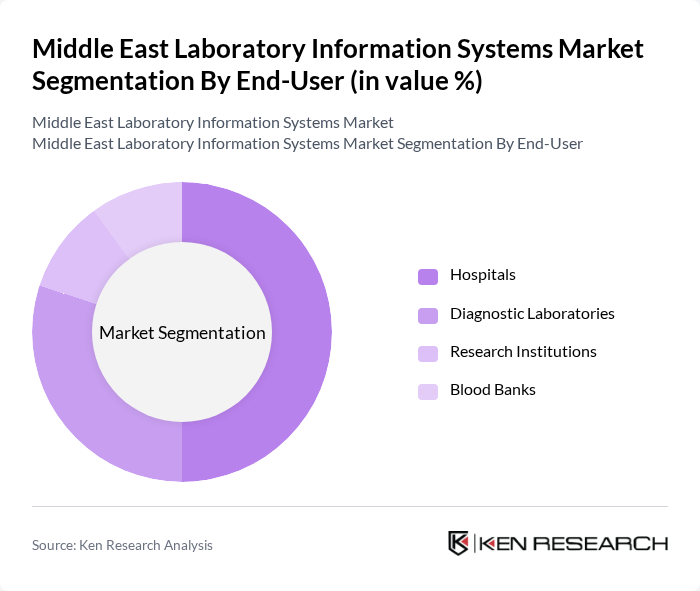

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, and Blood Banks. Hospitals are the dominant end-user segment, as they require comprehensive laboratory information systems to manage patient data, streamline operations, and enhance service delivery, particularly in emergency and critical care settings.

The Middle East Laboratory Information Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation, Siemens Healthineers, Meditech, Epic Systems Corporation, LabWare, Abbott Laboratories, Roche Diagnostics, Agilent Technologies, Sysmex Corporation, McKesson Corporation, QIAGEN N.V., Bio-Rad Laboratories, Ortho Clinical Diagnostics, Hologic, Inc., GE Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East laboratory information systems market appears promising, driven by technological advancements and increasing healthcare demands. As healthcare providers prioritize efficiency and patient-centric solutions, the integration of artificial intelligence and machine learning into laboratory systems is expected to enhance data analysis capabilities. Furthermore, the growing trend towards cloud-based solutions will facilitate easier access to data and improve collaboration among healthcare professionals, ultimately leading to better patient care and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Laboratory Information Systems Pathology Laboratory Information Systems Blood Bank Laboratory Information Systems Molecular Laboratory Information Systems Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Blood Banks |

| By Component | Software Services Hardware |

| By Deployment Mode | On-Premise Cloud-Based |

| By Application | Sample Management Data Management Reporting and Analytics |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | GCC Countries Levant Region North Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 150 | Laboratory Managers, IT Directors |

| Research Laboratories | 100 | Research Scientists, Data Analysts |

| Diagnostic Centers | 80 | Operations Managers, Quality Assurance Officers |

| Public Health Laboratories | 70 | Public Health Officials, Laboratory Technicians |

| Private Healthcare Facilities | 90 | Healthcare Administrators, Procurement Managers |

The Middle East Laboratory Information Systems Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for efficient healthcare services and advancements in laboratory automation technologies.