Middle East Luxury Furniture Boutiques Retail Market Overview

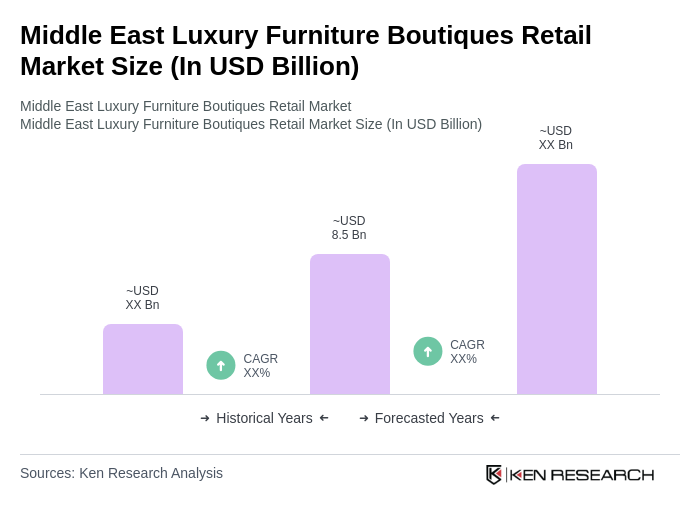

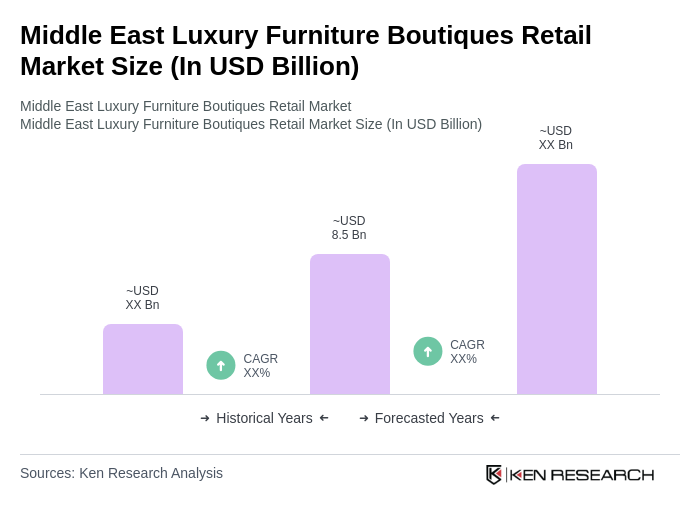

- The Middle East Luxury Furniture Boutiques Retail Market is valued at USD 8.5 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, an increasing number of high-net-worth individuals, and a growing interest in home aesthetics and interior design. The market has seen a surge in demand for premium and bespoke furniture, reflecting a shift towards personalized living spaces.

- Key players in this market include the UAE, Saudi Arabia, and Qatar, which dominate due to their affluent populations and a strong culture of luxury consumption. The UAE, particularly Dubai, is a hub for luxury retail, attracting international brands and consumers. Saudi Arabia's Vision 2030 initiative is also fostering growth in the luxury sector, while Qatar's investments in infrastructure and tourism are enhancing its market presence.

- In 2023, the UAE government implemented regulations to promote sustainable practices in the furniture industry. This includes guidelines for sourcing materials responsibly and reducing waste in production processes. The initiative aims to encourage manufacturers to adopt eco-friendly practices, aligning with global sustainability trends and enhancing the region's appeal to environmentally conscious consumers.

Middle East Luxury Furniture Boutiques Retail Market Segmentation

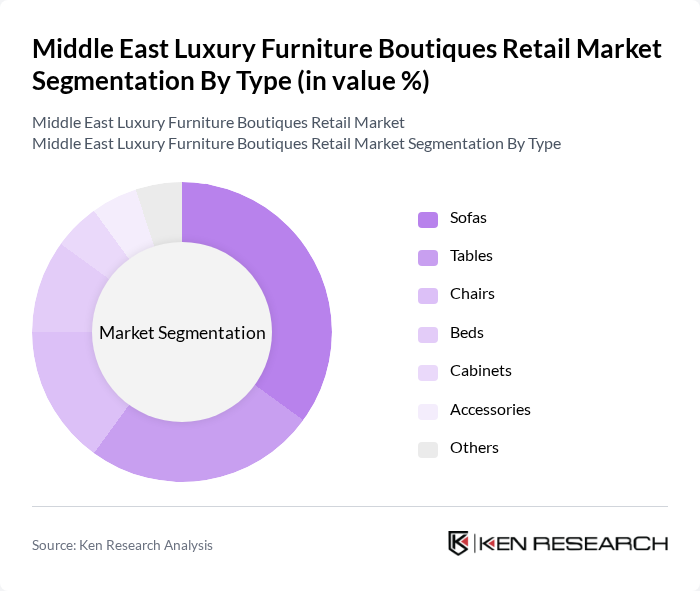

By Type:The market is segmented into various types of furniture, including sofas, tables, chairs, beds, cabinets, accessories, and others. Among these, sofas and tables are the most popular, driven by consumer preferences for comfort and functionality in living spaces. Sofas, in particular, dominate due to their central role in living room design, while tables serve both functional and aesthetic purposes in homes and commercial spaces.

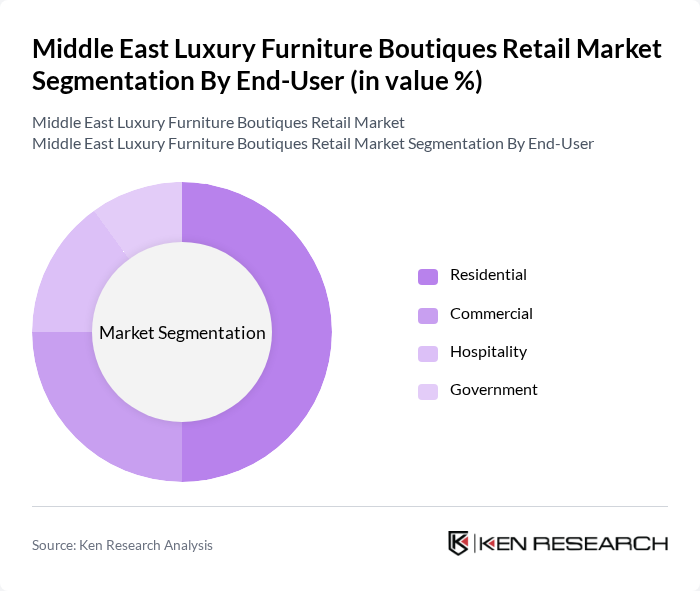

By End-User:The market is segmented by end-user categories, including residential, commercial, hospitality, and government. The residential segment leads the market, driven by increasing home ownership and a growing trend towards luxury home furnishings. The commercial segment is also significant, as businesses invest in high-quality furniture to enhance their brand image and customer experience.

Middle East Luxury Furniture Boutiques Retail Market Competitive Landscape

The Middle East Luxury Furniture Boutiques Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Habtoor Group, The One, Marina Home, IDdesign, Home Centre, Pottery Barn, Crate and Barrel, Roche Bobois, BoConcept, West Elm, Ligne Roset, Muji, IKEA, Natuzzi, Calligaris contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Luxury Furniture Boutiques Retail Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The Middle East has witnessed a significant rise in disposable income, with the average household income in the UAE reaching approximately $80,000 in future. This increase allows consumers to allocate more funds towards luxury items, including high-end furniture. As the region's economy continues to diversify, particularly in the Gulf Cooperation Council (GCC) countries, the purchasing power of consumers is expected to further enhance demand for luxury furniture, driving market growth.

- Rising Demand for Luxury Home Decor:The luxury home decor segment in the Middle East is projected to grow, with the market value estimated at $4 billion in future. This growth is fueled by a cultural shift towards home aesthetics, where consumers increasingly seek unique and high-quality furnishings. The trend is particularly pronounced among affluent millennials, who prioritize luxury and design, thus propelling the demand for boutique furniture retailers in the region.

- Growth in Real Estate and Hospitality Sectors:The real estate sector in the Middle East is expected to grow by 7% in future, driven by increased investments in residential and commercial properties. Concurrently, the hospitality sector is projected to see a 6% increase in new hotel openings, particularly in cities like Dubai and Riyadh. This expansion creates a robust demand for luxury furniture, as both sectors require high-quality furnishings to attract discerning clients and enhance overall aesthetics.

Market Challenges

- High Competition Among Luxury Brands:The Middle East luxury furniture market is characterized by intense competition, with over 250 established brands vying for market share. This saturation leads to price wars and aggressive marketing strategies, which can erode profit margins. Additionally, new entrants are continually emerging, making it challenging for existing brands to maintain their market position and customer loyalty amidst the fierce competition.

- Economic Fluctuations Affecting Consumer Spending:Economic instability in the region, influenced by fluctuating oil prices and geopolitical tensions, poses a significant challenge. For instance, the IMF projects a GDP growth rate of only 3% for the Middle East in future, which may lead to reduced consumer confidence and spending. As luxury items are often seen as discretionary, any economic downturn can adversely impact sales in the luxury furniture sector.

Middle East Luxury Furniture Boutiques Retail Market Future Outlook

The future of the Middle East luxury furniture market appears promising, driven by evolving consumer preferences and technological advancements. As e-commerce continues to expand, more consumers are expected to shop online for luxury items, enhancing accessibility. Additionally, the integration of smart technology in furniture design is likely to attract tech-savvy consumers, further stimulating market growth. The focus on sustainability will also shape product offerings, as consumers increasingly seek eco-friendly options in their purchasing decisions.

Market Opportunities

- Expansion of E-commerce Platforms:The e-commerce sector in the Middle East is projected to reach $30 billion by future, presenting a significant opportunity for luxury furniture boutiques. By enhancing their online presence and offering seamless shopping experiences, retailers can tap into a broader customer base, particularly among younger consumers who prefer online shopping for convenience and variety.

- Customization and Personalization Trends:The demand for customized furniture solutions is on the rise, with 65% of consumers expressing interest in personalized products. This trend allows luxury furniture retailers to differentiate themselves by offering bespoke services, catering to individual tastes and preferences. By leveraging this opportunity, brands can enhance customer satisfaction and loyalty, ultimately driving sales growth.