Region:Middle East

Author(s):Rebecca

Product Code:KRAD6090

Pages:100

Published On:December 2025

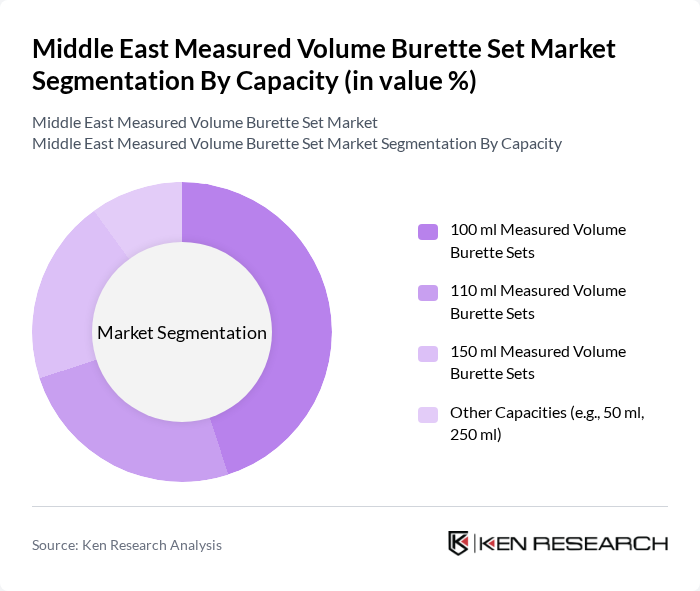

By Capacity:The market is segmented by capacity into various categories, including 100 ml, 110 ml, 150 ml, and other capacities such as 50 ml and 250 ml. The 100 ml measured volume burette sets are widely used in routine pediatric and general infusion applications because they offer an effective balance between dose accuracy and ease of handling in standard IV sets. The 150 ml sets are gaining traction, especially in critical care and high-dependency settings where larger controlled volumes are required, aligning with global trends in which the 150 ml capacity segment holds a leading share of measured volume burette usage.

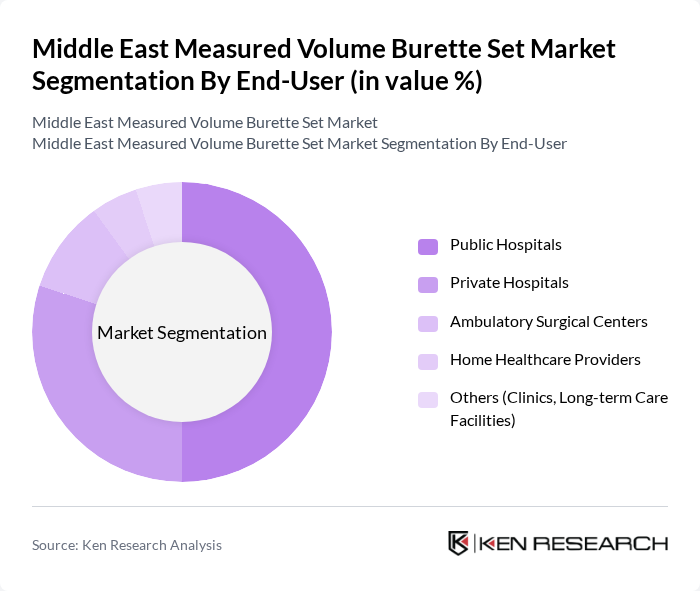

By End-User:The market is also segmented by end-user, which includes public hospitals, private hospitals, ambulatory surgical centers, home healthcare providers, and other facilities such as clinics and long-term care facilities. Public hospitals are the largest segment due to their extensive patient base, higher procedure volumes for pediatrics and critical care, and centralized procurement of infusion disposables. Private hospitals and ambulatory surgical centers are also significant contributors, driven by the increasing demand for outpatient surgeries, day-care procedures, and adherence to international accreditation standards that emphasize accurate fluid management and infusion safety.

The Middle East Measured Volume Burette Set Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Baxter International Inc., Terumo Corporation, Smiths Medical (ICU Medical, Inc.), Fresenius Kabi AG, Nipro Corporation, Becton, Dickinson and Company, Vygon SA, JMS Co., Ltd., Polymed Medical Devices (Poly Medicure Limited), Troge Medical GmbH, Amsino International, Inc., Kiefel GmbH (Medical Division), Hawk Bioengineering Co., Ltd., Jiangsu Kangjin Medical Instrument Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East measured volume burette set market appears promising, driven by ongoing advancements in healthcare technology and increasing investments in healthcare infrastructure. As the region continues to prioritize patient-centric care, the integration of digital health solutions and IoT technologies will likely enhance the functionality of burette sets. Furthermore, the growing trend towards home healthcare solutions is expected to create new avenues for market expansion, as patients seek more convenient and effective medication delivery options.

| Segment | Sub-Segments |

|---|---|

| By Capacity | ml Measured Volume Burette Sets ml Measured Volume Burette Sets ml Measured Volume Burette Sets Other Capacities (e.g., 50 ml, 250 ml) |

| By End-User | Public Hospitals Private Hospitals Ambulatory Surgical Centers Home Healthcare Providers Others (Clinics, Long-term Care Facilities) |

| By Application | Intravenous Fluid Therapy Pediatric & Neonatal Infusions Chemotherapy & Oncology Infusions Critical Care & Anesthesia Others |

| By Distribution Channel | Direct Sales to Healthcare Institutions Tender-based Institutional Procurement Medical Device Distributors & Dealers Online & E-procurement Platforms Retail & Hospital Pharmacies |

| By Material Type | PVC-based Plastic Burette Sets DEHP-free / PVC-free Burette Sets Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain Rest of Middle East |

| By Regulatory Compliance | SFDA, DHA, and Local MOH Approvals CE Marking ISO 13485 & Related Quality Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, Quality Control Supervisors |

| Educational Institutions | 80 | Lab Instructors, Research Coordinators |

| Pharmaceutical Research Facilities | 70 | Research Scientists, Procurement Managers |

| Government Research Labs | 60 | Lab Directors, Compliance Officers |

| Private Sector R&D Labs | 50 | Product Development Managers, Technical Directors |

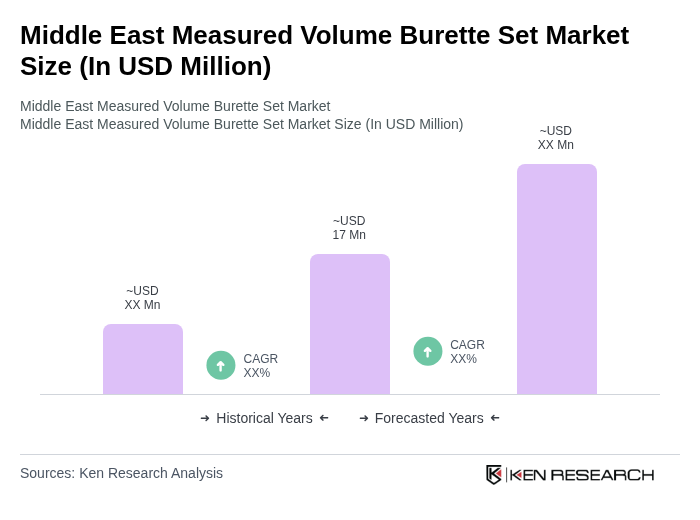

The Middle East Measured Volume Burette Set Market is valued at approximately USD 17 million, reflecting a historical analysis of the broader Middle East and Africa region, with significant contributions from countries like Saudi Arabia, the UAE, and Qatar.