Middle East Men's Coats Jackets Market Overview

- The Middle East Men's Coats Jackets Market is valued at USD 1.1 billion, based on a five-year historical analysis. This estimate aligns with the broader regional menswear market, which is driven by increasing urbanization, evolving fashion preferences, and rising disposable incomes among consumers. The demand for stylish and functional outerwear continues to surge, especially in urban centers where climate variations and lifestyle shifts necessitate a diverse range of coat and jacket options.

- Key players in this market include the UAE, Saudi Arabia, and Egypt, which dominate due to their large populations, robust retail sectors, and a growing interest in international and luxury fashion. The UAE, with Dubai as a major fashion hub, attracts global brands and consumers, while Saudi Arabia’s expanding retail infrastructure and Egypt’s rich cultural heritage further contribute to their market leadership.

- In 2023, the Saudi Arabian government enacted the “National Industrial Development and Logistics Program (NIDLP) Textile Manufacturing Regulations, 2023” issued by the Ministry of Industry and Mineral Resources. This regulation mandates foreign and domestic brands to establish local production facilities for clothing, including coats and jackets, with compliance requirements for minimum local content and workforce quotas. The initiative is designed to boost local employment, reduce import dependency, and support the broader economic diversification strategy under Saudi Vision 2030.

Middle East Men's Coats Jackets Market Segmentation

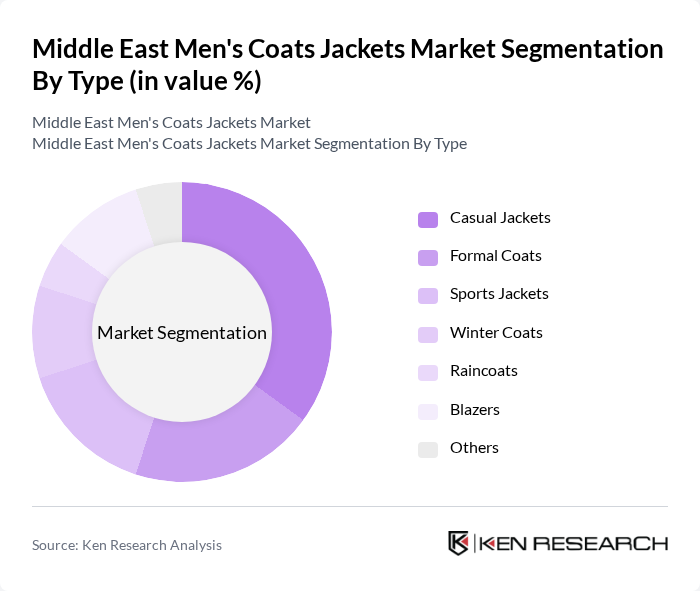

By Type:The market is segmented into various types of outerwear, including Casual Jackets, Formal Coats, Sports Jackets, Winter Coats, Raincoats, Blazers, and Others. Among these, Casual Jackets lead the market due to their versatility and strong appeal among young adults. The ongoing trend toward casualization in fashion has accelerated demand for stylish yet comfortable options suitable for both casual outings and semi-formal occasions.

By Fabric:The market is also segmented by fabric types, including Cotton, Wool, Polyester, Leather, Blends, and Others. Polyester remains the leading fabric due to its durability, affordability, and ease of care, making it a preferred choice for both casual and formal outerwear. The growing demand for sustainable and eco-friendly materials is influencing the market, with increased interest in blends that incorporate organic and recycled fibers. Leather jackets also hold a notable share, especially in luxury and premium segments.

Middle East Men's Coats Jackets Market Competitive Landscape

The Middle East Men's Coats Jackets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harithy Company, Al-Futtaim Group, Landmark Group, Alshaya Group, Majid Al Futtaim, Azadea Group, Al Jaber Group, Al Ghurair Group, Emax Group, Al Tayer Group, Bait Al Kandora, Ounass, Namshi, Souq.com, Carrefour, Zara Middle East, H&M Middle East, The North Face Middle East, Columbia Sportswear Middle East, Nike Middle East, Adidas Middle East, Puma Middle East, Under Armour Middle East, Levi Strauss & Co. Middle East, Patagonia Middle East contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Men's Coats Jackets Market Industry Analysis

Growth Drivers

- Increasing Fashion Consciousness Among Men:The Middle East has witnessed a significant rise in fashion consciousness among men, with the men's apparel market projected to reach $20 billion. This growth is driven by a younger demographic, with 70% of men aged 18-35 actively seeking stylish outerwear. The influence of global fashion trends and local designers has led to a 20% increase in demand for men's coats and jackets, reflecting a shift towards more fashionable choices in everyday wear.

- Rising Disposable Incomes:The average disposable income in the Middle East is expected to rise to $25,000 per capita, facilitating increased spending on fashion. This economic growth, particularly in the Gulf Cooperation Council (GCC) countries, has led to a 15% annual increase in consumer spending on clothing. As men have more disposable income, they are more likely to invest in high-quality coats and jackets, driving market expansion significantly.

- Expansion of Retail Outlets:The number of retail outlets in the Middle East has increased by 30% over the past three years, with major brands establishing a presence in key markets. This expansion includes both brick-and-mortar stores and online platforms, enhancing accessibility for consumers. In future, it is estimated that retail sales of men's outerwear will reach $6 billion, driven by the proliferation of shopping malls and e-commerce platforms catering to fashion-conscious men.

Market Challenges

- Intense Competition from Local and International Brands:The Middle East men's coats and jackets market faces fierce competition, with over 250 brands vying for market share. Local brands are increasingly innovating to capture consumer interest, while international brands are investing heavily in marketing. This competitive landscape has led to price wars, with some retailers reporting a 7% decline in profit margins, making it challenging for new entrants to establish themselves.

- Fluctuating Raw Material Prices:The volatility in raw material prices, particularly cotton and synthetic fibers, poses a significant challenge for manufacturers. In future, cotton prices are projected to fluctuate between $1.30 and $1.70 per pound, impacting production costs. This unpredictability can lead to increased retail prices, potentially deterring price-sensitive consumers and affecting overall sales in the men's outerwear segment.

Middle East Men's Coats Jackets Market Future Outlook

The future of the Middle East men's coats and jackets market appears promising, driven by evolving consumer preferences and technological advancements. The integration of smart textiles and sustainable materials is expected to reshape product offerings, appealing to environmentally conscious consumers. Additionally, the rise of e-commerce will facilitate greater market penetration, allowing brands to reach untapped demographics. As disposable incomes continue to rise, the demand for stylish and functional outerwear will likely increase, fostering a dynamic market environment.

Market Opportunities

- Growth of E-commerce Platforms:The e-commerce sector in the Middle East is projected to reach $35 billion, providing a significant opportunity for men's outerwear brands. With 80% of consumers preferring online shopping for convenience, brands can leverage this trend to expand their reach and enhance customer engagement through targeted marketing strategies.

- Increasing Demand for Sustainable Fashion:As sustainability becomes a priority for consumers, the demand for eco-friendly coats and jackets is on the rise. In future, the sustainable fashion market in the region is expected to grow by 25%, driven by consumer awareness and preference for ethically produced garments. Brands that adopt sustainable practices can differentiate themselves and capture a loyal customer base.