Region:Middle East

Author(s):Shubham

Product Code:KRAD3695

Pages:90

Published On:November 2025

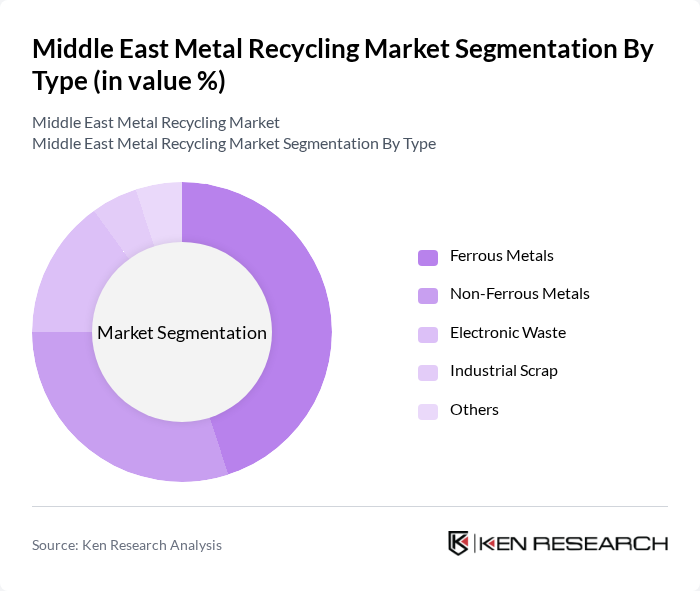

By Type:The market is segmented into various types of materials, including Ferrous Metals, Non-Ferrous Metals, Electronic Waste, Industrial Scrap, and Others. Among these, Ferrous Metals dominate the market due to their widespread use in construction and manufacturing. Non-Ferrous Metals are also significant, driven by the demand for lightweight materials in automotive and aerospace applications. Electronic Waste is gaining traction as technology advances and consumer electronics proliferate, leading to increased recycling efforts.

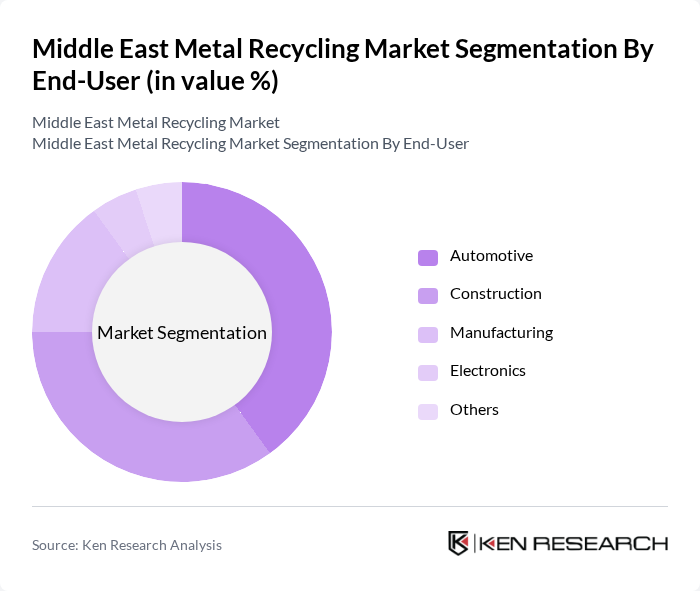

By End-User:The market is segmented by end-users, including Automotive, Construction, Manufacturing, Electronics, and Others. The Automotive sector is the leading end-user, driven by the increasing adoption of recycled metals in vehicle production. The Construction sector follows closely, as sustainable building practices gain momentum. The Manufacturing sector also contributes significantly, with industries seeking to reduce costs and environmental impact through recycling.

The Middle East Metal Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Recycling, Al Ghurair Resources, Al Ain Recycling, Al Jazeera Steel Products, Gulf Metal Foundry, Al Qabandi United, Al Kifah Holding Company, Al Mufeed Group, Al Maktoum Group, Al Mufeed Recycling, Al Maktoum Recycling, Al Mufeed Metal Recycling, Al Jazeera Recycling, Emirates Metal Recycling, Gulf Recycling contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East metal recycling market appears promising, driven by increasing government support and a shift towards sustainable practices. As countries in the region enhance their recycling infrastructure and adopt circular economy principles, the market is expected to expand. Additionally, technological advancements in recycling processes will likely improve efficiency and reduce costs, making recycling more attractive. The growing consumer demand for sustainable products will further propel the market, creating a robust environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrous Metals Non-Ferrous Metals Electronic Waste Industrial Scrap Others |

| By End-User | Automotive Construction Manufacturing Electronics Others |

| By Collection Method | Curbside Collection Drop-off Centers Buy-back Centers Others |

| By Processing Method | Mechanical Processing Pyrometallurgical Processing Hydrometallurgical Processing Others |

| By Source of Scrap | Post-Consumer Scrap Post-Industrial Scrap Others |

| By Geographic Distribution | GCC Countries Levant Region North Africa Others |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ferrous Metal Recycling Facilities | 100 | Facility Managers, Operations Directors |

| Non-Ferrous Metal Recycling Operations | 80 | Procurement Managers, Plant Supervisors |

| Government Recycling Policy Makers | 50 | Environmental Policy Analysts, Local Government Officials |

| Industry Associations and NGOs | 60 | Advocacy Directors, Research Analysts |

| Metal Waste Generators (Manufacturers) | 90 | Production Managers, Sustainability Officers |

The Middle East Metal Recycling Market is valued at approximately USD 8.5 billion, driven by urbanization, industrial activities, and a focus on sustainable practices, particularly in the construction and automotive sectors.