Region:Middle East

Author(s):Rebecca

Product Code:KRAD4318

Pages:81

Published On:December 2025

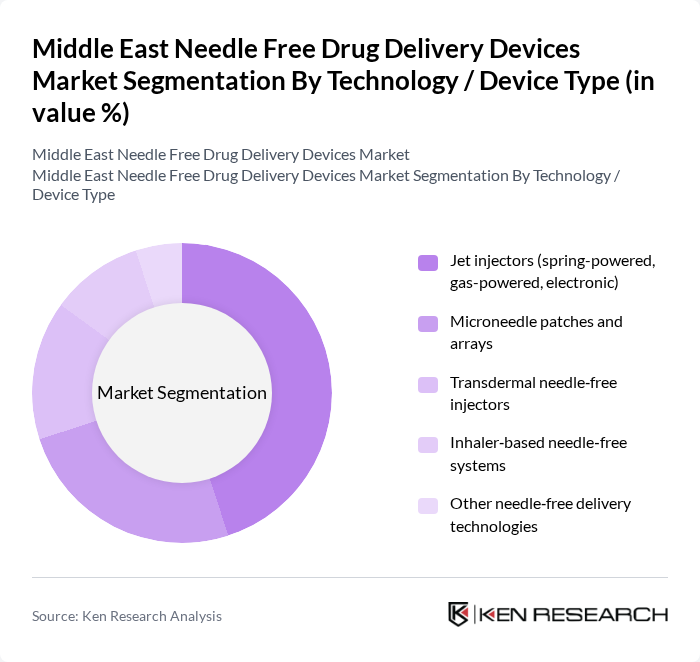

By Technology / Device Type:The technology segment includes various innovative devices that facilitate needle-free drug delivery. The subsegments are Jet injectors (spring-powered, gas-powered, electronic), Microneedle patches and arrays, Transdermal needle-free injectors, Inhaler-based needle-free systems, and Other needle-free delivery technologies. Among these, jet injectors are leading due to their widespread adoption in vaccination programs and their ability to deliver vaccines quickly and painlessly.

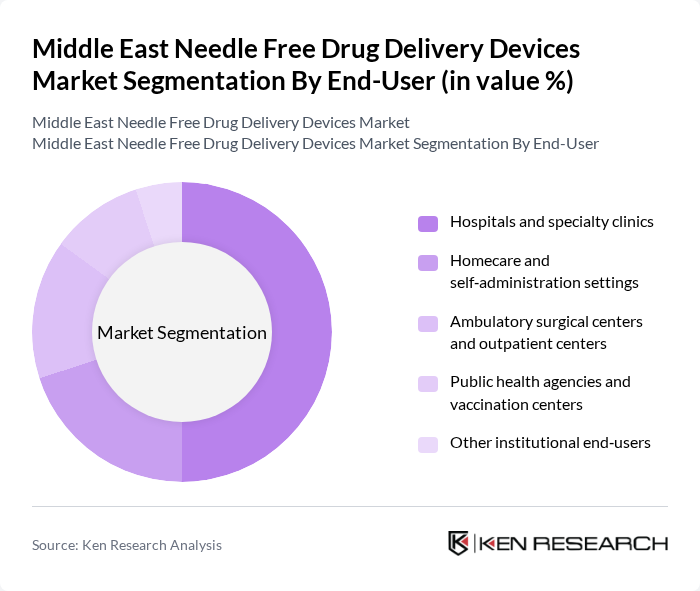

By End-User:The end-user segment encompasses various healthcare settings where needle-free drug delivery devices are utilized. This includes Hospitals and specialty clinics, Homecare and self-administration settings, Ambulatory surgical centers and outpatient centers, Public health agencies and vaccination centers, and Other institutional end-users. Hospitals and specialty clinics dominate this segment due to their high patient volume and the need for efficient drug delivery systems.

The Middle East Needle Free Drug Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as BD (Becton, Dickinson and Company), PharmaJet, Inc., Portal Instruments, Inc., Crossject S.A., Injex Pharma AG, Antares Pharma, Inc. (Halozyme Therapeutics), Zogenix, Inc. (UCB), Bioject Medical Technologies Inc., PharmaDerm (part of Viatris – legacy Mylan injectable franchise), Vaxxas Pty Ltd, Inovio Pharmaceuticals, Inc., Enesi Pharma Ltd, NuGen Medical Devices Inc., Crossject Middle East distribution partners (regional), Local and regional distributors of needle?free injection systems in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the needle-free drug delivery market in the Middle East appears promising, driven by increasing healthcare investments and a shift towards patient-centric solutions. As governments prioritize healthcare accessibility, the integration of digital health technologies is expected to enhance the efficiency of drug delivery systems. Furthermore, the rise of personalized medicine approaches will likely create tailored solutions, fostering innovation and expanding the market. These trends indicate a robust growth trajectory for needle-free devices in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology / Device Type | Jet injectors (spring-powered, gas-powered, electronic) Microneedle patches and arrays Transdermal needle?free injectors Inhaler?based needle?free systems Other needle?free delivery technologies |

| By End-User | Hospitals and specialty clinics Homecare and self?administration settings Ambulatory surgical centers and outpatient centers Public health agencies and vaccination centers Other institutional end?users |

| By Application | Vaccination and immunization programs Insulin and other diabetes therapies Pain management and local anesthesia Biologics and biosimilars (e.g., monoclonal antibodies, hormones) Other chronic and acute therapies |

| By Distribution Channel | Direct institutional sales (tenders and contracts) Medical device distributors and dealers Online and e?commerce medical platforms Other sales channels |

| By Country / Sub?Region | GCC countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Rest of Middle East (including Iran, Iraq, Jordan, Lebanon, etc.) North Africa (Egypt and neighboring markets) Other regional markets |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients High?risk and special?population cohorts |

| By Usage Pattern | Single?use / disposable systems Reusable systems with disposable components |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 60 | Product Managers, R&D Directors |

| Healthcare Providers | 70 | Doctors, Nurses, Pharmacists |

| Medical Device Distributors | 40 | Sales Managers, Distribution Heads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-users (Patients) | 80 | Chronic Disease Patients, General Public |

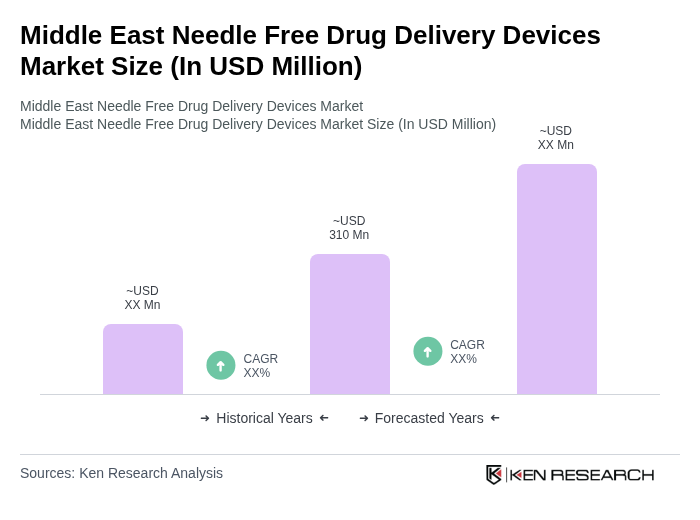

The Middle East Needle Free Drug Delivery Devices Market is valued at approximately USD 310 million, reflecting a significant growth trend driven by the increasing prevalence of chronic diseases and the demand for painless drug delivery methods.