Region:Middle East

Author(s):Dev

Product Code:KRAD7806

Pages:87

Published On:December 2025

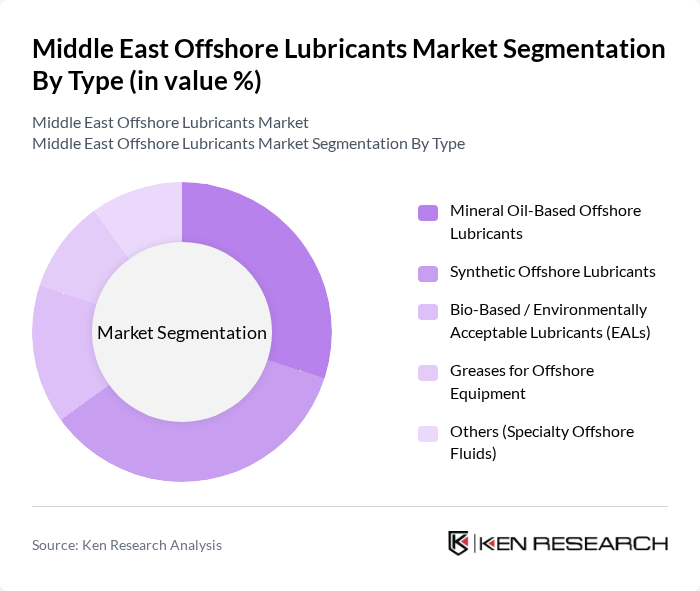

By Type:The market is segmented into various types of offshore lubricants, including mineral oil-based, synthetic, bio-based/environmentally acceptable lubricants (EALs), greases for offshore equipment, and specialty offshore fluids. This structure aligns with industry practice, where mineral and synthetic oils form the bulk of demand, while EALs and specialty fluids are gaining share in sensitive marine areas due to performance and environmental requirements. Each type serves specific applications and customer needs, with varying performance characteristics (oxidation stability, load-carrying capacity, water resistance) and environmental considerations such as biodegradability and toxicity.

By End-User Asset:The segmentation by end-user asset includes offshore drilling rigs (jack-ups and semi-submersibles), offshore production platforms (fixed and floating), FPSOs (floating production storage and offloading units), OSVs (offshore support vessels and supply vessels), and offshore wind and marine renewable assets. This breakdown reflects how offshore lubricants are specified in practice across drilling equipment, production topsides, subsea systems, propulsion and deck machinery on vessels, and rotating equipment used in offshore wind and other marine renewables. Each asset type has unique lubrication requirements based on operational conditions, load profiles, water ingress risk, and OEM specifications, driving demand for tailored formulations such as EP gear oils, hydraulic fluids, compressor oils, stern-tube lubricants, and corrosion-protective greases.

The Middle East Offshore Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Shell plc, TotalEnergies SE, BP plc, Chevron Corporation, FUCHS SE, Castrol Limited, Gulf Oil International Ltd., Klüber Lubrication München SE & Co. KG, LUKOIL Marine Lubricants DMCC, ADNOC Distribution, Saudi Aramco (Luberef), PETROMIN Corporation, PETROLCOM Oil & Gas Services, ENOC Lubricants (Emirates National Oil Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East offshore lubricants market appears promising, driven by ongoing investments in exploration and production activities. As companies increasingly adopt advanced lubricant technologies, the focus on sustainability will shape product development. Additionally, the integration of digital solutions for lubricant management is expected to enhance operational efficiency. These trends indicate a robust market environment, with opportunities for growth in both traditional and innovative lubricant solutions, catering to evolving industry needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oil-Based Offshore Lubricants Synthetic Offshore Lubricants Bio-Based / Environmentally Acceptable Lubricants (EALs) Greases for Offshore Equipment Others (Specialty Offshore Fluids) |

| By End-User Asset | Offshore Drilling Rigs (Jack-ups, Semi-submersibles) Offshore Production Platforms (Fixed & Floating) FPSOs (Floating Production Storage and Offloading Units) OSVs (Offshore Support Vessels & Supply Vessels) Offshore Wind & Marine Renewable Assets |

| By Offshore Application | Engine Oils for Main and Auxiliary Engines Hydraulic Fluids for Deck & Subsea Equipment Gear Oils for Winches, Gears & Thrusters Compressor & Turbine Oils Greases & Specialty Fluids (Thrusters, Wire Ropes, Subsea) |

| By Packaging Type | Bulk & IBC Container Supply (Barge / Truck) Drums Pails Cartridges & Small Packs Others |

| By Supply / Distribution Channel | Direct Supply to NOCs, IOCs & Drilling Contractors Marine & Offshore Distributors / Bunker Suppliers OEM / Service Company Alliances Online & E-Procurement Portals Retail & Other Channels |

| By Country / Sub-Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain Rest of Middle East & East Mediterranean (incl. Egypt, Israel, Cyprus) |

| By Customer Type | National Oil Companies (NOCs) International Oil Companies (IOCs) Drilling & Marine Contractors Offshore Service Companies & EPCs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Drilling Operations | 120 | Operations Managers, Technical Directors |

| Marine Transportation Sector | 90 | Fleet Managers, Procurement Officers |

| Lubricant Manufacturing Companies | 80 | Product Development Managers, Quality Control Engineers |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

| Research and Development Institutions | 60 | Research Scientists, Technical Consultants |

The Middle East Offshore Lubricants Market is valued at approximately USD 1.2 billion, reflecting a consistent growth trend aligned with the broader lubricants market in the region, driven by increased offshore oil and gas exploration activities.