Region:Middle East

Author(s):Dev

Product Code:KRAD6412

Pages:91

Published On:December 2025

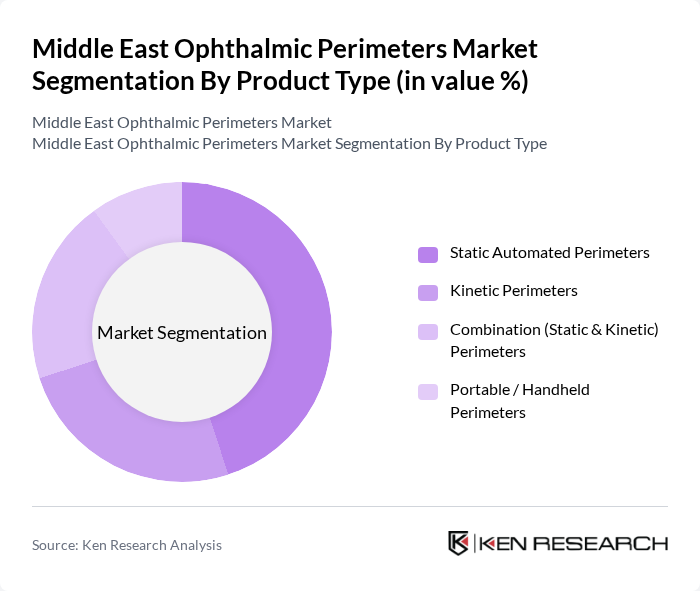

By Product Type:The product type segmentation includes various categories of ophthalmic perimeters, each catering to specific diagnostic needs. The subsegments are Static Automated Perimeters, Kinetic Perimeters, Combination (Static & Kinetic) Perimeters, and Portable / Handheld Perimeters. Among these, Static Automated Perimeters are leading the market due to their accuracy and efficiency in diagnosing visual field defects, making them the preferred choice in hospitals and clinics, in line with global trends where automated perimetry is the standard of care for glaucoma and neuro?ophthalmology assessments.

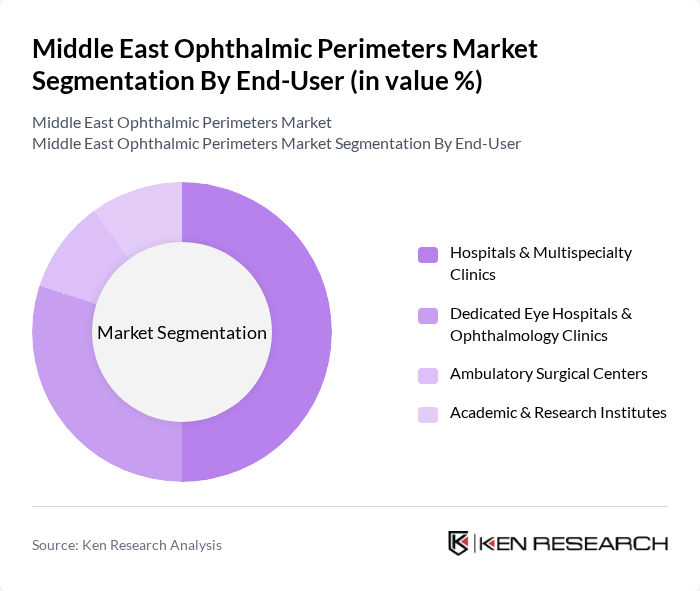

By End-User:The end-user segmentation encompasses Hospitals & Multispecialty Clinics, Dedicated Eye Hospitals & Ophthalmology Clinics, Ambulatory Surgical Centers, and Academic & Research Institutes. Hospitals & Multispecialty Clinics dominate this segment due to their comprehensive services, higher patient volumes for glaucoma and retinal disease management, and greater budget capacity for acquiring automated and premium perimeter systems, while dedicated eye hospitals and clinics represent a rapidly growing user base as specialized ophthalmic networks expand across the Middle East.

The Middle East Ophthalmic Perimeters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carl Zeiss Meditec AG, Haag-Streit AG, Topcon Corporation, NIDEK Co., Ltd., Heidelberg Engineering GmbH, Optopol Technology Sp. z o.o., Oculus Optikgeräte GmbH, Medmont International Pty Ltd, Luneau Technology / Visionix Group, Canon Medical Systems Corporation, EssilorLuxottica (Vision-R / Visionix Platforms), Bausch + Lomb Corporation, Metrovision, Takagi Seiko Co., Ltd., CSO Srl (Costruzione Strumenti Oftalmici) contribute to innovation, geographic expansion, and service delivery in this space, offering a spectrum from high?end automated perimeters to portable and mid?range solutions tailored to hospital, clinic, and outreach settings.

The future of the Middle East ophthalmic perimeters market appears promising, driven by technological innovations and an increasing focus on patient-centric healthcare solutions. As healthcare infrastructure expands, particularly in underserved areas, the adoption of advanced diagnostic tools is expected to rise. Additionally, the integration of telemedicine will facilitate remote consultations, enhancing access to eye care services. These trends indicate a shift towards more efficient and accessible eye health management, ultimately improving patient outcomes across the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Static Automated Perimeters Kinetic Perimeters Combination (Static & Kinetic) Perimeters Portable / Handheld Perimeters |

| By End-User | Hospitals & Multispecialty Clinics Dedicated Eye Hospitals & Ophthalmology Clinics Ambulatory Surgical Centers Academic & Research Institutes |

| By Clinical Application | Glaucoma Diagnosis and Monitoring Neuro-ophthalmic and Neurological Disorders Assessment Retinal and Macular Disease Evaluation Routine Vision Screening & Occupational Eye Exams |

| By Distribution Channel | Direct Tenders to Hospitals and Government Institutions Appointed Regional Distributors / Importers Company-owned Sales & Service Offices Online Procurement Platforms & E-commerce |

| By Country / Sub?Region | Gulf Cooperation Council (GCC) Countries Rest of Middle East (including Levant & Iran) North Africa Rest of Middle East & Africa |

| By Technology & Modality | Standalone Table?top Perimeters Integrated Perimetry Workstations with Imaging (OCT / Fundus) Virtual Reality (VR) / Head?mounted Perimetry Systems Perimetry Software Platforms & EMR-integrated Solutions |

| By Pricing & Ownership Model | Capital Purchase (One?time Sale) Leasing & Rental Models Pay?per?Use / Subscription-based Models Managed Service & Long?term Maintenance Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Clinics | 100 | Ophthalmologists, Clinic Managers |

| Hospitals with Eye Care Departments | 90 | Healthcare Administrators, Medical Directors |

| Optometry Practices | 80 | Optometrists, Practice Owners |

| Medical Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Organizations | 60 | Policy Makers, Health Analysts |

The Middle East Ophthalmic Perimeters Market is valued at approximately USD 30 million, reflecting a five-year historical analysis and benchmarking against the broader ophthalmic devices market in the region.