Region:Middle East

Author(s):Shubham

Product Code:KRAD1025

Pages:99

Published On:November 2025

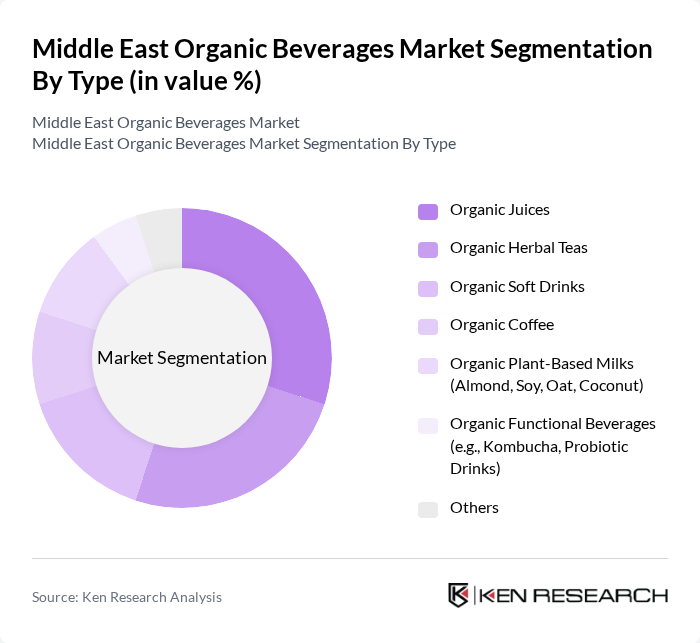

By Type:The market is segmented into various types of organic beverages, including organic juices, organic herbal teas, organic soft drinks, organic coffee, organic plant-based milks, organic functional beverages, and others. Among these, organic juices and organic herbal teas are particularly popular due to their perceived health benefits and natural ingredients. The increasing trend of health and wellness among consumers has significantly influenced the demand for these products.

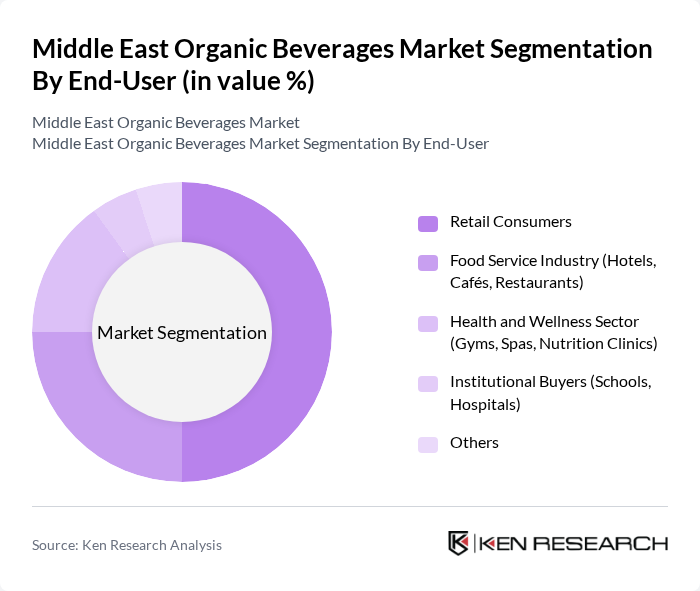

By End-User:The end-user segmentation includes retail consumers, the food service industry, the health and wellness sector, institutional buyers, and others. Retail consumers are the largest segment, driven by the increasing availability of organic beverages in supermarkets and online platforms. The food service industry is also growing, as restaurants and cafes increasingly offer organic options to cater to health-conscious customers.

The Middle East Organic Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Farms, Koita Foods, Almarai, Nadec (National Agricultural Development Company), Pure Harvest Smart Farms, Al Watania Agriculture, Al Rawabi Dairy Company, Greenheart Organic Farms, Organic Oasis, The Organic Farm, Fresh Organic, Emirates Food Industries, Savola Group, Juhayna Food Industries, Dubai Refreshment Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East organic beverages market appears promising, driven by increasing health awareness and a shift towards sustainable consumption. As consumers continue to prioritize health and wellness, the demand for organic beverages is expected to rise. Innovations in product development, such as functional beverages and plant-based options, will likely capture consumer interest. Additionally, the growth of e-commerce will facilitate easier access to organic products, further enhancing market dynamics and consumer engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Juices Organic Herbal Teas Organic Soft Drinks Organic Coffee Organic Plant-Based Milks (Almond, Soy, Oat, Coconut) Organic Functional Beverages (e.g., Kombucha, Probiotic Drinks) Others |

| By End-User | Retail Consumers Food Service Industry (Hotels, Cafés, Restaurants) Health and Wellness Sector (Gyms, Spas, Nutrition Clinics) Institutional Buyers (Schools, Hospitals) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Organic Stores Convenience Stores Direct Sales (Farmers Markets, Subscription Models) Others |

| By Packaging Type | Bottles (Glass, PET) Cans Tetra Packs Pouches Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine) North Africa (Egypt, Morocco, Tunisia, Algeria) Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences (Vegan, Fitness Enthusiasts, Families) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Beverages | 120 | Health-conscious Consumers, Organic Product Buyers |

| Retailer Insights on Organic Beverage Sales | 60 | Store Managers, Category Buyers |

| Producer Perspectives on Market Challenges | 40 | Farm Owners, Beverage Manufacturers |

| Distribution Channel Effectiveness | 50 | Logistics Managers, Supply Chain Coordinators |

| Impact of Marketing on Consumer Choices | 45 | Marketing Executives, Brand Managers |

The Middle East Organic Beverages Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for organic products among consumers in the region.