Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0134

Pages:86

Published On:August 2025

By Technology:

The technology segment includes various types of coatings such as water-borne, solvent-borne, powder, UV-cured, and others. Among these, water-borne coatings are leading the market due to their eco-friendliness and low VOC emissions, making them increasingly popular in both residential and commercial applications. The shift towards sustainable solutions has driven consumer preference towards water-borne options, which are also easier to apply and clean up. Solvent-borne coatings follow closely, favored for their durability and performance in industrial applications .

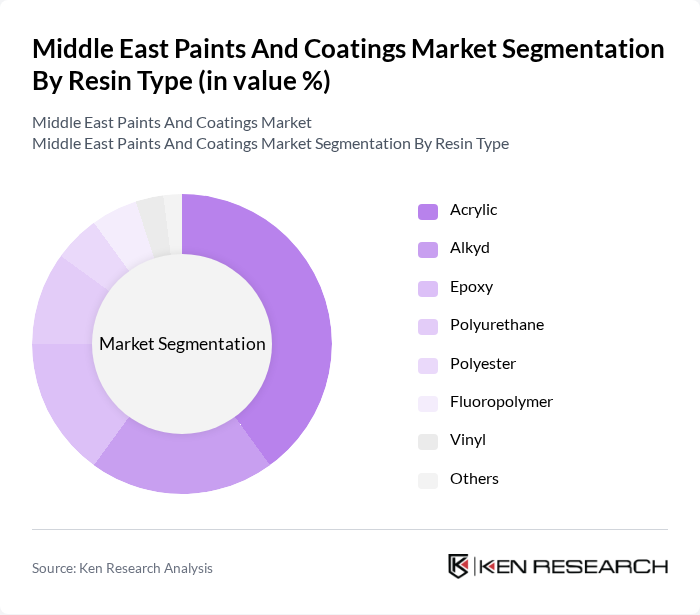

By Resin Type:

This segment encompasses various resin types including acrylic, alkyd, epoxy, polyurethane, polyester, fluoropolymer, vinyl, and others. Acrylic resins dominate the market due to their versatility, excellent adhesion, and weather resistance, making them suitable for a wide range of applications from architectural to automotive. Epoxy resins are also gaining traction, particularly in industrial applications, due to their superior chemical resistance and durability. The trend towards high-performance coatings is driving the growth of these resin types .

The Middle East Paints And Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, RPM International Inc., Jotun A/S, National Paints Factories Co. Ltd., Al Jazeera Paints Co., Sigma Paints Middle East Ltd. (PPG Group), Hempel A/S, Kansai Paint Co., Ltd., Asian Paints Berger (Berger Paints Emirates Ltd.), SAK Coat (Saudi Arabia), Nippon Paint Holdings Co., Ltd., Caparol Arabia LLC (DAW Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East paints and coatings market is poised for significant transformation, driven by technological innovations and a growing emphasis on sustainability. As urbanization accelerates, particularly in Gulf Cooperation Council (GCC) countries, the demand for advanced coatings is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and product quality. Companies that adapt to these trends and invest in eco-friendly solutions are likely to gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology | Water-borne coatings Solvent-borne coatings Powder coatings UV-cured coatings Others (e.g., radiation-cured) |

| By Resin Type | Acrylic Alkyd Epoxy Polyurethane Polyester Fluoropolymer Vinyl Others |

| By Application | Architectural (Residential & Commercial) Industrial Automotive Marine Wood Packaging Others (Aerospace, Furniture, etc.) |

| By End-User Industry | Construction Automotive & Transportation Industrial Equipment Marine Furniture & Wood Packaging Others |

| By Country/Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Egypt Rest of Middle East & North Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Decorative Paints Market | 100 | Marketing Managers, Product Development Managers |

| Industrial Coatings Sector | 80 | Operations Managers, Quality Control Managers |

| Architectural Coatings Segment | 60 | Architects, Interior Designers |

| Automotive Paints Market | 50 | Procurement Managers, Production Managers |

| Protective Coatings Applications | 40 | Safety Managers, Maintenance Managers |

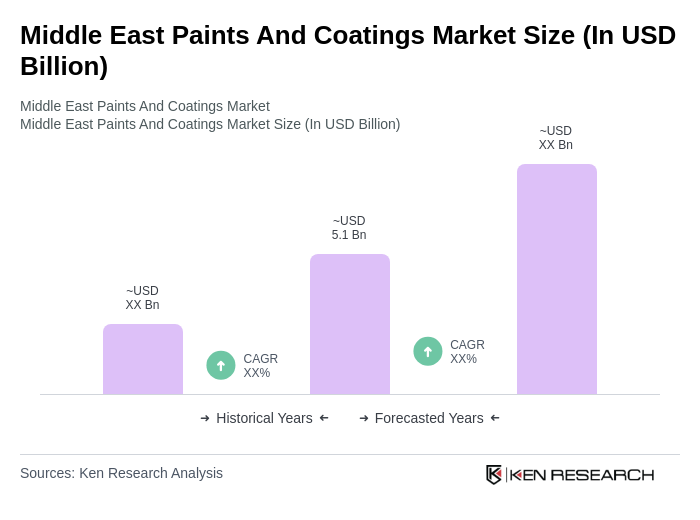

The Middle East Paints and Coatings Market is valued at approximately USD 5.1 billion, driven by growth in the construction sector, urbanization, and demand for decorative and protective coatings across various industries.