Region:Middle East

Author(s):Shubham

Product Code:KRAD0639

Pages:87

Published On:August 2025

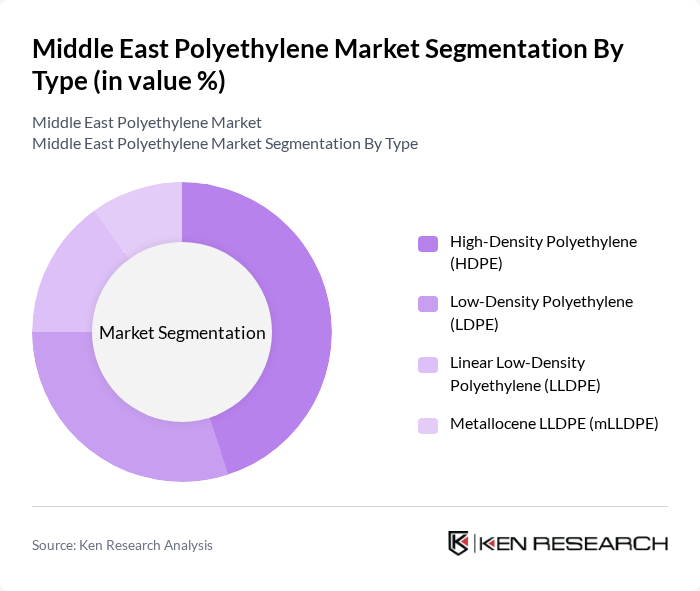

By Type:The polyethylene market can be segmented into four main types: High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), and Metallocene LLDPE (mLLDPE). Among these, HDPE is widely used in the region for pressure pipes, blow-molded containers, and geomembranes due to its stiffness and chemical resistance. LDPE remains important for film and extrusion coating owing to its clarity and sealability. LLDPE, including mLLDPE, has been gaining traction in flexible packaging and agricultural films for toughness, downgauging, and seal performance improvements, reflecting global converter preferences .

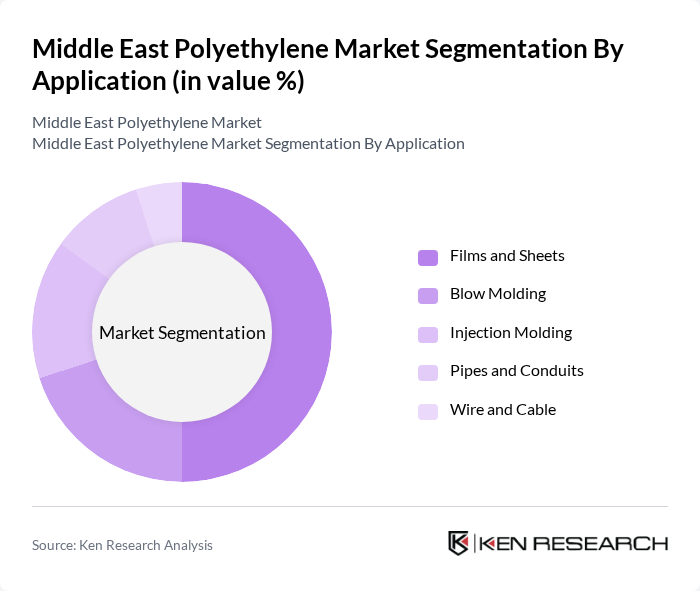

By Application:The applications of polyethylene are diverse, including films and sheets, blow molding, injection molding, pipes and conduits, and wire and cable. Films and sheets dominate regional demand due to extensive use in food, consumer, and agricultural packaging. Blow molding and injection molding serve containers, caps, crates, and consumer goods. Pipes and conduits are significant in water, gas, and district infrastructure applications across GCC construction programs. Wire and cable applications use PE grades for insulation and jacketing in power and telecom networks ; .

The Middle East Polyethylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Abu Dhabi National Oil Company (ADNOC), Borouge PLC, Saudi Ethylene and Polyethylene Company (SEPC) – Tasnee/Sadara JV, Qatar Petrochemical Company (QAPCO), Petro Rabigh (Rabigh Refining and Petrochemical Co.), Jazan Integrated Gasification and Polyethylene (planned), Oman Shell – OQ (formerly ORPIC) – Liwa Plastics Industries Complex, Kuwait – Petrochemical Industries Company (PIC, a KPC subsidiary), Kuwait Petroleum Corporation (KPC), National Petrochemical Industrial Company (NATPET), Ibn Zahr (Saudi European Petrochemical Company) – SIPCHEM, LyondellBasell Industries, ExxonMobil – Al-Jubail joint ventures (JV marketing in ME), INEOS (trading and JV interests in region) contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East polyethylene market is poised for significant transformation, driven by a shift towards sustainable practices and innovative production technologies. As consumer preferences evolve, companies are increasingly adopting eco-friendly materials and processes. The integration of advanced recycling technologies is expected to enhance the circular economy, while strategic partnerships with local manufacturers will facilitate market penetration. Additionally, the growth of e-commerce is likely to further boost demand for polyethylene packaging solutions, creating new avenues for expansion and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Density Polyethylene (HDPE) Low-Density Polyethylene (LDPE) Linear Low-Density Polyethylene (LLDPE) Metallocene LLDPE (mLLDPE) |

| By Application | Films and Sheets Blow Molding Injection Molding Pipes and Conduits Wire and Cable |

| By End-User Industry | Packaging Building and Construction Agriculture Electrical and Electronics Transportation |

| By Distribution Channel | Direct Sales (Producers to Converters/End Users) Authorized Distributors/Traders Online Trading Platforms |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Israel Jordan Lebanon |

| By Processing Technology | Gas-Phase Slurry-Loop Solution |

| By Sustainability Attribute | Virgin PE Recycled Content PE Bio-based/CCU-Attributed PE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 120 | Product Managers, Procurement Specialists |

| Automotive Sector Applications | 90 | Design Engineers, Supply Chain Managers |

| Construction Material Usage | 80 | Project Managers, Material Suppliers |

| Consumer Goods Sector Trends | 100 | Marketing Directors, Brand Managers |

| Environmental Impact Assessments | 60 | Sustainability Consultants, Regulatory Affairs Managers |

The Middle East Polyethylene Market is valued at approximately USD 1214 billion, based on a five-year historical analysis of regional consumption and average market prices, with reported consumption around 8.3 million tons of polyethylene in primary forms.