Region:Middle East

Author(s):Shubham

Product Code:KRAA8721

Pages:99

Published On:November 2025

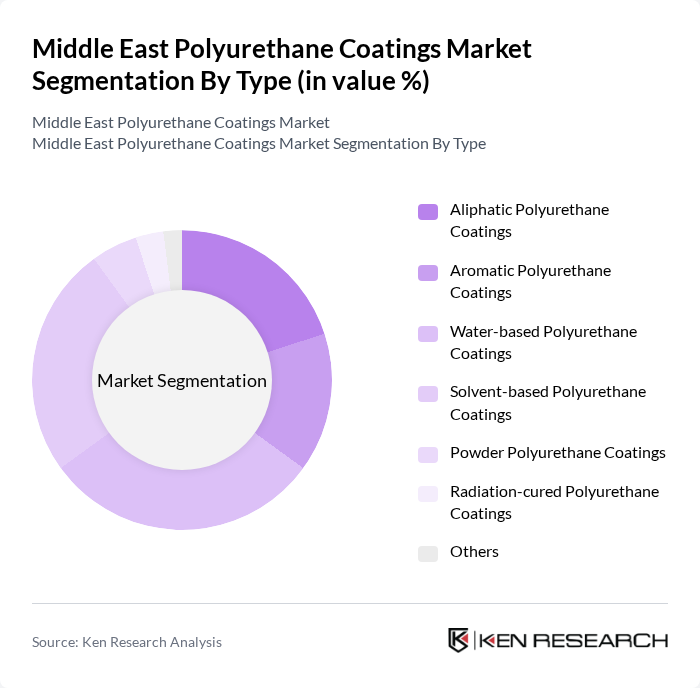

By Type:The polyurethane coatings market is segmented into various types, including aliphatic, aromatic, water-based, solvent-based, powder, radiation-cured, and others. Among these, water-based polyurethane coatings are gaining traction due to their eco-friendliness and low VOC emissions, making them a preferred choice in the construction and automotive sectors. Solvent-based coatings, while still significant, are gradually being replaced by more sustainable options.

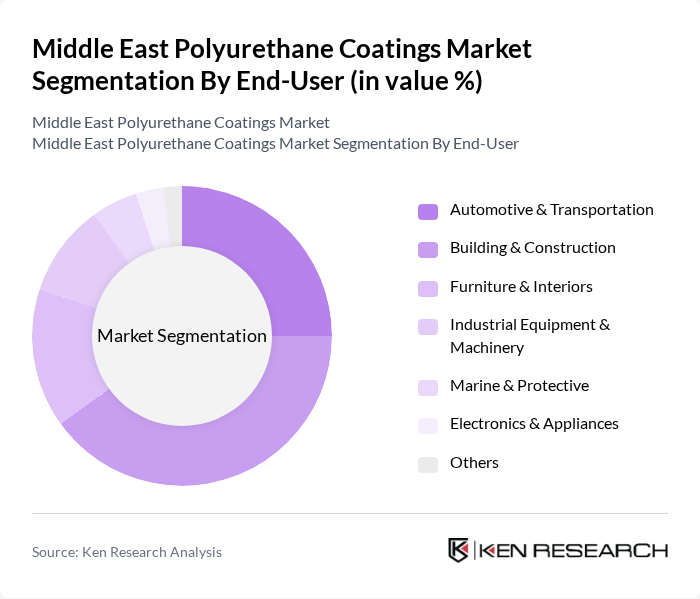

By End-User:The end-user segmentation includes automotive & transportation, building & construction, furniture & interiors, industrial equipment & machinery, marine & protective, electronics & appliances, and others. The building and construction sector is the largest consumer of polyurethane coatings, driven by ongoing infrastructure projects and the need for durable finishes. The automotive sector follows closely, with increasing demand for high-performance coatings that enhance vehicle aesthetics and longevity.

The Middle East Polyurethane Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, PPG Industries, Inc., AkzoNobel N.V., The Sherwin-Williams Company, RPM International Inc., Huntsman Corporation, Covestro AG, Jotun A/S, Hempel A/S, National Paints Factories Co. Ltd., Asian Paints Ltd., Kansai Paint Co., Ltd., Berger Paints Emirates LLC, Sigma Paints Saudi Arabia Ltd., Al-Jazeera Paints Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East polyurethane coatings market appears promising, driven by increasing investments in sustainable technologies and a robust construction sector. As the demand for high-performance and eco-friendly coatings rises, manufacturers are likely to focus on innovation and compliance with environmental standards. Additionally, the expansion of e-commerce platforms is expected to enhance distribution channels, making products more accessible. Overall, the market is poised for growth, with significant opportunities emerging in various sectors, including automotive and infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Aliphatic Polyurethane Coatings Aromatic Polyurethane Coatings Water-based Polyurethane Coatings Solvent-based Polyurethane Coatings Powder Polyurethane Coatings Radiation-cured Polyurethane Coatings Others |

| By End-User | Automotive & Transportation Building & Construction Furniture & Interiors Industrial Equipment & Machinery Marine & Protective Electronics & Appliances Others |

| By Application | Protective Coatings Decorative Coatings Industrial Floor Coatings Marine Coatings Pipeline & Steel Structure Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Technology | Spray Coating Brush Coating Roller Coating Powder Coating Radiation-cured Coating Others |

| By Performance Characteristics | High Durability Chemical Resistance UV Resistance Abrasion Resistance Gloss Retention Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Coatings | 100 | Project Managers, Procurement Officers |

| Automotive Coatings | 80 | Manufacturing Engineers, Quality Control Managers |

| Furniture and Interior Coatings | 70 | Product Designers, Operations Managers |

| Industrial Applications | 60 | Facility Managers, Maintenance Supervisors |

| Consumer Goods Coatings | 90 | Brand Managers, Supply Chain Analysts |

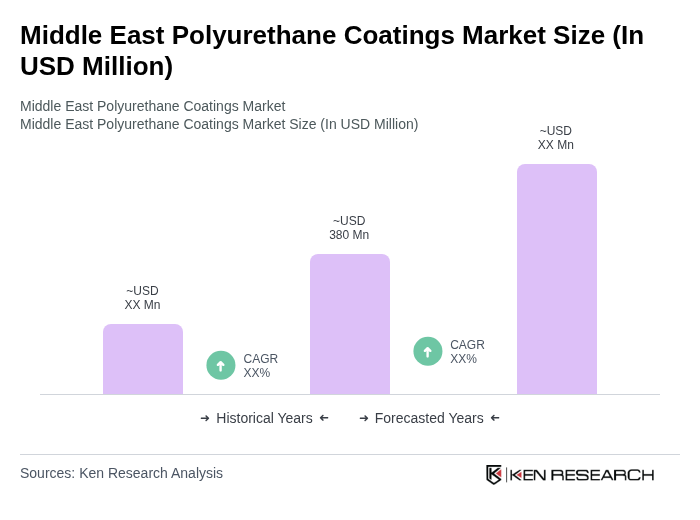

The Middle East Polyurethane Coatings Market is valued at approximately USD 380 million, reflecting a robust growth trajectory driven by increasing demand across various sectors, including automotive, construction, and furniture.