Region:Middle East

Author(s):Dev

Product Code:KRAD7675

Pages:99

Published On:December 2025

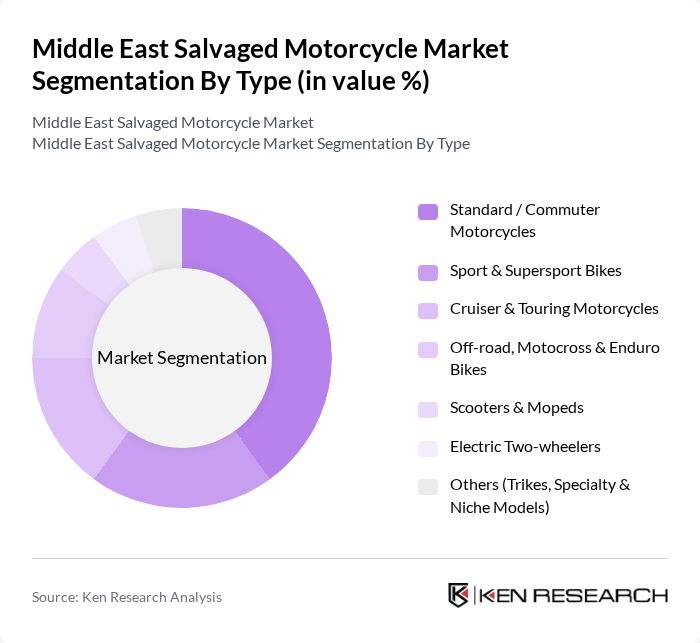

By Type:The market is segmented into various types of motorcycles, including Standard / Commuter Motorcycles, Sport & Supersport Bikes, Cruiser & Touring Motorcycles, Off-road, Motocross & Enduro Bikes, Scooters & Mopeds, Electric Two-wheelers, and Others (Trikes, Specialty & Niche Models). Among these, Standard / Commuter Motorcycles dominate the market due to their affordability and practicality for daily commuting. The increasing urbanization and traffic congestion in major cities have led consumers to prefer these models for their efficiency and cost-effectiveness.

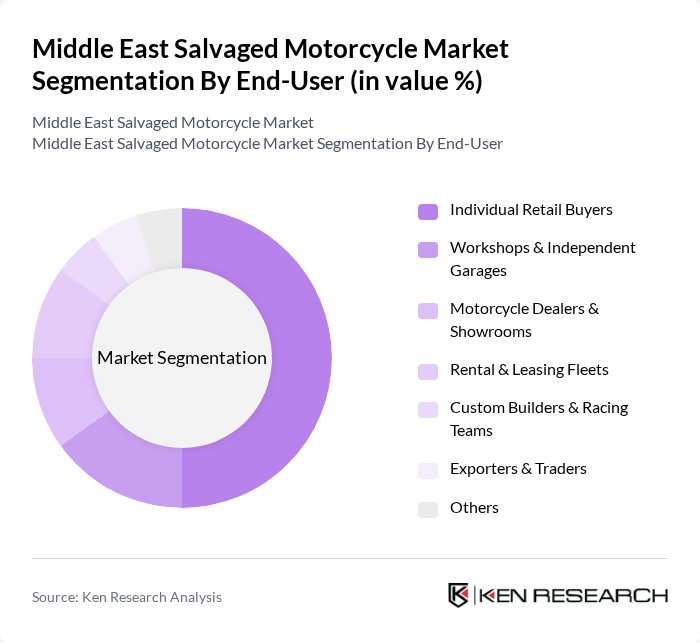

By End-User:The end-user segmentation includes Individual Retail Buyers, Workshops & Independent Garages, Motorcycle Dealers & Showrooms, Rental & Leasing Fleets, Custom Builders & Racing Teams, Exporters & Traders, and Others. Individual Retail Buyers represent the largest segment, driven by the increasing number of consumers looking for budget-friendly options. The trend of customizing motorcycles has also led to a rise in demand from Custom Builders & Racing Teams, who seek salvaged motorcycles for restoration and modification projects.

The Middle East Salvaged Motorcycle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Copart Inc. – Middle East Operations, Emirates Auction LLC (UAE), Mazad (Qatar Auctions LLC), Ritchie Bros. Auctioneers – Regional Presence, Dubizzle / OLX UAE – Motorcycles & Parts Category, OpenSooq – Regional Classifieds Platform, ScrapMyCar UAE / Regional Vehicle Dismantlers, Al-Futtaim Auto Centers (Used Vehicle & Salvage-related Operations), Al Jirah Auctions (Saudi Arabia), Haraj.com.sa – Saudi Online Marketplace (Motorcycles & Salvage), MotorbikeDubai.com / Specialist Used & Damaged Bike Dealers, Local Insurance Company Auction Platforms (e.g., RSA Insurance, AXA / GIG Gulf – Salvage Disposal), Regional Motorcycle Scrap Yards & Parts Recyclers (UAE, Saudi Arabia, Qatar), OEM-affiliated Certified Pre-owned & Trade-in Programs (Honda, Yamaha, Kawasaki, etc.), Emerging Online Salvage-focused Marketplaces in GCC & Levant contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East salvaged motorcycle market is poised for significant evolution, driven by increasing consumer interest in sustainable transportation and the rise of electric motorcycles. As urban populations grow, the demand for affordable and eco-friendly options will likely intensify. Additionally, the expansion of online platforms will facilitate greater access to salvaged motorcycles, enhancing market visibility. With a focus on customization and community engagement, the market is expected to attract a diverse range of consumers, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard / Commuter Motorcycles Sport & Supersport Bikes Cruiser & Touring Motorcycles Off-road, Motocross & Enduro Bikes Scooters & Mopeds Electric Two-wheelers Others (Trikes, Specialty & Niche Models) |

| By End-User | Individual Retail Buyers Workshops & Independent Garages Motorcycle Dealers & Showrooms Rental & Leasing Fleets Custom Builders & Racing Teams Exporters & Traders Others |

| By Condition | Dismantling Grade (Total Loss for Parts) Repairable – Light Damage Repairable – Structural/Heavy Damage Rebuilt / Refurbished Certified Pre-owned (from Insurance / OEM Programs) |

| By Source of Acquisition | Insurance & Copart-style Auctions Police & Government Auctions Franchise & Independent Dealerships Online B2B/B2C Marketplaces Scrap Yards & Dismantlers Private Sellers |

| By Geographic Distribution | GCC Countries Levant Iran Iraq Egypt & Rest of Middle East |

| By Price Range | Sub-USD 1,000 Segment USD 1,000–2,500 Segment USD 2,500–5,000 Segment Above USD 5,000 Segment |

| By Purpose | Daily Commuting Recreational & Hobby Riding Motorsports & Track Use Custom Builds & Restoration Projects Parts Harvesting & Dismantling Export & Re-export |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Salvage Yard Operations | 90 | Salvage Yard Owners, Operations Managers |

| Motorcycle Repair Shops | 70 | Shop Owners, Mechanics |

| Motorcycle Enthusiasts | 140 | Club Members, Online Forum Participants |

| Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| Consumers of Salvaged Parts | 110 | DIY Enthusiasts, Motorcycle Owners |

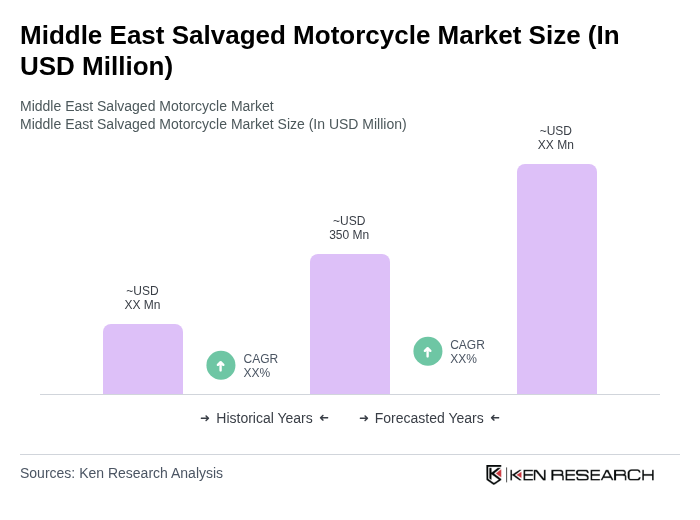

The Middle East Salvaged Motorcycle Market is valued at approximately USD 350 million, driven by increasing demand for affordable transportation, motorcycle customization, and sustainability through recycling. This market has shown significant growth over the past five years.