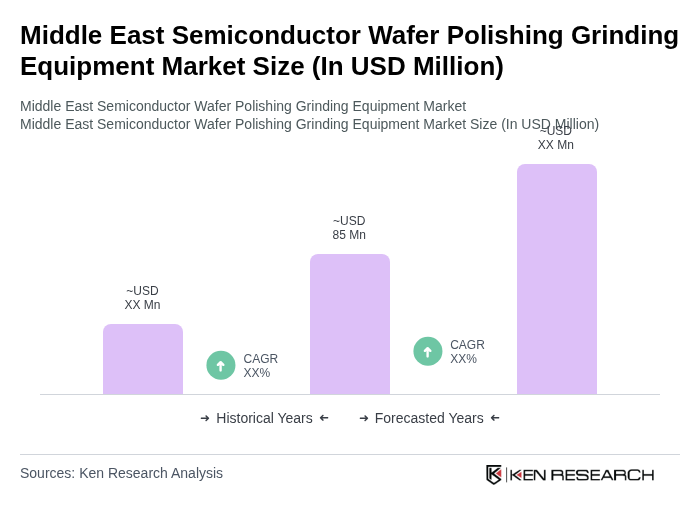

Middle East Semiconductor Wafer Polishing Grinding Equipment Market Overview

- The Middle East Semiconductor Wafer Polishing Grinding Equipment Market is valued at USD 85 million, based on a five-year historical analysis and its share within the global semiconductor wafer polishing and grinding equipment market. This growth is primarily driven by the increasing demand for semiconductor devices across various sectors, including consumer electronics, automotive (particularly power electronics and ADAS), telecommunications, and data?center infrastructure, which raises demand for advanced wafer surface preparation tools. The rapid advancements in technology, ongoing node shrink, adoption of 300 mm wafers, and the push for miniaturization of electronic components have further fueled the need for efficient wafer polishing and grinding solutions with tighter planarity and defect specifications.

- Key players in this market include Israel, the United Arab Emirates, and Saudi Arabia. These countries are emerging as leading demand centers in the region, supported by initiatives to attract semiconductor design, packaging, and advanced electronics manufacturing, along with large-scale investments in technology and digital infrastructure. Israel accounts for the majority of regional semiconductor?related activity and R&D, while the UAE and Saudi Arabia are leveraging national programs and sovereign investment vehicles to develop high?tech industrial bases and semiconductor?adjacent manufacturing, which in turn supports demand for wafer polishing and grinding equipment.

- In 2023, the UAE government implemented a new regulation aimed at promoting local manufacturing of semiconductor equipment. This regulation includes incentives for companies that establish production facilities within the country, thereby encouraging foreign investment and fostering innovation in the semiconductor sector, as reflected in measures such as the “Industrial Property Law” Federal Decree?Law No. 11 of 2021 issued by the UAE government, which strengthens protection and commercialization of industrial innovations and supports advanced manufacturing projects, including semiconductor and electronics technologies.

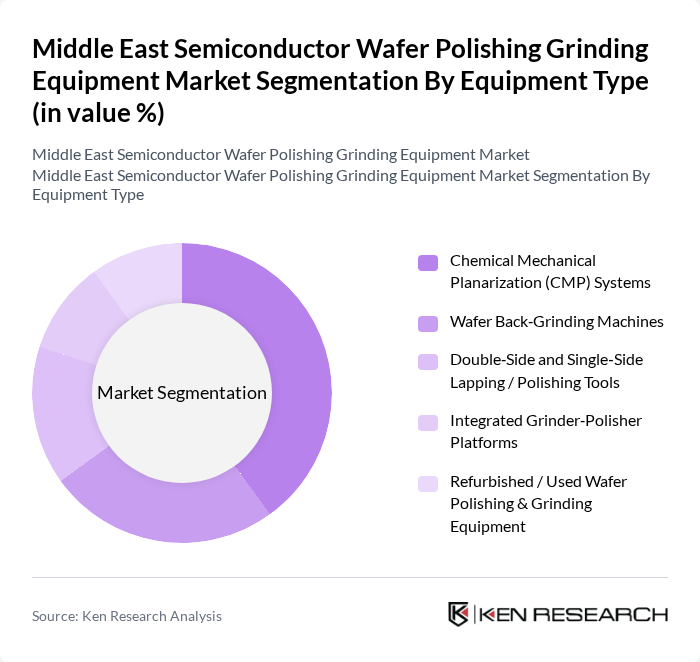

Middle East Semiconductor Wafer Polishing Grinding Equipment Market Segmentation

By Equipment Type:The equipment type segmentation includes various tools essential for wafer polishing and grinding processes. The subsegments are Chemical Mechanical Planarization (CMP) Systems, Wafer Back?Grinding Machines, Double?Side and Single?Side Lapping / Polishing Tools, Integrated Grinder?Polisher Platforms, and Refurbished / Used Wafer Polishing & Grinding Equipment. Among these, CMP systems are leading due to their critical role in achieving the required surface finish and flatness for advanced semiconductor devices, in line with global trends where CMP tools account for the largest share of wafer polishing and grinding equipment revenues.

By Process Step:The process step segmentation encompasses Front?End Wafer Surface Polishing, Back?End Wafer Thinning and Back?Grinding, Wafer Edge Grinding and Beveling, and Stress Relief and Planarization. The Back-End Wafer Thinning and Back-Grinding segment is currently dominating the market due to the increasing need for thinner wafers in high-performance applications, such as advanced packaging, power devices, and mobile SoCs, which is essential for enhancing device performance, enabling 3D integration, and reducing overall system costs.

Middle East Semiconductor Wafer Polishing Grinding Equipment Market Competitive Landscape

The Middle East Semiconductor Wafer Polishing Grinding Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Ebara Corporation, Lapmaster Wolters GmbH, Logitech Limited, DISCO Corporation, Tokyo Seimitsu Co., Ltd. (ACCRETECH), Revasum, Inc., Okamoto Machine Tool Works, Ltd., SKC Solmics Co., Ltd., Nanoscience Instruments, Inc., Entrepix, Inc., SpeedFam Co., Ltd., Strasbaugh, Inc., GigaMat Technologies, Inc., Lam Research Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Semiconductor Wafer Polishing Grinding Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for Advanced Semiconductor Technologies:The Middle East's semiconductor market is projected to reach $10 billion in future, driven by the rising demand for advanced technologies. The region's focus on digital transformation and smart technologies is expected to increase the need for high-performance semiconductor devices. This demand is further supported by the anticipated growth in data centers, which are expected to increase by 15% annually, necessitating advanced wafer polishing and grinding equipment to meet production needs.

- Expansion of Electronics Manufacturing in the Region:The electronics manufacturing sector in the Middle East is expected to grow significantly, with an estimated value of $20 billion in future. This growth is fueled by the establishment of new manufacturing facilities and the expansion of existing ones, particularly in countries like Saudi Arabia and the UAE. The increase in local production capabilities is driving the demand for semiconductor wafer polishing and grinding equipment, as manufacturers seek to enhance their production efficiency and output quality.

- Government Initiatives to Boost Semiconductor Production:Governments in the Middle East are investing heavily in the semiconductor industry, with over $5 billion allocated for development initiatives in future. These initiatives include funding for research and development, infrastructure improvements, and incentives for local manufacturing. Such government support is expected to create a favorable environment for semiconductor production, thereby increasing the demand for wafer polishing and grinding equipment as manufacturers scale up operations to meet both local and international market needs.

Market Challenges

- High Capital Investment Requirements:The semiconductor wafer polishing and grinding equipment market faces significant challenges due to high capital investment requirements, which can exceed $1 million per facility. This financial barrier limits entry for smaller manufacturers and can hinder the expansion of existing operations. As a result, many companies may struggle to upgrade their equipment or invest in new technologies, potentially impacting their competitiveness in the rapidly evolving semiconductor landscape.

- Supply Chain Disruptions:The semiconductor industry is currently experiencing supply chain disruptions, with lead times for critical components extending up to 12 months. These disruptions are exacerbated by geopolitical tensions and the ongoing effects of the COVID-19 pandemic. Such challenges can delay production schedules and increase costs for manufacturers in the Middle East, ultimately affecting their ability to meet market demand for semiconductor wafer polishing and grinding equipment.

Middle East Semiconductor Wafer Polishing Grinding Equipment Market Future Outlook

The future of the Middle East semiconductor wafer polishing and grinding equipment market appears promising, driven by technological advancements and increasing investments in the sector. As the region continues to embrace digital transformation, the demand for high-quality semiconductor devices will rise. Additionally, the ongoing development of 5G infrastructure and electric vehicles will further stimulate the market, encouraging manufacturers to adopt innovative solutions and enhance production capabilities to meet evolving consumer needs.

Market Opportunities

- Growth in Electric Vehicle Semiconductor Needs:The electric vehicle market in the Middle East is projected to grow to $7 billion in future, creating substantial demand for semiconductors. This growth presents an opportunity for wafer polishing and grinding equipment manufacturers to cater to the specific needs of electric vehicle production, enhancing their market presence and driving innovation in semiconductor technologies.

- Adoption of AI and IoT Technologies:The increasing adoption of artificial intelligence and Internet of Things technologies in various sectors is expected to drive demand for advanced semiconductors. With an estimated investment of $3 billion in AI and IoT initiatives in future, manufacturers will require state-of-the-art wafer polishing and grinding equipment to produce high-performance chips, creating a significant opportunity for growth in this segment.