Region:Middle East

Author(s):Dev

Product Code:KRAA1505

Pages:93

Published On:August 2025

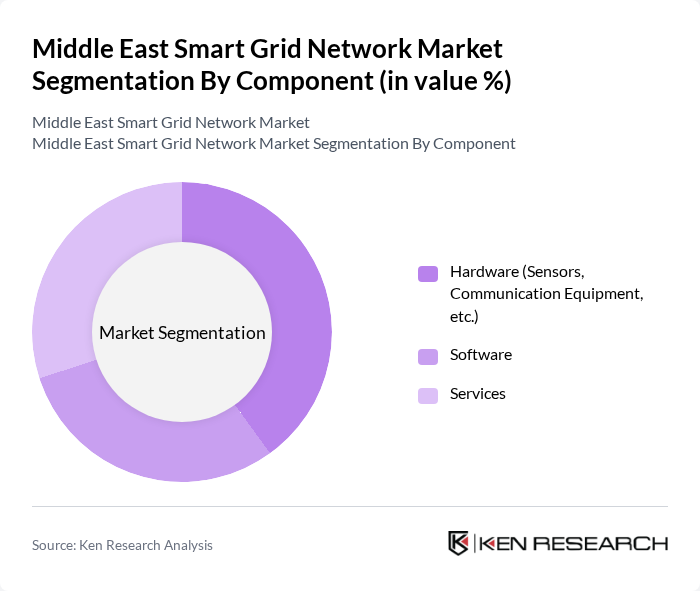

By Component:The components of the smart grid network include hardware, software, and services. Hardware encompasses sensors, smart meters, and communication equipment essential for real-time monitoring and control. Software includes applications for grid data management, analytics, and cybersecurity. Services involve installation, maintenance, consulting, and training, which are crucial for the effective implementation and ongoing optimization of smart grid technologies.

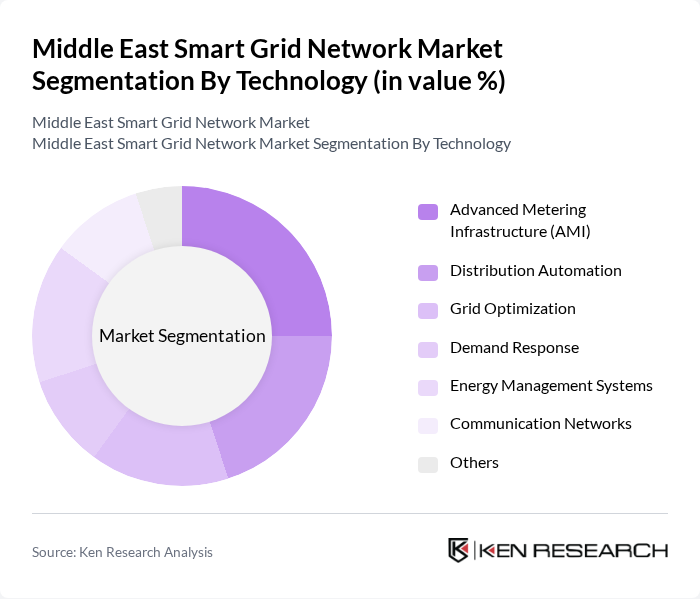

By Technology:The technology segment includes advanced metering infrastructure (AMI), distribution automation, grid optimization, demand response, energy management systems, communication networks, and others. Advanced metering infrastructure enables two-way communication and real-time data collection. Distribution automation facilitates remote monitoring and control of grid assets. Grid optimization uses analytics and AI for predictive maintenance and loss reduction. Demand response allows utilities and consumers to manage peak loads. Energy management systems integrate renewable sources and optimize consumption. Communication networks connect all grid components for seamless data exchange. Other technologies include cybersecurity solutions and energy storage integration.

The Middle East Smart Grid Network Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, General Electric Company, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Cisco Systems, Inc., Itron, Inc., Landis+Gyr AG, Eaton Corporation plc, Oracle Corporation, Enel X, Trilliant Networks, Inc., Sensus (Xylem Inc.), Aclara Technologies LLC, Saudi Electricity Company (SEC), Dubai Electricity and Water Authority (DEWA), Qatar General Electricity & Water Corporation (KAHRAMAA), Abu Dhabi Distribution Company (ADDC), National Grid SA (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East smart grid network market appears promising, driven by technological innovations and a strong commitment to sustainability. As countries prioritize energy efficiency and renewable integration, the demand for smart grid solutions will likely increase. Furthermore, advancements in artificial intelligence and machine learning will enhance grid management capabilities, enabling more efficient energy distribution. The focus on developing electric vehicle infrastructure will also play a crucial role in shaping the market landscape, fostering a more resilient energy ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Sensors, Communication Equipment, etc.) Software Services |

| By Technology | Advanced Metering Infrastructure (AMI) Distribution Automation Grid Optimization Demand Response Energy Management Systems Communication Networks Others |

| By Application | Power Generation and Transmission Networks Distribution Networks Advanced Metering Infrastructure (AMI) Electric Vehicle Integration Energy Storage Integration |

| By End-User | Utilities Residential Commercial Industrial Government & Municipalities |

| By Geography | United Arab Emirates Saudi Arabia Qatar Kuwait Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies in Smart Grid Implementation | 100 | Energy Managers, Operations Directors |

| Technology Providers for Smart Grid Solutions | 80 | Product Managers, Business Development Executives |

| Government Agencies Overseeing Energy Policies | 60 | Policy Analysts, Regulatory Affairs Managers |

| Consultants Specializing in Energy Efficiency | 50 | Energy Consultants, Sustainability Advisors |

| Research Institutions Focused on Energy Technologies | 40 | Research Scientists, Academic Professors |

The Middle East Smart Grid Network Market is valued at approximately USD 6 billion, driven by the increasing demand for energy efficiency, renewable energy integration, and modernization of grid infrastructure.