Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0306

Pages:83

Published On:August 2025

Market.png)

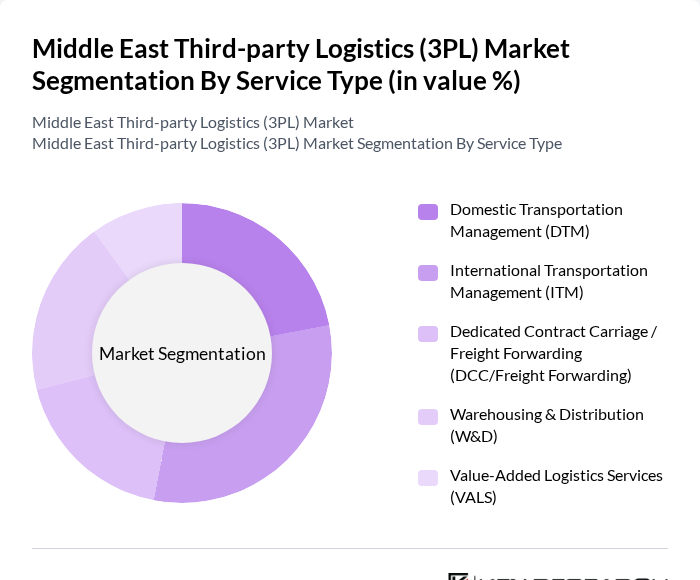

By Service Type:The service type segmentation includes various logistics services that cater to different needs within the market. The subsegments are Domestic Transportation Management (DTM), International Transportation Management (ITM), Dedicated Contract Carriage / Freight Forwarding (DCC/Freight Forwarding), Warehousing & Distribution (W&D), and Value-Added Logistics Services (VALS). Each of these subsegments plays a crucial role in the overall logistics ecosystem, with specific services tailored to meet the demands of various industries .

The International Transportation Management (ITM) subsegment is currently dominating the market due to the increasing globalization of trade and the need for efficient cross-border logistics solutions. Companies are increasingly relying on ITM services to navigate complex international regulations and ensure timely deliveries. The rise of e-commerce has also fueled demand for international shipping solutions, as businesses seek to expand their reach to global customers. This trend is expected to continue, solidifying ITM's position as a key driver of growth in the logistics sector .

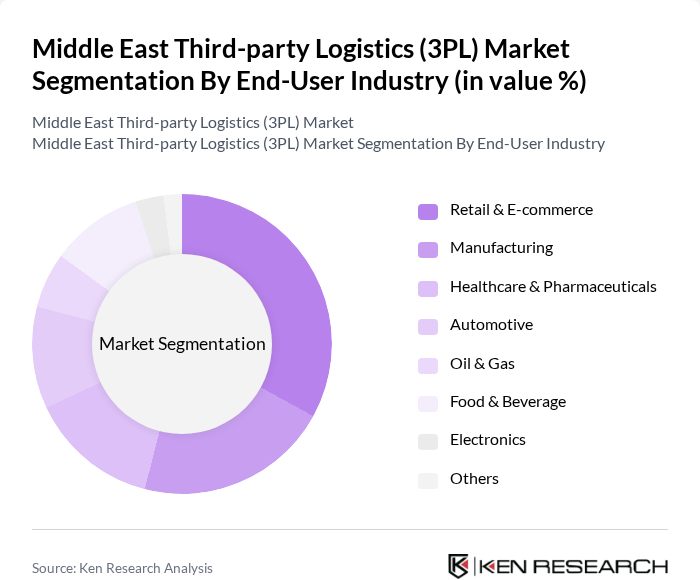

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize logistics services, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Oil & Gas, Food & Beverage, Electronics, and Others. Each industry has unique logistics requirements, driving demand for tailored solutions that enhance efficiency and reduce costs .

The Retail & E-commerce sector is the leading end-user industry in the logistics market, driven by the exponential growth of online shopping and consumer demand for fast delivery services. Retailers are increasingly investing in logistics solutions to enhance their supply chain efficiency and meet customer expectations. The shift towards omnichannel retailing and the adoption of digital platforms have further intensified the need for robust logistics capabilities, making this sector a significant contributor to the overall growth of the logistics market .

The Middle East Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, Agility Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, FedEx Logistics, UPS Supply Chain Solutions, Al-Futtaim Logistics, Bahri Logistics, Gulf Agency Company (GAC), Hellmann Worldwide Logistics, Bolloré Logistics, DSV Solutions, Kerry Logistics Network contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East 3PL market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to adopt advanced technologies such as AI and automation to enhance efficiency. Additionally, the shift towards sustainable logistics practices will shape operational strategies, with companies increasingly focusing on reducing their carbon footprint. This evolving landscape presents a dynamic environment for growth and innovation in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Domestic Transportation Management (DTM) International Transportation Management (ITM) Dedicated Contract Carriage / Freight Forwarding (DCC/Freight Forwarding) Warehousing & Distribution (W&D) Value-Added Logistics Services (VALS) |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Oil & Gas Food & Beverage Electronics Others |

| By Mode of Transport | Roadways Airways Seaways Railways |

| By Country/Region | United Arab Emirates (UAE) Saudi Arabia Qatar Kuwait Oman Bahrain Rest of Middle East |

| By Technology Adoption | Cloud-based Solutions IoT Integration Blockchain Technology Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 60 | Logistics Directors, Supply Chain Managers |

| Healthcare Supply Chain Solutions | 50 | Operations Managers, Procurement Specialists |

| Automotive Logistics Services | 40 | Warehouse Managers, Distribution Coordinators |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Logistics Analysts |

| Cold Chain Logistics for Food Products | 45 | Quality Assurance Managers, Supply Chain Directors |

The Middle East Third-party Logistics (3PL) Market is valued at approximately USD 110 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and the region's strategic location as a trade hub.