Region:Middle East

Author(s):Shubham

Product Code:KRAD5408

Pages:98

Published On:December 2025

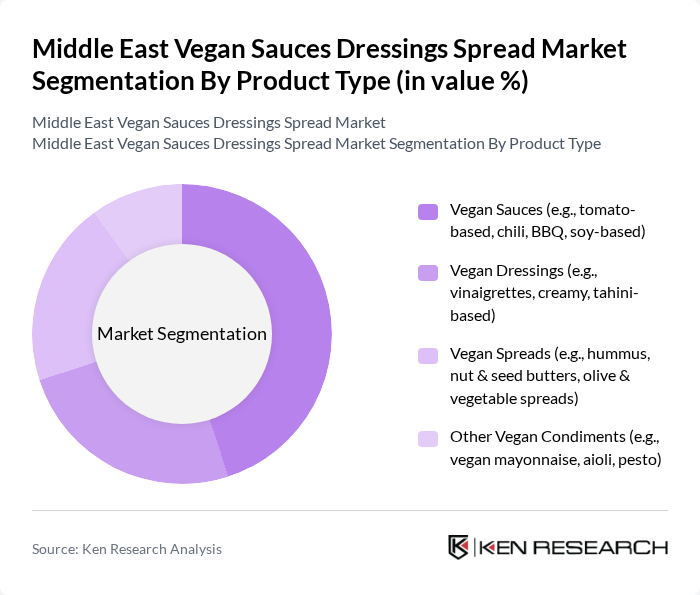

By Product Type:The product type segmentation includes various categories such as vegan sauces, vegan dressings, vegan spreads, and other vegan condiments. Among these, vegan sauces are currently leading the market due to their versatility and widespread use in both household and commercial kitchens. The increasing popularity of plant-based diets has led to a surge in demand for sauces that complement vegan meals, making this sub-segment particularly dominant.

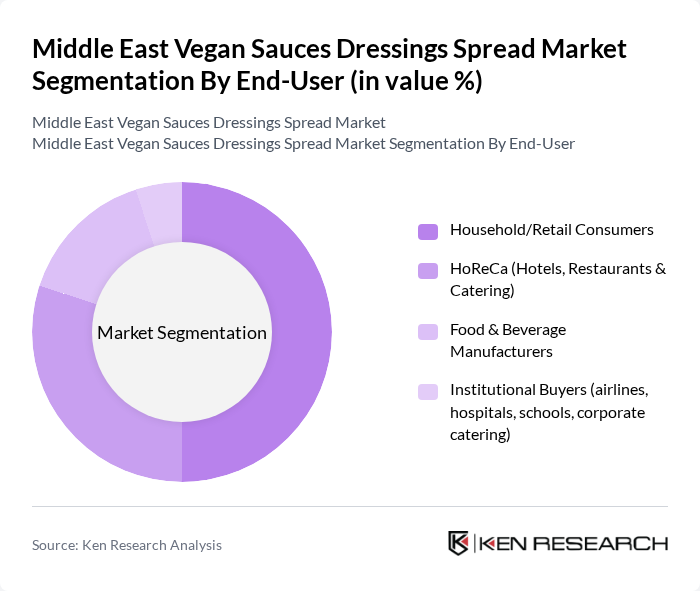

By End-User:The end-user segmentation encompasses household/retail consumers, HoReCa (Hotels, Restaurants & Catering), food & beverage manufacturers, and institutional buyers. The household/retail consumer segment is currently the largest, driven by the increasing number of individuals adopting vegan diets and the growing availability of vegan products in supermarkets and online platforms. This trend is further supported by the rising health consciousness among consumers.

The Middle East Vegan Sauces Dressings Spread Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever plc (Hellmann’s Vegan, Sir Kensington’s, Maille), The Kraft Heinz Company (Heinz Vegan Mayonnaise & Sauces), Nestlé S.A. (Garden Gourmet, plant-based cooking solutions), Upfield Holdings B.V. (Flora Plant, Becel, Rama plant-based spreads), Al Islami Foods (UAE – plant-based and vegan-ready sauces & condiments), Americana Group (Kuwait/Saudi Arabia – foodservice sauces & vegan menu solutions), Almarai Company (Saudi Arabia – dairy-free and plant-based spreads & dressings), IFFCO Group (Noor and other brands – plant-based mayonnaise & sauces), Hunter Foods LLC (UAE – clean-label, vegan sauces and dip accompaniments), Biona Organic (vegan organic sauces, ketchups and spreads), Dr. Oetker (vegan pizza sauces, dessert sauces and toppings), Violife (plant-based spreads and cooking creams used as bases for sauces), Oatly Group AB (oat-based spreads and culinary creams for vegan sauces), Al Ain Farms (UAE – emerging plant-based and vegan-friendly products), Regional & Private Label Brands (Lulu, Carrefour, Spinneys, Choithrams house brands) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East vegan sauces and dressings market appears promising, driven by increasing health consciousness and a growing vegan population. Innovations in product development, particularly in flavor profiles and organic ingredients, are expected to enhance consumer appeal. Additionally, the rise of e-commerce platforms is facilitating easier access to vegan products, allowing brands to reach a broader audience. As these trends continue, the market is likely to experience sustained growth and diversification in offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vegan Sauces (e.g., tomato-based, chili, BBQ, soy-based) Vegan Dressings (e.g., vinaigrettes, creamy, tahini-based) Vegan Spreads (e.g., hummus, nut & seed butters, olive & vegetable spreads) Other Vegan Condiments (e.g., vegan mayonnaise, aioli, pesto) |

| By End-User | Household/Retail Consumers HoReCa (Hotels, Restaurants & Catering) Food & Beverage Manufacturers Institutional Buyers (airlines, hospitals, schools, corporate catering) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Groceries Specialty & Health Food Stores Online Retail & E-commerce Platforms HoReCa & Foodservice Distributors |

| By Flavor Profile | Middle Eastern & Arabic (e.g., tahini, garlic, harissa, za’atar) Western (e.g., Italian, American-style BBQ, ranch-style) Asian & Fusion (e.g., soy-ginger, sriracha, curry-based) Sweet & Dessert-Oriented (e.g., chocolate, date, nut-based spreads) |

| By Packaging Type | Bottles (glass & PET) Jars Squeeze Packs & Pouches Single-Serve Sachets Bulk Foodservice Packs |

| By Ingredient & Claim | Organic & Clean-Label Conventional Gluten-Free Allergen-Free (soy-free, nut-free, etc.) Fortified/Functional (e.g., high-protein, reduced sodium, added fiber) |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegan Sauce Retailers | 100 | Store Managers, Product Buyers |

| Health Food Distributors | 80 | Distribution Managers, Sales Representatives |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Vegan Diet Adopters |

| Food Service Operators | 70 | Restaurant Owners, Menu Planners |

| Market Analysts | 40 | Industry Experts, Market Researchers |

The Middle East Vegan Sauces Dressings Spread Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by the increasing consumer shift towards plant-based diets and rising health consciousness among millennials and Gen Z.