Region:Middle East

Author(s):Shubham

Product Code:KRAC2111

Pages:85

Published On:October 2025

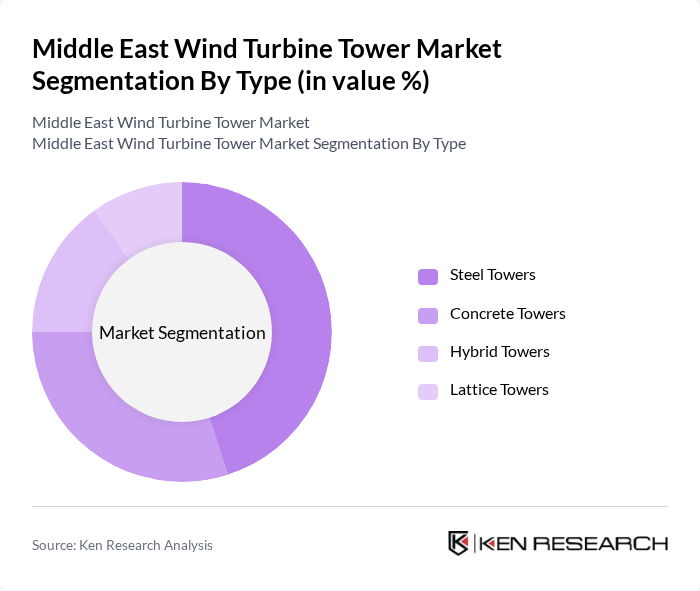

By Type:The market is segmented into four types of wind turbine towers: Steel Towers, Concrete Towers, Hybrid Towers, and Lattice Towers. Steel Towers are widely used due to their strength and durability, forming the largest segment in the Middle East and Africa region. Concrete Towers are gaining significant traction globally for their cost-effectiveness and environmental benefits, with the fastest growth trajectory. Hybrid Towers combine the advantages of both materials, enabling greater heights while reducing material costs, and Lattice Towers are preferred for specific applications due to their lightweight structure and ease of transportation.

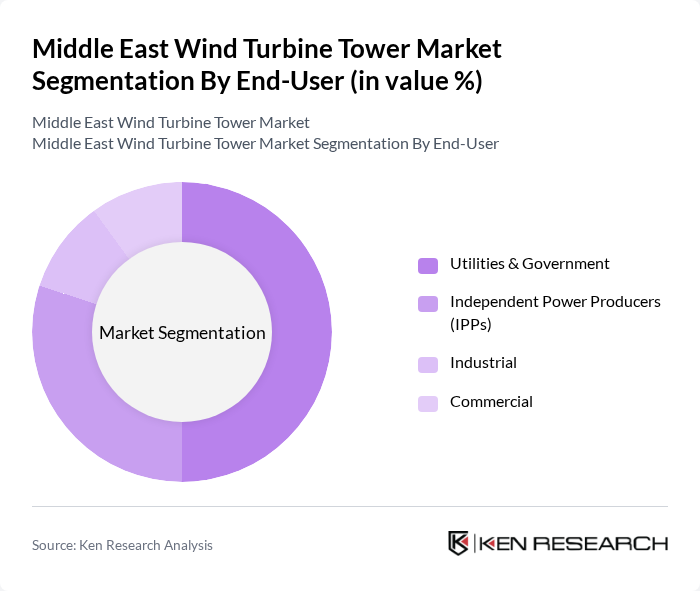

By End-User:The market is categorized into Utilities & Government, Independent Power Producers (IPPs), Industrial, and Commercial sectors. Utilities & Government are the largest end-users, driven by large-scale renewable energy projects and government mandates aligned with national diversification strategies. IPPs are also significant players, focusing on developing wind farms to meet energy demands and capitalize on favorable power purchase agreements. The Industrial and Commercial sectors are increasingly adopting wind energy solutions for sustainability objectives and long-term cost savings, particularly as corporate renewable energy commitments intensify across the region.

The Middle East Wind Turbine Tower Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Nordex SE, CS Wind Corporation, Arcosa Wind Towers, Marmen Inc., GRI Renewable Industries, Enercon GmbH, Goldwind Science & Technology Co., Ltd., Mingyang Smart Energy Group Co., Ltd., Modvion AB, China National Building Material Co Ltd, Lekela Power, Acciona Energía contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East wind turbine tower market appears promising, driven by increasing investments in renewable energy and supportive government policies. As countries strive to meet their renewable energy targets, the focus will likely shift towards enhancing local manufacturing capabilities and fostering international collaborations. Furthermore, the integration of digital technologies in wind operations is expected to optimize performance and reduce costs, paving the way for a more sustainable energy landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Towers Concrete Towers Hybrid Towers Lattice Towers |

| By End-User | Utilities & Government Independent Power Producers (IPPs) Industrial Commercial |

| By Application | Onshore Wind Farms Offshore Wind Farms Distributed Generation |

| By Country | Saudi Arabia United Arab Emirates (UAE) Egypt Morocco South Africa Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Turbine Manufacturers | 60 | Product Managers, R&D Engineers |

| Energy Project Developers | 50 | Project Managers, Business Development Executives |

| Government Energy Regulators | 40 | Policy Makers, Regulatory Affairs Specialists |

| Consultants in Renewable Energy | 45 | Energy Analysts, Sustainability Consultants |

| Wind Farm Operators | 40 | Operations Managers, Maintenance Supervisors |

The Middle East Wind Turbine Tower Market is valued at approximately USD 620 million, reflecting significant growth driven by investments in renewable energy projects and government initiatives aimed at diversifying energy sources and enhancing sustainability.