Middle East Women's Dresses Skirts Market Overview

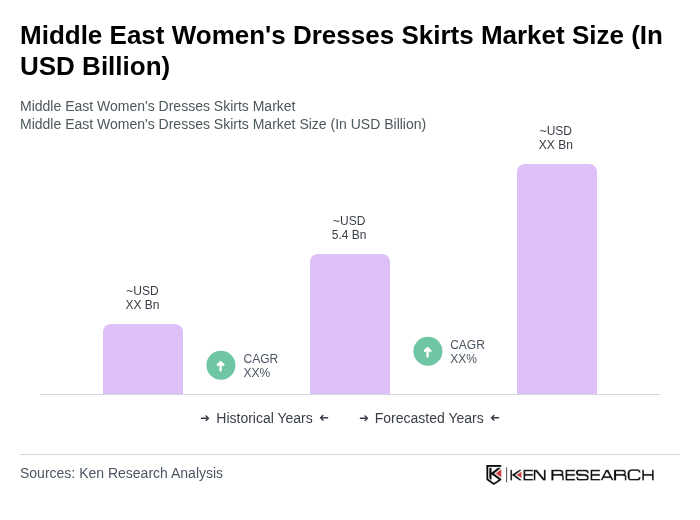

- The Middle East Women's Dresses Skirts Market is valued at USD 5.4 billion, based on a five-year historical analysis of regional revenues within the global women’s dresses and skirts category and the Europe–Middle East–Africa split reported by leading industry studies. This growth is primarily driven by increasing disposable incomes, evolving fashion trends, and a rising demand for modest yet stylish clothing options among women in the region. The market has seen a significant shift towards online shopping, further boosting sales and accessibility, supported by strong ecommerce adoption in Gulf markets and fashion-specific online platforms.

- Key players in this market include the GCC countries, particularly Saudi Arabia and the UAE, which dominate due to their affluent consumer base and a strong retail infrastructure. Additionally, cities like Dubai and Riyadh are known for their vibrant fashion scenes, attracting both local and international brands, thus enhancing market growth through a mix of malls, flagship stores, and online pure players.

- In 2023, the Saudi Arabian government implemented regulations to promote local textile and garment production under broader industrial and localization programs, aiming to reduce dependency on imports. This initiative is supported by instruments such as the National Industrial Development and Logistics Program (NIDLP) and the Industrial Investment Law, 2020 issued by the Ministry of Industry and Mineral Resources, which provide incentives including customs advantages, financing support through the Saudi Industrial Development Fund, and facilitation of local manufacturing licenses for textile and apparel investors. These measures encourage manufacturers and retailers to increase local sourcing, thereby fostering economic growth and sustainability within the fashion industry.

Middle East Women's Dresses Skirts Market Segmentation

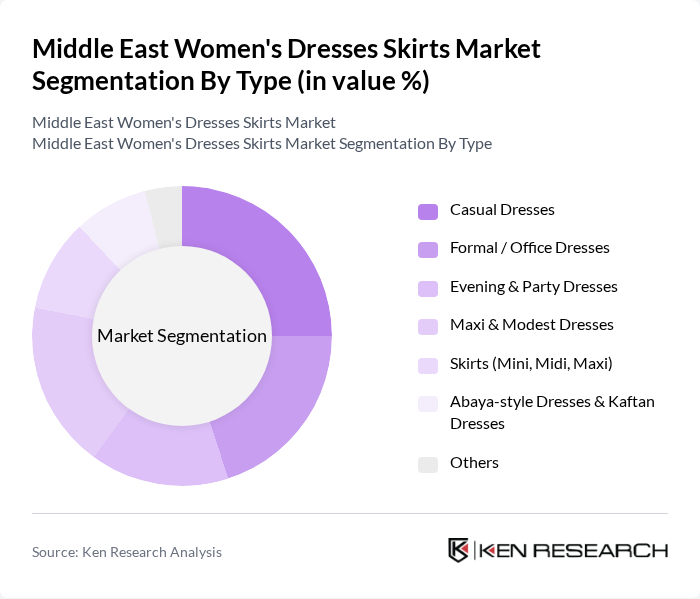

By Type:The market can be segmented into various types of dresses and skirts, including Casual Dresses, Formal / Office Dresses, Evening & Party Dresses, Maxi & Modest Dresses, Skirts (Mini, Midi, Maxi), Abaya-style Dresses & Kaftan Dresses, and Others. Each of these segments caters to different consumer preferences and occasions, reflecting the diverse fashion landscape in the Middle East, where demand for modest, occasion-wear, and contemporary Western-style apparel coexists.

By Fabric Type:The market is also segmented by fabric type, including Cotton, Polyester, Silk, Linen, Blends (Cotton-Poly, Viscose, Rayon), Performance & Stretch Fabrics, and Others. The choice of fabric significantly influences consumer purchasing decisions, with preferences shifting towards sustainable and comfortable materials such as breathable cottons, linen, and eco-friendly blends, alongside performance fabrics that offer stretch and durability for everyday wear.

Middle East Women's Dresses Skirts Market Competitive Landscape

The Middle East Women's Dresses Skirts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Max Fashion (Landmark Group), Splash (Landmark Group), Centrepoint (Landmark Group), Redtag, Ounass, Namshi, Nisnass, Zara (Inditex), H&M, Mango, Stradivarius, Bershka, Forever 21, Marks & Spencer, BCBGMAXAZRIA, Ted Baker, Riva Fashion, Splash Fashions (Saudi & GCC Franchises) contribute to innovation, geographic expansion, and service delivery in this space, with many brands strengthening omnichannel offerings and localized modest collections.

Middle East Women's Dresses Skirts Market Industry Analysis

Growth Drivers

- Increasing Disposable Income Among Women:The disposable income of women in the Middle East is projected to reach approximately $1.5 trillion in future, reflecting a significant increase from previous years. This rise in income allows women to spend more on fashion, particularly dresses and skirts, which are seen as essential components of their wardrobes. As women gain financial independence, their purchasing power enhances the demand for stylish and high-quality clothing, driving market growth.

- Rising Fashion Consciousness and Trends:The Middle East has witnessed a surge in fashion consciousness, with the fashion retail market expected to grow to $60 billion in future. This trend is fueled by increased exposure to global fashion trends through social media and international brands. Women are increasingly seeking unique and trendy dresses and skirts that reflect their personal style, leading to a robust demand for diverse fashion offerings in the region.

- Expansion of E-commerce Platforms:E-commerce sales in the Middle East are anticipated to reach $35 billion in future, driven by the growing internet penetration rate, which is projected to exceed 95%. This expansion allows women to access a wider variety of dresses and skirts from both local and international brands. The convenience of online shopping, coupled with targeted marketing strategies, is significantly enhancing consumer engagement and driving sales in the women's fashion segment.

Market Challenges

- Intense Competition from Local and International Brands:The Middle East women's dresses and skirts market is characterized by fierce competition, with over 1,200 brands vying for market share. This saturation leads to price wars and challenges in brand differentiation. Local brands often struggle to compete with established international names that have greater resources for marketing and distribution, making it difficult for them to maintain profitability and market presence.

- Fluctuating Raw Material Prices:The textile industry is heavily impacted by the volatility of raw material prices, particularly cotton and synthetic fibers. In future, cotton prices are expected to fluctuate between $0.90 and $1.30 per pound, influenced by global supply chain disruptions and climate change. These fluctuations can significantly affect production costs for manufacturers, leading to increased prices for consumers and potential reductions in profit margins for brands.

Middle East Women's Dresses Skirts Market Future Outlook

The future of the Middle East women's dresses and skirts market appears promising, driven by evolving consumer preferences and technological advancements. As women increasingly prioritize sustainability, brands that adopt eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement, allowing for virtual try-ons and personalized shopping experiences, further driving market growth in future.

Market Opportunities

- Growth of Sustainable Fashion:The demand for sustainable fashion is on the rise, with the market for eco-friendly clothing projected to reach $10 billion in future. Brands that focus on sustainable materials and ethical production practices can tap into this growing consumer base, appealing to environmentally conscious shoppers and enhancing brand loyalty.

- Increasing Online Shopping Trends:With online shopping expected to account for 25% of total retail sales in the Middle East in future, brands that enhance their digital presence can capitalize on this trend. Investing in user-friendly e-commerce platforms and targeted digital marketing strategies will enable brands to reach a broader audience and increase sales significantly.