Region:Middle East

Author(s):Rebecca

Product Code:KRAD4273

Pages:83

Published On:December 2025

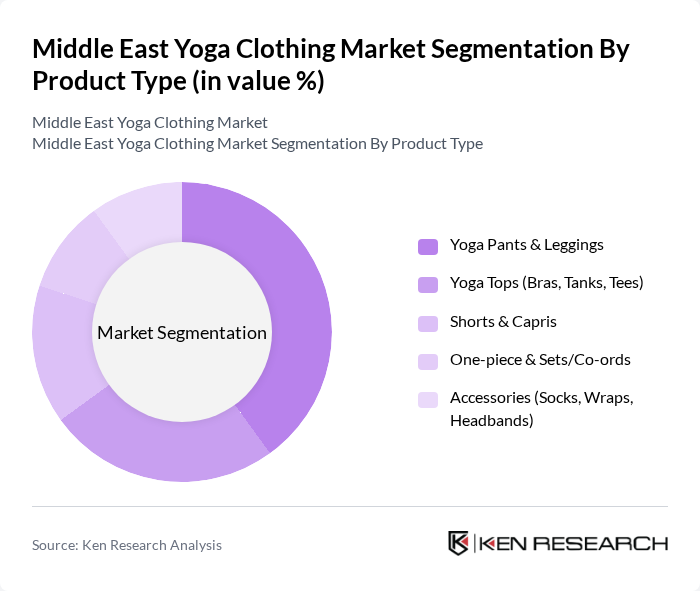

By Product Type:The product type segmentation includes various categories such as Yoga Pants & Leggings, Yoga Tops (Bras, Tanks, Tees), Shorts & Capris, One-piece & Sets/Co-ords, and Accessories (Socks, Wraps, Headbands). Among these, Yoga Pants & Leggings dominate the market due to their versatility and comfort, appealing to a wide range of consumers. The trend towards athleisure has further boosted the demand for stylish and functional yoga pants, making them a staple in many wardrobes.

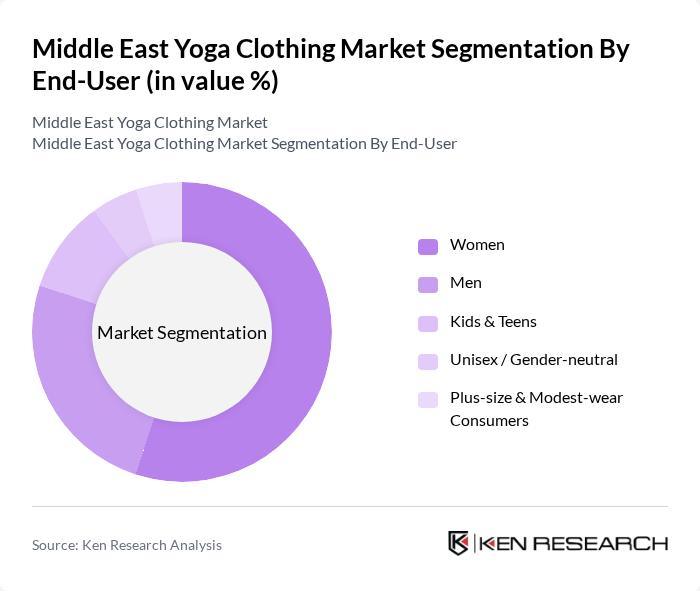

By End-User:The end-user segmentation includes Women, Men, Kids & Teens, Unisex / Gender-neutral, and Plus-size & Modest-wear Consumers. Women represent the largest segment, driven by the increasing participation of females in yoga and fitness activities. The growing trend of body positivity and inclusivity has also led to a rise in demand for plus-size and modest-wear options, catering to diverse consumer needs.

The Middle East Yoga Clothing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lululemon Athletica Inc., Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Decathlon S.A. (Domyos / Kimjaly), Athleta, Inc. (Gap Inc.), Fabletics, LLC, Alo Yoga (Color Image Apparel, Inc.), Gymshark Ltd, Namshi General Trading LLC (Private Label Activewear), Sun & Sand Sports LLC (Regional Multi-brand Retailer), Lorna Jane Pty Ltd, Oysho (Industria de Diseño Textil, S.A. – Inditex), Local & Regional DTC Brands (e.g., The Giving Movement, UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East yoga clothing market appears promising, driven by a growing emphasis on health and wellness among consumers. As more individuals adopt yoga as a lifestyle choice, the demand for specialized apparel is expected to rise. Additionally, the integration of technology in clothing, such as moisture-wicking fabrics and smart textiles, will likely enhance product appeal. Brands that focus on sustainability and inclusivity will also find opportunities to differentiate themselves in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Yoga Pants & Leggings Yoga Tops (Bras, Tanks, Tees) Shorts & Capris One-piece & Sets/Co-ords Accessories (Socks, Wraps, Headbands) |

| By End-User | Women Men Kids & Teens Unisex / Gender-neutral Plus-size & Modest-wear Consumers |

| By Distribution Channel | E-commerce Marketplaces Brand-owned Online Stores Specialty Sports & Yoga Stores Department Stores & Fashion Retail Chains Hypermarkets, Supermarkets & Other Offline Channels |

| By Material | Cotton & Organic Cotton Polyester & Recycled Polyester Nylon & Spandex Blends Bamboo, Tencel & Other Sustainable Fibres Performance Blends (Moisture-wicking / Compression) |

| By Price Range | Mass / Value Mid-range Premium Luxury & Designer Private-label & Discount |

| By Usage Occasion | Studio & Gym Yoga Home & Digital/Online Yoga Athleisure & Everyday Wear Outdoor & Retreat / Wellness Travel Others |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Yoga Studio Owners | 60 | Studio Managers, Franchise Owners |

| Yoga Practitioners | 120 | Regular Attendees, Casual Participants |

| Retail Buyers | 70 | Merchandise Managers, Purchasing Agents |

| Fitness Influencers | 50 | Social Media Influencers, Brand Ambassadors |

| Health and Wellness Experts | 40 | Nutritionists, Fitness Coaches |

The Middle East Yoga Clothing Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and the rising popularity of yoga and fitness activities among consumers in the region.