Region:Africa

Author(s):Rebecca

Product Code:KRAA1437

Pages:85

Published On:August 2025

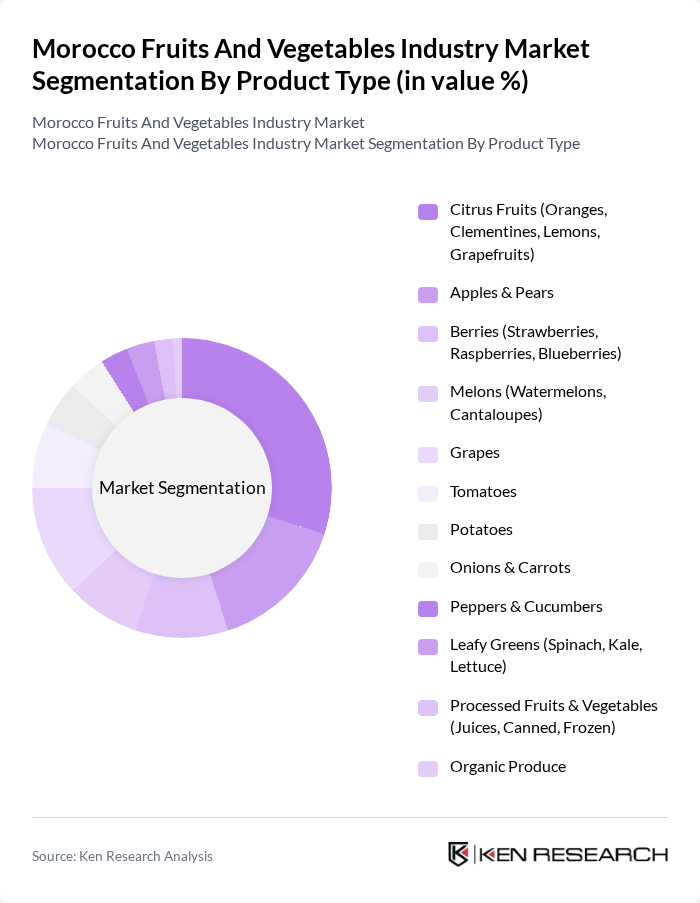

By Product Type:The product type segmentation includes categories such as Citrus Fruits, Apples & Pears, Berries, Melons, Grapes, Tomatoes, Potatoes, Onions & Carrots, Peppers & Cucumbers, Leafy Greens, Processed Fruits & Vegetables, and Organic Produce. Among these, Citrus Fruits are particularly dominant due to their high export demand and favorable growing conditions in Morocco. Tomatoes also represent a significant share, driven by both domestic consumption and export opportunities. The increasing health consciousness among consumers has led to a rise in the popularity of organic produce and value-added products such as packaged and processed fruits and vegetables .

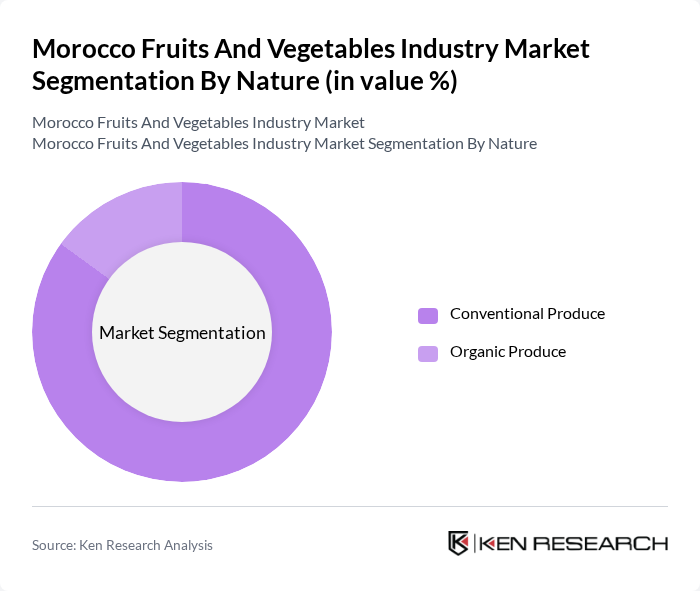

By Nature:The nature segmentation includes Conventional Produce and Organic Produce. Conventional produce dominates the market due to its widespread availability and lower production costs. However, there is a growing trend towards organic produce as consumers become more health-conscious and environmentally aware. This shift is gradually increasing the market share of organic products, supported by government incentives and stricter food safety regulations .

The Morocco Fruits and Vegetables Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Les Domaines Agricoles, SanLucar Fruit S.L.U., Copag (Coopérative Agricole de Taroudant), Maroc Taswiq, Azura Group, Delassus Group, Idyl Maroc, Morocco Berry Company, Fresh Fruit Maroc, MORGHATI EXPORT, Les Jardins de Marrakech, Agafay Fruits, Best Fruits Maroc, Green Valley Maroc, Duroc Maroc contribute to innovation, geographic expansion, and service delivery in this space .

The future of Morocco's fruits and vegetables industry appears promising, driven by increasing domestic consumption and expanding export markets. As health trends continue to influence consumer preferences, the demand for organic and locally sourced produce is expected to rise. Additionally, technological innovations in agriculture will likely enhance productivity and sustainability. However, addressing climate change and supply chain challenges will be crucial for maintaining growth and ensuring the industry's long-term viability in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Citrus Fruits (Oranges, Clementines, Lemons, Grapefruits) Apples & Pears Berries (Strawberries, Raspberries, Blueberries) Melons (Watermelons, Cantaloupes) Grapes Tomatoes Potatoes Onions & Carrots Peppers & Cucumbers Leafy Greens (Spinach, Kale, Lettuce) Processed Fruits & Vegetables (Juices, Canned, Frozen) Organic Produce |

| By Nature | Conventional Produce Organic Produce |

| By End Use | Fresh Consumption Food Processing Industry HoReCa (Hotels, Restaurants, Cafés) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Platforms Wholesale Markets |

| By Region | Northern Morocco Central Morocco Southern Morocco |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fruit Producers | 100 | Farm Owners, Agricultural Managers |

| Vegetable Distributors | 80 | Wholesale Managers, Supply Chain Coordinators |

| Retail Market Insights | 60 | Store Managers, Category Buyers |

| Export Market Analysis | 50 | Export Managers, Trade Compliance Officers |

| Consumer Preferences | 70 | End Consumers, Market Researchers |

The Morocco Fruits and Vegetables Industry Market is valued at approximately USD 4.4 billion, driven by increasing domestic consumption, robust export demand, and favorable climatic conditions that support diverse agricultural production.