Region:Europe

Author(s):Geetanshi

Product Code:KRAB5225

Pages:82

Published On:October 2025

By Type:The market is segmented into various types, including Learning Management Systems (LMS), Massive Open Online Courses (MOOCs), Virtual Classrooms, E-Learning Content Development, Assessment and Evaluation Tools, Mobile Learning Applications, and Others. Among these, Learning Management Systems (LMS) are the most dominant due to their widespread adoption in both educational institutions and corporate training environments. The increasing need for centralized learning solutions that facilitate tracking and reporting of learner progress has driven the demand for LMS platforms.

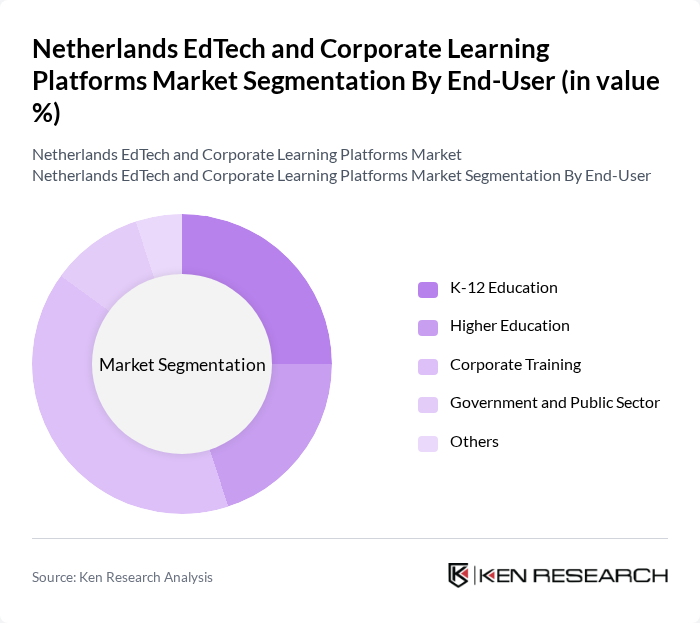

By End-User:The market is segmented by end-users, including K-12 Education, Higher Education, Corporate Training, Government and Public Sector, and Others. Corporate Training is the leading segment, driven by the increasing need for employee skill development and compliance training in various industries. Companies are investing in EdTech solutions to enhance workforce capabilities and adapt to the rapidly changing job market.

The Netherlands EdTech and Corporate Learning Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Reducate EdTech Group (E-WISE), Noordhoff, GoodHabitz, Studytube, LessonUp, Squla, New Heroes, Iddink Group, Blink Learning, Pluvo, Moodle Pty Ltd., Coursera Inc., LinkedIn Learning, FutureLearn Ltd., Khan Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands EdTech and corporate learning platforms market appears promising, driven by ongoing technological advancements and a cultural shift towards digital learning. As educational institutions increasingly embrace blended learning models, the integration of AI and personalized learning experiences will become more prevalent. Furthermore, partnerships between EdTech companies and educational institutions are expected to flourish, enhancing the quality and accessibility of digital education. This collaborative approach will likely foster innovation and drive market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Massive Open Online Courses (MOOCs) Virtual Classrooms E-Learning Content Development Assessment and Evaluation Tools Mobile Learning Applications Others |

| By End-User | K-12 Education Higher Education Corporate Training Government and Public Sector Others |

| By Application | Skill Development Compliance Training Employee Onboarding Continuous Professional Development Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Offline Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| By Geographic Coverage | National Regional Local International Others |

| By User Demographics | Age Group (Children, Adults, Seniors) Professional Background (Students, Working Professionals) Learning Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Learning Platforms | 120 | HR Managers, Learning & Development Directors |

| EdTech Adoption in Higher Education | 100 | University Administrators, Faculty Heads |

| Training Solutions for SMEs | 80 | Small Business Owners, Training Coordinators |

| Online Learning Tools for K-12 | 70 | School Principals, Curriculum Developers |

| Corporate Upskilling Programs | 90 | Talent Development Managers, Learning Consultants |

The Netherlands EdTech and Corporate Learning Platforms Market is valued at approximately USD 2.6 billion, reflecting significant growth driven by the increasing adoption of digital learning solutions and the demand for personalized learning experiences.