Region:Europe

Author(s):Dev

Product Code:KRAB3035

Pages:83

Published On:October 2025

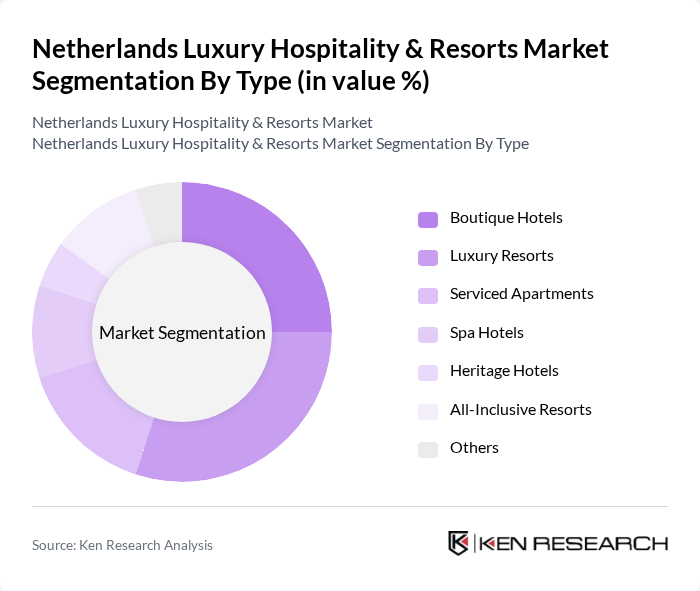

By Type:The luxury hospitality market in the Netherlands is segmented into various types, including Boutique Hotels, Luxury Resorts, Serviced Apartments, Spa Hotels, Heritage Hotels, All-Inclusive Resorts, and Others. Each type caters to different consumer preferences and experiences, with Boutique Hotels often favored for their unique charm and personalized service, while Luxury Resorts provide extensive amenities and leisure options.

By End-User:The market is also segmented by end-user categories, which include Leisure Travelers, Business Travelers, Event Planners, Travel Agencies, Corporate Clients, and Others. Leisure Travelers dominate the market, driven by a growing trend of experiential travel, while Business Travelers seek high-quality accommodations that offer convenience and amenities tailored to their professional needs.

The Netherlands Luxury Hospitality & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hotel Okura Amsterdam, Waldorf Astoria Amsterdam, InterContinental Amstel Amsterdam, The Dylan Amsterdam, Conservatorium Hotel, Sofitel Legend The Grand Amsterdam, Pulitzer Amsterdam, Andaz Amsterdam Prinsengracht, Hilton Amsterdam, NH Collection Amsterdam Grand Hotel Krasnapolsky, Hotel des Indes, The Hague, Grand Hotel Karel V, Hotel de L'Europe Amsterdam, The Grand Amsterdam, Hotel Pulitzer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands luxury hospitality market appears promising, driven by evolving consumer preferences and a focus on sustainability. As travelers increasingly seek eco-friendly accommodations and personalized experiences, luxury hotels are adapting their offerings to meet these demands. Additionally, advancements in technology are enhancing guest experiences, allowing for greater customization and efficiency. The market is expected to continue evolving, with a strong emphasis on integrating sustainability into luxury hospitality practices, ensuring long-term growth and relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Serviced Apartments Spa Hotels Heritage Hotels All-Inclusive Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies Corporate Clients Others |

| By Price Range | Budget Luxury Mid-Range Luxury High-End Luxury Ultra-Luxury Others |

| By Service Type | Room Service Concierge Services Spa and Wellness Services Dining Options Event Hosting Others |

| By Distribution Channel | Direct Booking Online Travel Agencies (OTAs) Travel Agents Corporate Bookings Others |

| By Location | Urban Areas Coastal Areas Countryside Historical Sites Others |

| By Customer Segment | Families Couples Solo Travelers Groups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Management | 100 | General Managers, Operations Directors |

| Travel Agency Insights | 80 | Luxury Travel Advisors, Agency Owners |

| Consumer Preferences in Luxury Travel | 150 | Affluent Travelers, Frequent Luxury Guests |

| Market Trends in Hospitality | 70 | Industry Analysts, Market Researchers |

| Luxury Resort Development | 60 | Real Estate Developers, Investment Analysts |

The Netherlands Luxury Hospitality & Resorts Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is attributed to increased international tourism, rising disposable incomes, and a demand for unique travel experiences.