Region:Europe

Author(s):Dev

Product Code:KRAA4909

Pages:81

Published On:September 2025

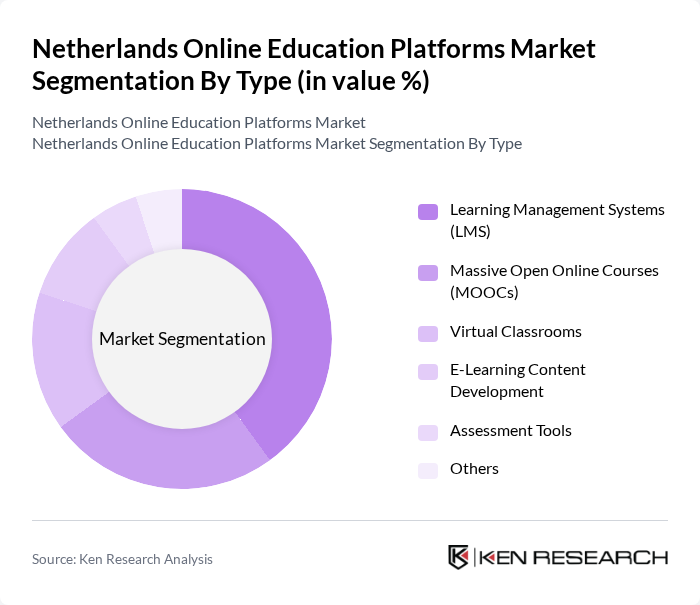

By Type:The online education platforms market can be segmented into various types, including Learning Management Systems (LMS), Massive Open Online Courses (MOOCs), Virtual Classrooms, E-Learning Content Development, Assessment Tools, and Others. Among these, Learning Management Systems (LMS) have emerged as the dominant sub-segment due to their ability to provide comprehensive solutions for educational institutions and corporate training programs. The increasing need for structured learning environments and the ability to track learner progress have made LMS a preferred choice for many organizations.

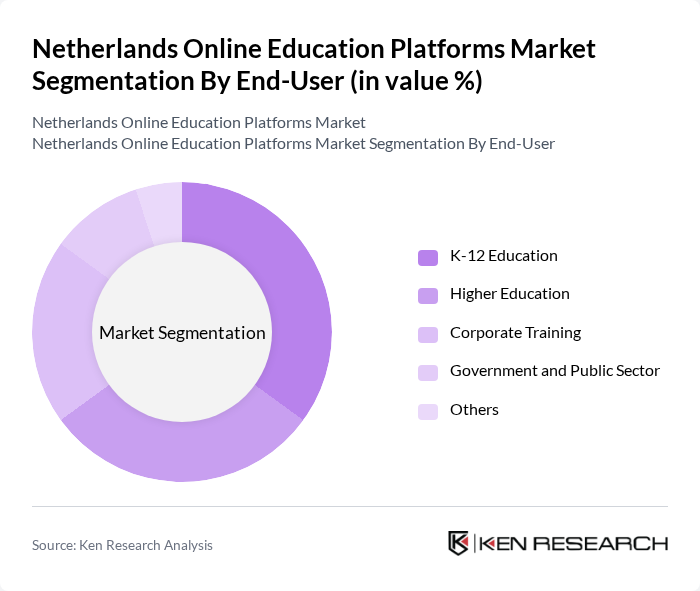

By End-User:The market can also be segmented based on end-users, which include K-12 Education, Higher Education, Corporate Training, Government and Public Sector, and Others. The K-12 Education segment is currently leading the market, driven by the increasing integration of technology in schools and the growing demand for personalized learning experiences. Schools are increasingly adopting online platforms to enhance student engagement and facilitate remote learning, especially in light of recent global events.

The Netherlands Online Education Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera Inc., Udemy Inc., Skillshare Inc., EdX Inc., LinkedIn Learning, Pluralsight Inc., FutureLearn Ltd., Khan Academy, OpenClassrooms, LearnWorlds, Teachable, MasterClass, Codecademy, Alison, Edureka contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online education market in the Netherlands appears promising, driven by technological advancements and evolving learner preferences. As institutions increasingly adopt hybrid learning models, the integration of artificial intelligence and personalized learning experiences will likely enhance engagement and outcomes. Furthermore, the growing emphasis on lifelong learning and upskilling will create new opportunities for online platforms to cater to diverse learner needs, ensuring sustained growth in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Massive Open Online Courses (MOOCs) Virtual Classrooms E-Learning Content Development Assessment Tools Others |

| By End-User | K-12 Education Higher Education Corporate Training Government and Public Sector Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Others |

| By Subject Area | STEM (Science, Technology, Engineering, Mathematics) Humanities and Social Sciences Business and Management Language Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| By Geographic Reach | Local National International Others |

| By User Demographics | Age Group (Children, Adults, Seniors) Professional Background (Students, Working Professionals) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Online Learning | 150 | University Administrators, Faculty Members |

| Corporate Training Platforms | 100 | HR Managers, Training Coordinators |

| K-12 Online Education | 120 | School Principals, Teachers |

| Adult Learning and Skill Development | 80 | Adult Learners, Program Coordinators |

| EdTech Startups and Innovations | 70 | Startup Founders, Product Managers |

The Netherlands Online Education Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital learning solutions and the demand for flexible education options, particularly in the wake of the pandemic.