Region:Europe

Author(s):Dev

Product Code:KRAB5492

Pages:93

Published On:October 2025

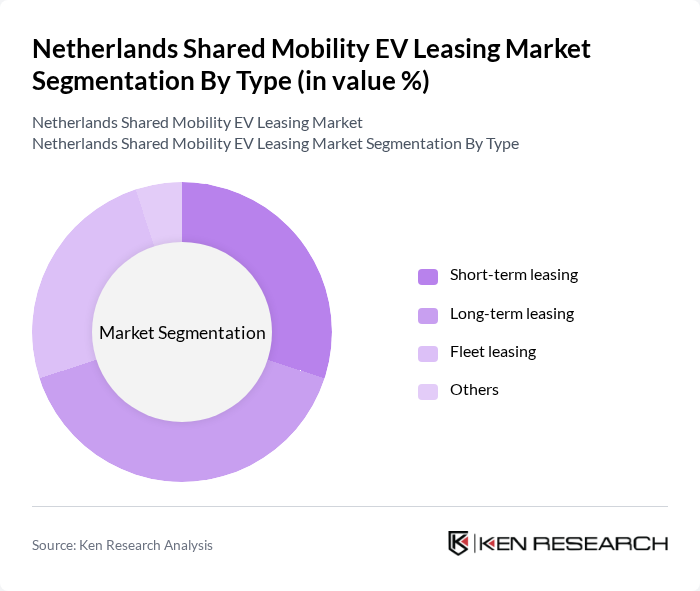

By Type:The market is segmented into various types of leasing options, including short-term leasing, long-term leasing, fleet leasing, and others. Each of these segments caters to different consumer needs and preferences, with varying lease durations and payment models. The demand for short-term leasing has surged due to the increasing popularity of flexible mobility solutions, while long-term leasing remains a preferred choice for businesses looking to maintain a sustainable fleet.

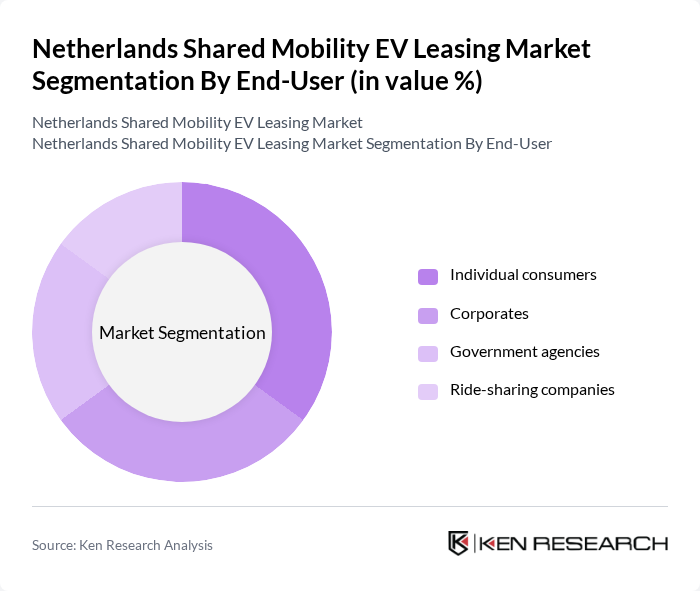

By End-User:The end-user segmentation includes individual consumers, corporates, government agencies, and ride-sharing companies. Individual consumers are increasingly opting for shared mobility solutions due to their convenience and cost-effectiveness. Corporates are also leveraging these services to enhance their sustainability initiatives, while government agencies are promoting shared mobility as part of their urban transport strategies.

The Netherlands Shared Mobility EV Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as LeasePlan Corporation N.V., ALD Automotive, Arval, Greenwheels, Sixt SE, Europcar Mobility Group, TCR Group, Share Now, Zipcar, Getaround, MyWheels, SnappCar, Q8A, Vattenfall, Tesla Leasing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands shared mobility EV leasing market appears promising, driven by ongoing technological advancements and a strong governmental push towards sustainability. As urbanization continues to rise, the demand for shared mobility solutions is expected to increase, with a focus on integrating smart technologies into EVs. Additionally, the expansion of charging infrastructure will likely alleviate current limitations, making EV leasing more attractive to consumers and businesses alike, fostering a more sustainable transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term leasing Long-term leasing Fleet leasing Others |

| By End-User | Individual consumers Corporates Government agencies Ride-sharing companies |

| By Vehicle Category | Compact cars SUVs Vans Others |

| By Lease Duration | Monthly leases Annual leases Multi-year leases |

| By Payment Model | Fixed monthly payments Pay-per-use Subscription models |

| By Charging Options | Home charging Public charging Fast charging |

| By Policy Support | Subsidies Tax exemptions Grants for infrastructure |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Fleet Managers | 100 | Fleet Operations Managers, Sustainability Officers |

| Shared Mobility Service Providers | 80 | Business Development Managers, Operations Directors |

| Consumers Interested in EV Leasing | 150 | Potential EV Users, Environmentally Conscious Consumers |

| Government Policy Makers | 50 | Transport Policy Analysts, Environmental Regulators |

| Charging Infrastructure Providers | 70 | Business Development Executives, Technical Managers |

The Netherlands Shared Mobility EV Leasing Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by urbanization, government incentives for electric vehicles, and a rising consumer preference for sustainable transportation options.