Region:Africa

Author(s):Geetanshi

Product Code:KRAB2756

Pages:91

Published On:October 2025

By Type:The market is segmented into Learning Management Systems (LMS), Virtual Classrooms, Mobile Learning Applications, E-Assessment Tools, Content Development Platforms, Simulation-Based Learning, Game-Based Learning, Online Courses, E-Books and Digital Resources, Certification Programs, and Others. Among these, Learning Management Systems (LMS) continue to dominate due to their ability to streamline educational processes and provide centralized platforms for educators and learners. The surge in remote and hybrid learning models, coupled with the need for scalable solutions for both academic and corporate training, has further accelerated LMS adoption. Mobile learning applications and virtual classrooms are also experiencing rapid growth, reflecting the shift toward mobile-first and interactive learning experiences .

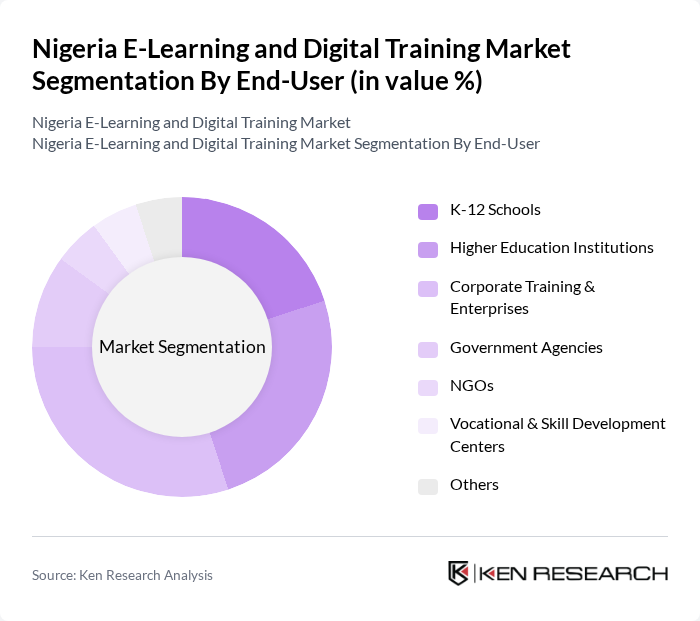

By End-User:The end-user segmentation includes K-12 Schools, Higher Education Institutions, Corporate Training & Enterprises, Government Agencies, NGOs, Vocational & Skill Development Centers, and Others. The Corporate Training & Enterprises segment leads the market, driven by the urgent need for upskilling and reskilling in response to evolving workforce demands. Organizations are investing in digital training platforms to enhance employee productivity, support compliance, and foster continuous professional development. Higher education institutions and K-12 schools are also significant adopters, leveraging e-learning to expand access and improve learning outcomes .

The Nigeria E-Learning and Digital Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Andela, Coursera, Udemy, Pluralsight, Skillshare, Learn Africa, Decagon, Tuteria, Edukoya, Study.com, Konga, Jumia, Google Digital Garage, Microsoft Learn, FutureLearn, uLesson, Pass.ng, Prepclass, Edves, Gradely, Kobo360 Academy, AltSchool Africa, ScholarX, Teesas, Seamfix Learn contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's e-learning and digital training market appears promising, driven by technological advancements and increasing government support. As internet penetration continues to rise, more individuals will gain access to online learning platforms. Additionally, the growing emphasis on skill development in response to workforce demands will likely lead to innovative e-learning solutions. Collaborations between private companies and educational institutions are expected to enhance content quality and accessibility, fostering a more robust digital education ecosystem in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Virtual Classrooms Mobile Learning Applications E-Assessment Tools Content Development Platforms Simulation-Based Learning Game-Based Learning Online Courses E-Books and Digital Resources Certification Programs Others |

| By End-User | K-12 Schools Higher Education Institutions Corporate Training & Enterprises Government Agencies NGOs Vocational & Skill Development Centers Others |

| By Content Type | Academic Content Professional Development Vocational Training Soft Skills Training Technical Skills Training Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Corporate Licensing One-Time Purchase Institutional Licensing Others |

| By Geographic Reach | National Regional International Others |

| By User Demographics | Age Group Educational Background Professional Experience Geographic Location (Urban/Rural) Learning Preferences (Self-paced/Instructor-led) Device Usage (Mobile/Desktop) Others |

| By Distribution Channel | Direct Sales Online Marketplaces Educational Institutions Resellers and Distributors Telecom Partnerships Others |

| By Application | Academic Learning Professional Development Skill Development & Certification Compliance Training Language Learning Others |

| By Subject Area | Technology and IT Skills Business and Management Health and Safety Language Learning Arts and Humanities Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 60 | University Administrators, IT Directors |

| Corporate Training Programs | 50 | HR Managers, Training Coordinators |

| Vocational Training Centers | 40 | Program Directors, Instructors |

| e-Learning Platform Providers | 40 | Product Managers, Business Development Executives |

| Students and Learners | 70 | Undergraduate Students, Adult Learners |

The Nigeria E-Learning and Digital Training Market is valued at approximately USD 400 million, reflecting significant growth driven by increased digital technology adoption, smartphone penetration, and a youthful population seeking flexible learning solutions.