Region:Africa

Author(s):Shubham

Product Code:KRAB3151

Pages:98

Published On:October 2025

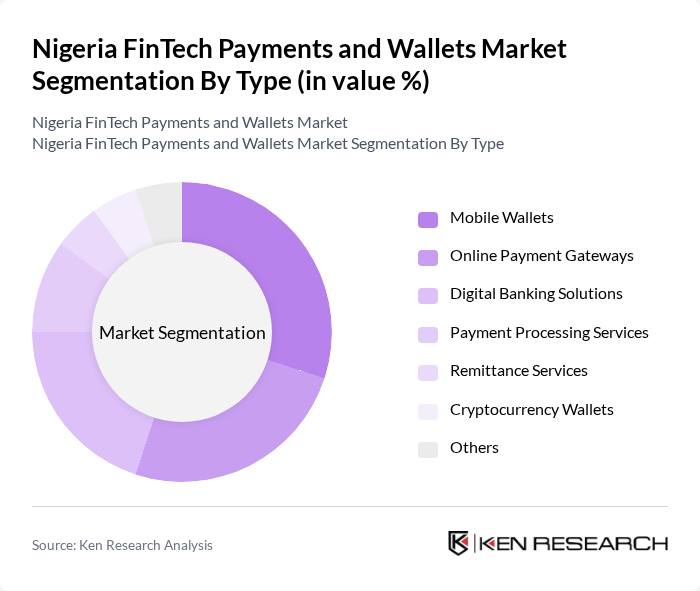

By Type:The market is segmented into various types, including Mobile Wallets, Online Payment Gateways, Digital Banking Solutions, Payment Processing Services, Remittance Services, Cryptocurrency Wallets, and Others. Each of these segments plays a crucial role in catering to the diverse needs of consumers and businesses in Nigeria.

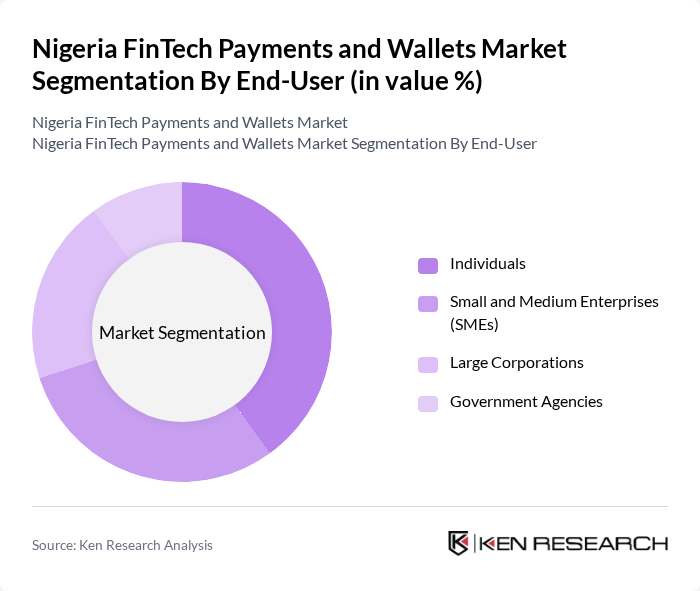

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Agencies. Each segment has unique requirements and preferences, influencing the types of payment solutions they adopt.

The Nigeria FinTech Payments and Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Paystack, Flutterwave, Interswitch, Paga, OPay, Kuda Bank, Cowrywise, Remita, Zenith Bank, First Bank of Nigeria, Access Bank, GTBank, Union Bank, Chipper Cash, Wallet.ng contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's FinTech payments and wallets market appears promising, driven by technological advancements and increasing consumer acceptance of digital transactions. As mobile payment solutions become more integrated into daily life, the market is likely to witness a surge in innovative payment methods. Additionally, the collaboration between FinTech firms and traditional banks is expected to enhance service offerings, making financial services more accessible to underserved populations, thereby fostering economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Gateways Digital Banking Solutions Payment Processing Services Remittance Services Cryptocurrency Wallets Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Agencies |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cash Payments |

| By Transaction Type | Peer-to-Peer Transactions Business-to-Business Transactions Business-to-Consumer Transactions |

| By Distribution Channel | Online Platforms Mobile Applications Physical Retail Outlets |

| By Customer Segment | Urban Customers Rural Customers Corporate Clients |

| By Pricing Model | Subscription-Based Transaction Fee-Based Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Mobile Wallets | 150 | End-users, Tech-savvy Consumers |

| Small Business Payment Solutions | 100 | Small Business Owners, Financial Managers |

| Corporate Payment Systems | 80 | Finance Directors, CFOs |

| Regulatory Impact on FinTech | 60 | Regulatory Officials, Compliance Officers |

| Investment Trends in FinTech | 70 | Venture Capitalists, Financial Analysts |

The Nigeria FinTech Payments and Wallets Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital payment solutions, smartphone penetration, and a growing unbanked population seeking financial inclusion.