Region:Africa

Author(s):Shubham

Product Code:KRAD0713

Pages:98

Published On:August 2025

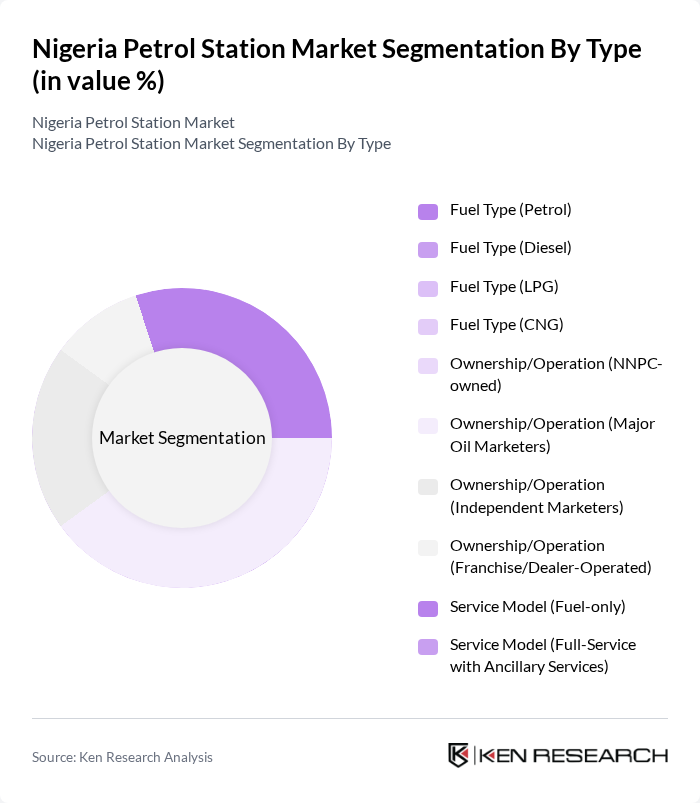

By Type:The market is segmented into fuel type, ownership/operation, and service model. Petrol (PMS) and diesel (AGO) remain the most commonly sold fuels at forecourts, with LPG and emerging CNG supplied at a smaller, growing base from select sites. Ownership/operation includes NNPC-branded outlets, major oil marketers, and a large population of independent marketers, with franchise/dealer-operated models prevalent across networks. Service models include fuel-only sites and full-service stations with convenience retail and ancillary services, increasingly important for margins and customer retention .

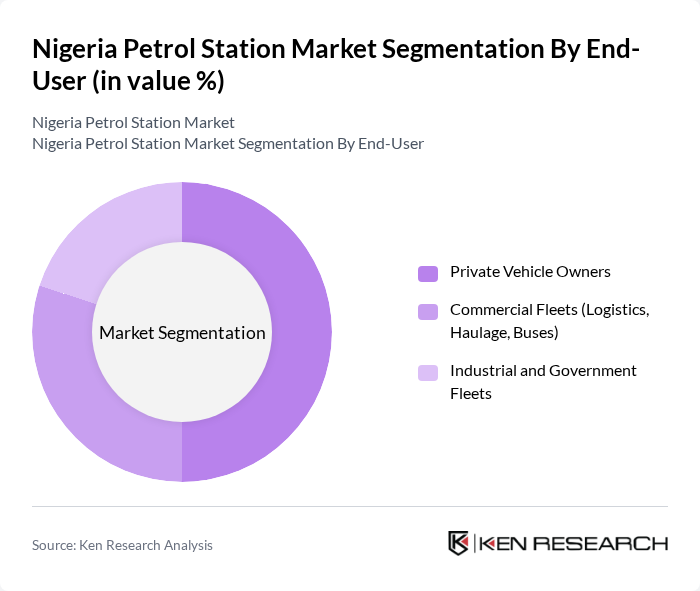

By End-User:The end-user segmentation includes private vehicle owners, commercial fleets, and industrial/government fleets. Private motorists account for a large share of PMS demand, while commercial fleets (logistics, haulage, buses) drive significant diesel sales; industrial and government users contribute materially via bulk purchases and fleet fueling, reflecting Nigeria’s road-transport–heavy energy use profile .

The Nigeria Petrol Station Market is characterized by a mix of international majors, NNPC-branded outlets, and strong local independents. Leading participants include TotalEnergies Marketing Nigeria Plc, 11 Plc (formerly Mobil Oil Nigeria Plc brand on forecourts), Oando Plc, Conoil Plc, NNPC Retail Limited, Ardova Plc, Eterna Plc, MRS Oil Nigeria Plc, Rainoil Limited, NIPCO Plc, Aiteo Group, Sahara Group (Asharami Synergy Plc), Matrix Energy Group, Pinnacle Oil and Gas Limited, and Northwest Petroleum & Gas Company Limited.

The future of the Nigeria petrol station market appears promising, driven by increasing vehicle ownership and urbanization. As the government invests in energy infrastructure, petrol stations will likely see improved supply chains and reduced shortages. Additionally, the shift towards cleaner fuels and digital payment solutions will enhance customer experiences. Strategic partnerships with local businesses can further bolster market resilience, ensuring that petrol stations adapt to evolving consumer preferences and regulatory landscapes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fuel Type (Petrol, Diesel, LPG, CNG) Ownership/Operation (NNPC-owned, Major Oil Marketers, Independent Marketers, Franchise/Dealer-Operated) Service Model (Fuel-only, Full-Service with Ancillary Services) |

| By End-User | Private Vehicle Owners Commercial Fleets (Logistics, Haulage, Buses) Industrial and Government Fleets |

| By Location | Urban Corridors (e.g., Lagos, Abuja, Port Harcourt) Highway/Intercity Corridors Semi-urban and Rural Areas |

| By Service Offering | Convenience Retail (C-store, ATM, POS) Vehicle Services (Car Wash, Lube/Quick Service, Tyre/Battery) Foodservice/QSR Co-locations Alternative Energy Add-ons (LPG Autogas, CNG, Solar Power for Site) |

| By Brand Affiliation | Major Oil Marketers (e.g., TotalEnergies, Mobil, Conoil, MRS, Oando) NNPC Retail Independent/Unbranded Stations |

| By Transaction Method | Cash Cards/POS Mobile/USSD and Fleet Cards |

| By Market Channel | Walk-in/Retail B2B & Fleet Contracts Partnerships with Ride-Hailing/Logistics Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Petrol Station Operators | 100 | Station Managers, Franchise Owners |

| Rural Petrol Station Owners | 80 | Independent Operators, Local Entrepreneurs |

| Consumer Fuel Purchase Behavior | 120 | Regular Consumers, Fleet Managers |

| Regulatory Impact Assessment | 60 | Government Officials, Policy Analysts |

| Fuel Pricing Strategy Insights | 70 | Financial Analysts, Market Strategists |

The Nigeria Petrol Station Market is valued at approximately USD 1.1 billion, based on a five-year historical analysis. This valuation reflects the market's position within the mid-hundreds of millions to low billions range, driven by factors such as vehicle ownership and urbanization.