Region:Africa

Author(s):Rebecca

Product Code:KRAB4168

Pages:98

Published On:October 2025

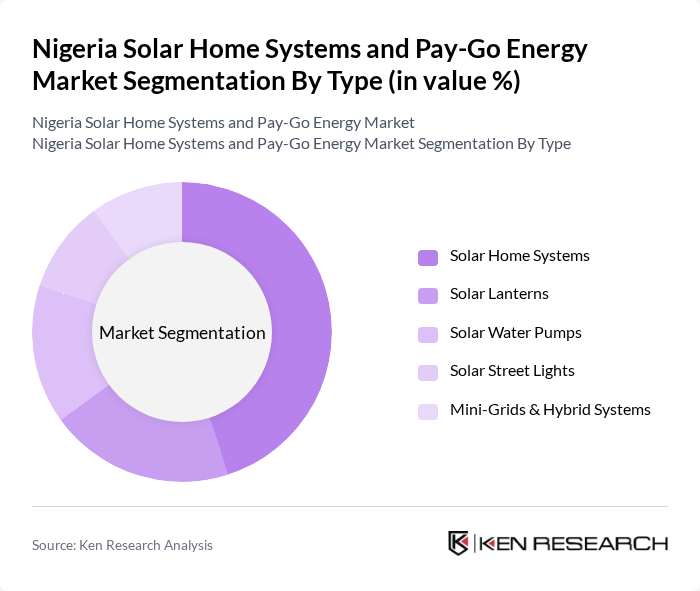

By Type:The market is segmented into Solar Home Systems, Solar Lanterns, Solar Water Pumps, Solar Street Lights, and Mini-Grids & Hybrid Systems. Solar Home Systems are the most widely adopted due to their ability to provide comprehensive energy solutions for households, including lighting, device charging, and small appliance operation. Solar Lanterns offer portable lighting for off-grid users, while Solar Water Pumps and Solar Street Lights address agricultural and public infrastructure needs. Mini-Grids & Hybrid Systems are increasingly deployed in rural communities to deliver reliable, scalable power .

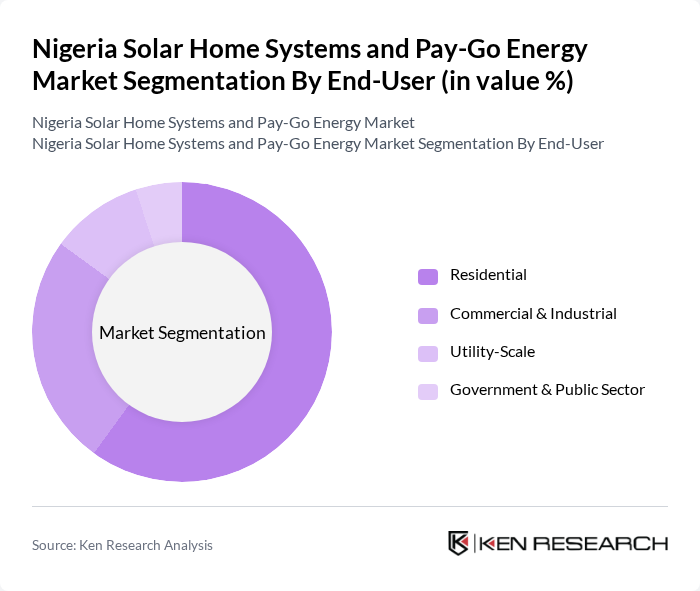

By End-User:The end-user segmentation includes Residential, Commercial & Industrial, Utility-Scale, and Government & Public Sector. The Residential segment leads the market, as millions of households seek reliable and affordable energy alternatives to the unstable national grid. Commercial & Industrial users are increasingly adopting solar solutions to reduce operational costs and ensure business continuity during frequent grid outages. Utility-Scale projects and Government & Public Sector initiatives focus on expanding access through mini-grids and public lighting, supporting broader electrification goals .

The Nigeria Solar Home Systems and Pay-Go Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lumos Nigeria, Daystar Power, Solynta Energy, Greenlight Planet, M-KOPA Solar, d.light, Solar Depot Nigeria, BBOXX, Fenix International, Engie Energy Access, Zola Electric, PowerGen Renewable Energy, SunCulture, Rubitec Solar, and Arnergy Solar Limited drive innovation, geographic expansion, and service delivery in this sector.

The future of Nigeria's solar home systems and Pay-Go energy market appears promising, driven by increasing energy demands and supportive government policies. As urbanization accelerates, more households will seek reliable energy solutions, particularly in off-grid areas. The integration of smart technologies and microgrid systems will enhance energy efficiency and accessibility. Furthermore, the growing emphasis on sustainability will likely lead to increased investments in renewable energy, positioning Nigeria as a leader in solar energy adoption in Africa.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Home Systems Solar Lanterns Solar Water Pumps Solar Street Lights Mini-Grids & Hybrid Systems |

| By End-User | Residential Commercial & Industrial Utility-Scale Government & Public Sector |

| By Distribution Mode | Direct Sales Online Sales Retail & Distribution Partnerships Others |

| By Application | Off-Grid (Solar Home Systems, Mini-Grids) Grid-Connected Rural Electrification Rooftop Installations |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Grants |

| By Policy Support | Subsidies Tax Exemptions & Incentives Renewable Energy Certificates (RECs) |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Home System Users | 100 | Homeowners, Renters |

| Pay-Go Energy Service Providers | 60 | Business Owners, Operations Managers |

| Government Energy Policy Makers | 40 | Regulatory Officials, Energy Advisors |

| Community Leaders in Rural Areas | 50 | Local Government Officials, NGO Representatives |

| Energy Sector Analysts | 40 | Market Researchers, Financial Analysts |

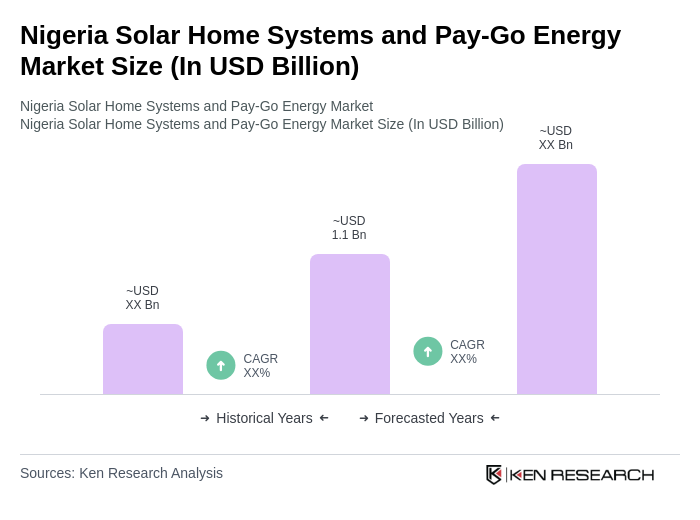

The Nigeria Solar Home Systems and Pay-Go Energy Market is valued at approximately USD 1.1 billion, driven by electricity shortages, population growth, and the need for reliable power solutions, particularly in rural areas with limited grid access.