Region:Africa

Author(s):Geetanshi

Product Code:KRAB0151

Pages:80

Published On:August 2025

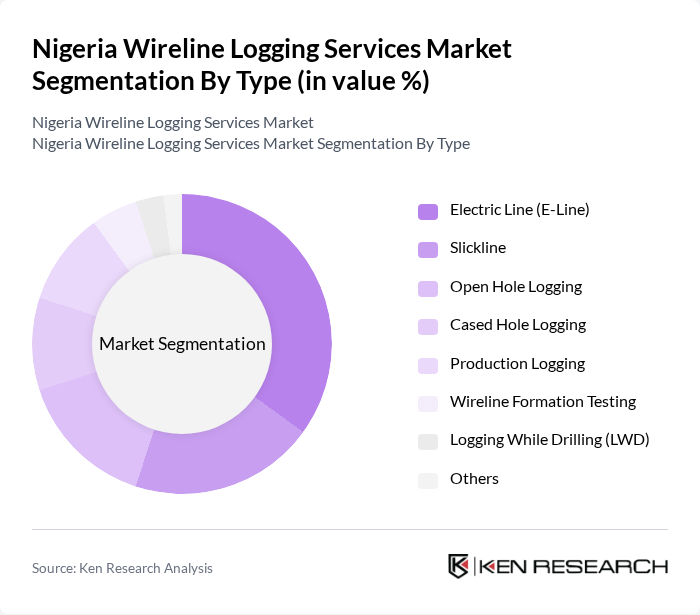

By Type:The wireline logging services market can be segmented into various types, including Electric Line (E-Line), Slickline, Open Hole Logging, Cased Hole Logging, Production Logging, Wireline Formation Testing, Logging While Drilling (LWD), and Others. Among these, Electric Line (E-Line) is the most dominant due to its efficiency in data acquisition and real-time monitoring capabilities, which are crucial for optimizing drilling operations. Open Hole Logging and Cased Hole Logging are also significant segments, providing formation evaluation and well integrity data for both uncased and cased wells.

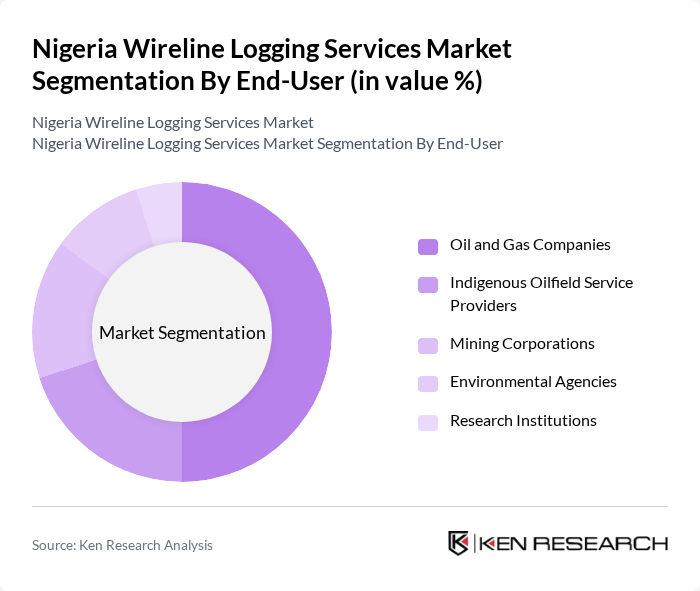

By End-User:The end-user segmentation includes Oil and Gas Companies, Indigenous Oilfield Service Providers, Mining Corporations, Environmental Agencies, and Research Institutions. Oil and Gas Companies are the leading end-users, driven by their need for precise data to enhance exploration and production efficiency, which is critical in a competitive market. Indigenous service providers are gaining prominence due to local content policies, while environmental agencies and research institutions utilize wireline logging for subsurface analysis and monitoring.

The Nigeria Wireline Logging Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Energy Quest Oilfield Ltd, FloSmart Energy Services Ltd, Geoservices S.A., Core Laboratories N.V., Petrofac Limited, Expro Group, Superior Energy Services, Inc., TGS-NOPEC Geophysical Company ASA, RPS Group plc, TechnipFMC plc, Aker Solutions ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria wireline logging services market appears promising, driven by ongoing investments in technology and infrastructure. As the government continues to prioritize local content and environmental sustainability, companies are likely to adapt by enhancing their service offerings. Furthermore, the integration of digital technologies, such as AI and data analytics, will streamline operations and improve data accuracy. This evolution will position the market for robust growth, aligning with global energy transition trends and local resource management strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Line (E-Line) Slickline Open Hole Logging Cased Hole Logging Production Logging Wireline Formation Testing Logging While Drilling (LWD) Others |

| By End-User | Oil and Gas Companies Indigenous Oilfield Service Providers Mining Corporations Environmental Agencies Research Institutions |

| By Application | Exploration Production Reservoir Characterization Well Integrity Assessment |

| By Service Type | Data Acquisition Services Data Interpretation Services Consulting Services Well Completion Services Well Intervention Services |

| By Distribution Channel | Direct Sales Distributors Online Platforms |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| By Region | Niger Delta Chad Basin Inland Basins Offshore Nigeria Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 60 | Geologists, Exploration Managers |

| Service Providers in Wireline Logging | 50 | Technical Directors, Operations Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 40 | Academic Researchers, Industry Analysts |

| Oilfield Service Companies | 45 | Business Development Managers, Project Leads |

The Nigeria Wireline Logging Services Market is valued at approximately USD 190 million, driven by increased exploration and production activities in the oil and gas sector, particularly in the Niger Delta region.