Region:North America

Author(s):Geetanshi

Product Code:KRAA1313

Pages:86

Published On:August 2025

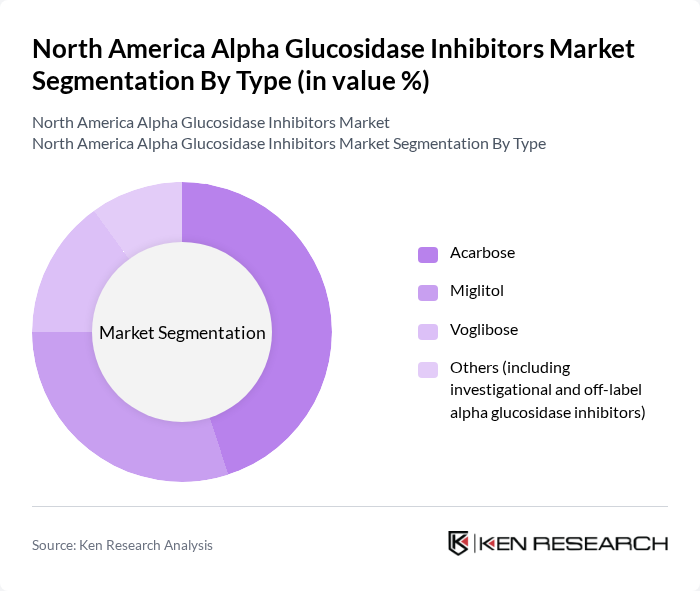

By Type:The market is segmented into various types of alpha-glucosidase inhibitors, including Acarbose, Miglitol, Voglibose, and others, which encompass investigational and off-label alpha-glucosidase inhibitors. Acarbose is the leading sub-segment due to its established efficacy in managing postprandial blood glucose levels and its widespread acceptance among healthcare professionals. The increasing focus on personalized medicine, combination therapies, and patient-centric approaches is also driving the demand for these medications .

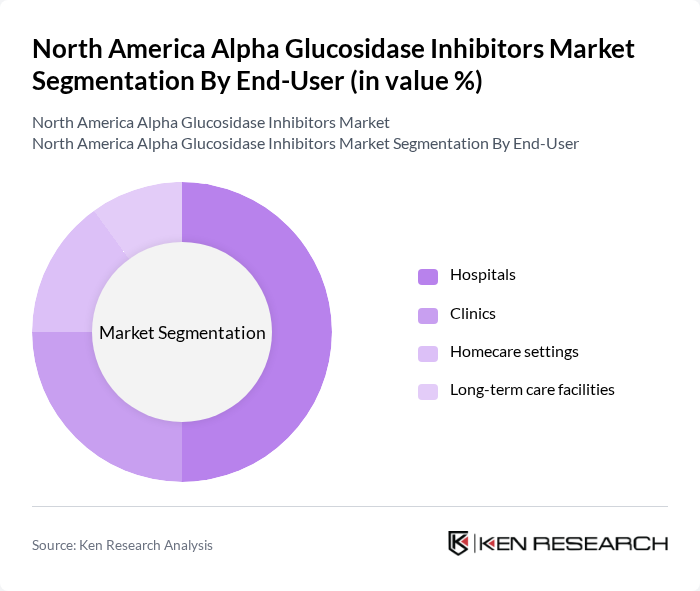

By End-User:The end-user segmentation includes hospitals, clinics, homecare settings, and long-term care facilities. Hospitals are the dominant end-user segment, primarily due to the high volume of diabetic patients receiving treatment in these settings. The increasing trend of outpatient care, expansion of diabetes management programs, and integration of digital health solutions in hospitals are further propelling this segment's growth .

The North America Alpha Glucosidase Inhibitors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takeda Pharmaceutical Company Limited, Pfizer Inc., Bayer AG, Glenmark Pharmaceuticals Ltd., Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Novartis AG, Sanofi S.A., Torrent Pharmaceuticals Ltd., Unichem Laboratories Ltd., Hexal AG, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Amgen Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North America alpha-glucosidase inhibitors market is poised for significant evolution, driven by ongoing innovations in drug development and a shift towards personalized medicine. As healthcare systems increasingly adopt digital health solutions, patient engagement and adherence are expected to improve. Furthermore, the expansion of telemedicine services will facilitate better access to diabetes management resources, enhancing treatment outcomes. These trends indicate a promising future for the market, with a focus on improving patient-centric care and therapeutic effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Acarbose Miglitol Voglibose Others (including investigational and off-label alpha glucosidase inhibitors) |

| By End-User | Hospitals Clinics Homecare settings Long-term care facilities |

| By Distribution Channel | Retail pharmacies Online pharmacies Hospital pharmacies Mail-order pharmacies |

| By Formulation | Tablets Capsules Oral solutions Extended-release formulations |

| By Patient Demographics | Adults (18-64 years) Elderly (65+ years) Pediatric (under 18 years) Others (including special populations such as pregnant women) |

| By Geography | United States Canada Mexico Rest of North America |

| By Pricing Strategy | Premium pricing Competitive pricing Value-based pricing Generic pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists | 60 | Diabetes Specialists, Clinical Researchers |

| Pharmacists | 50 | Community Pharmacists, Hospital Pharmacists |

| Diabetes Patients | 100 | Type 2 Diabetes Patients, Caregivers |

| Healthcare Providers | 70 | General Practitioners, Nurse Practitioners |

| Health Economists | 40 | Policy Analysts, Market Access Managers |

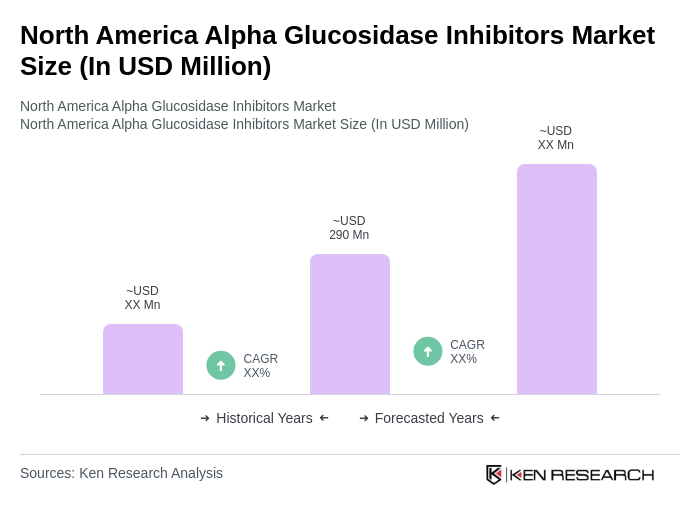

The North America Alpha Glucosidase Inhibitors Market is valued at approximately USD 290 million, driven by the increasing prevalence of diabetes and the growing adoption of these inhibitors as effective treatment options for glycemic control.