Region:North America

Author(s):Rebecca

Product Code:KRAD0180

Pages:83

Published On:August 2025

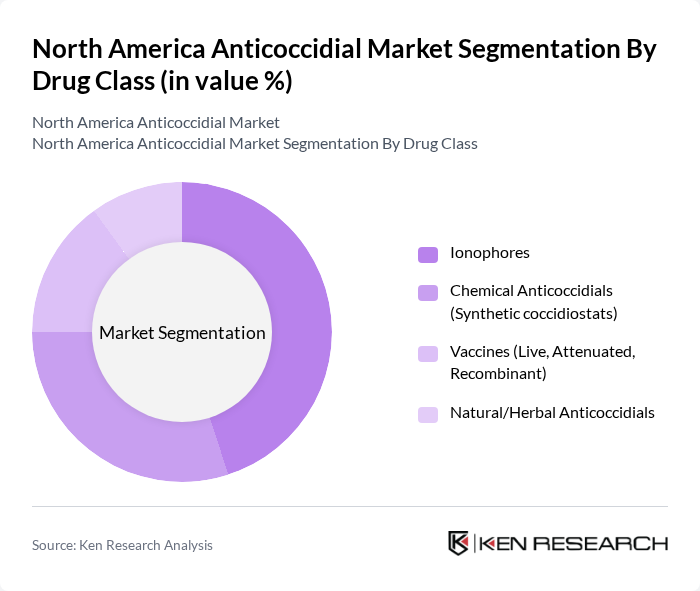

By Drug Class:The drug class segmentation includes various types of anticoccidials used in veterinary medicine. The primary subsegments are Ionophores, Chemical Anticoccidials (Synthetic coccidiostats), Vaccines (Live, Attenuated, Recombinant), and Natural/Herbal Anticoccidials. Ionophores are widely used due to their effectiveness and cost-efficiency, while vaccines are gaining traction as a preventive measure against coccidiosis. Synthetic drugs dominate the market due to their proven efficacy and affordability, while natural/herbal alternatives are increasingly adopted in organic and sustainable farming systems .

By Animal Species:This segmentation focuses on the different animal species that require anticoccidial treatments. The primary subsegments include Poultry (Broilers, Layers, Turkeys), Swine, Cattle, and Others (Sheep, Goats, Rabbits). Poultry remains the dominant segment due to the high prevalence of coccidiosis in birds and the intensive nature of poultry farming, leading to increased demand for effective treatments. Swine and cattle segments are also significant, driven by the need for disease management in large-scale production systems .

The North America Anticoccidial Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Huvepharma, Virbac, Phibro Animal Health Corporation, Kemin Industries, Alltech, Dechra Pharmaceuticals, Vetoquinol, Neogen Corporation, Trouw Nutrition, Zydus Animal Health contribute to innovation, geographic expansion, and service delivery in this space .

The North America anticoccidial market is poised for significant evolution, driven by trends such as the increasing shift towards preventive healthcare in livestock and the rising demand for antibiotic-free meat. As consumers become more health-conscious, the market is likely to see a surge in demand for sustainable and eco-friendly products. Additionally, the integration of advanced technologies in farming practices will enhance disease management, ensuring that producers can maintain high standards of animal welfare while meeting consumer expectations for quality and safety.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Ionophores Chemical Anticoccidials (Synthetic coccidiostats) Vaccines (Live, Attenuated, Recombinant) Natural/Herbal Anticoccidials |

| By Animal Species | Poultry (Broilers, Layers, Turkeys) Swine Cattle Others (Sheep, Goats, Rabbits) |

| By Distribution Channel | Veterinary Hospitals & Clinics Online Pharmacies Distributors/Wholesalers Retail Pharmacies |

| By Formulation | Powder Liquid Granules Premix |

| By Country | United States Canada Mexico Rest of North America |

| By Application | Preventive Treatment Therapeutic Treatment Growth Promotion |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Anticoccidial Usage | 100 | Poultry Farm Owners, Veterinarians |

| Livestock Health Management | 80 | Livestock Producers, Animal Health Specialists |

| Regulatory Compliance Insights | 60 | Regulatory Affairs Managers, Compliance Officers |

| Market Trends in Anticoccidials | 90 | Industry Analysts, Market Researchers |

| Emerging Alternatives to Anticoccidials | 70 | Research Scientists, Product Developers |

The North America Anticoccidial Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for poultry and livestock products, as well as advancements in veterinary medicine and animal health awareness.