North America ATV and UTV Market Overview

- The North America ATV and UTV market is valued at USD 9.3 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in outdoor recreational activities, coupled with advancements in vehicle technology such as adaptive suspension systems, lightweight chassis, and smart safety features (including collision detection and augmented reality). The rising popularity of off-road sports, family trips, and utility applications in agriculture and construction has significantly contributed to the market's expansion. Manufacturers are also introducing customizable models tailored for both recreational and utility use, further fueling demand .

- The United States dominates the North American ATV and UTV market due to its vast landscapes suitable for off-road activities, a strong culture of outdoor recreation, and a well-established distribution network. Canada also plays a significant role, driven by its rugged terrain and a growing interest in recreational vehicles. These regions benefit from a high consumer base and supportive regulatory frameworks that encourage innovation and safety in the industry .

- In 2023, the U.S. Consumer Product Safety Commission (CPSC) issued the “Final Rule: Safety Standard for Recreational Off-Highway Vehicles (ROVs)” under 16 CFR Part 1422, mandating enhanced safety features for ATVs and UTVs. This regulation requires manufacturers to implement roll-over protection systems, improved braking systems, and occupant retention measures. The rule aims to reduce accidents and improve overall safety for users, thereby promoting responsible usage of these vehicles .

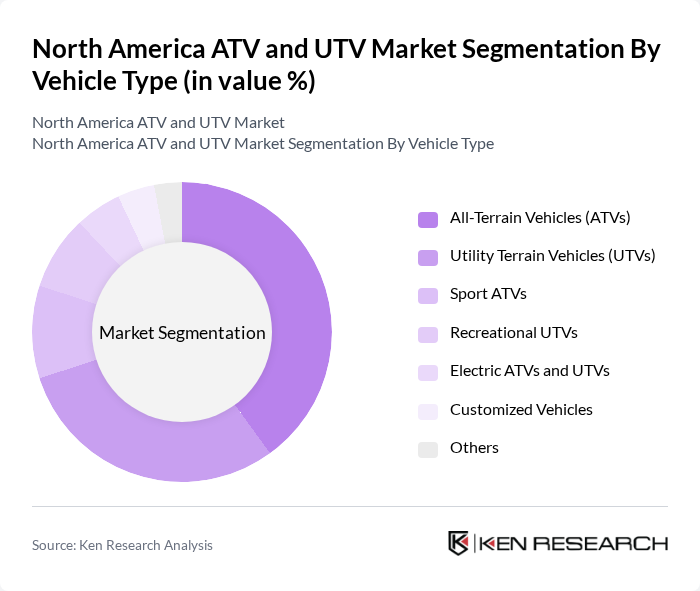

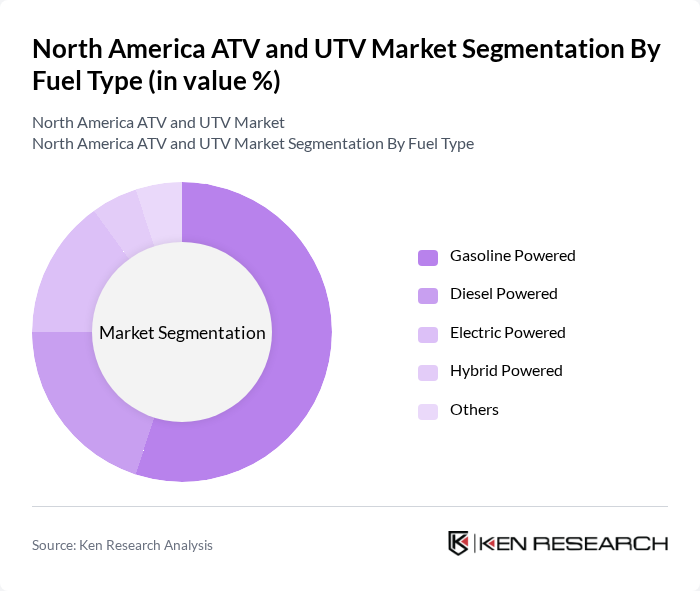

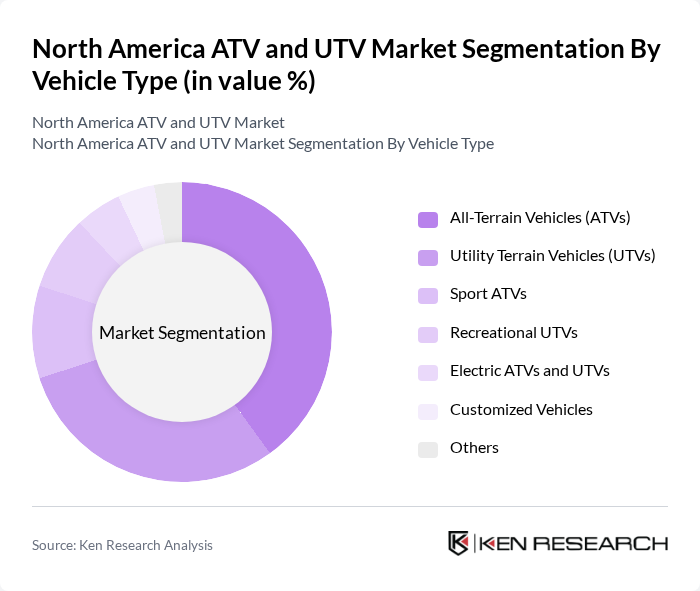

North America ATV and UTV Market Segmentation

By Vehicle Type:The vehicle type segmentation includes various categories such as All-Terrain Vehicles (ATVs), Utility Terrain Vehicles (UTVs), Sport ATVs, Recreational UTVs, Electric ATVs and UTVs, Customized Vehicles, and Others. Among these, All-Terrain Vehicles (ATVs) remain the most popular due to their versatility and ability to navigate diverse terrains, making them a preferred choice for both recreational and utility purposes. UTVs are also gaining traction, especially in agricultural, construction, and utility applications, owing to their larger capacity, enhanced seating, and advanced safety features. The market is witnessing an increase in demand for electric and customized vehicles, driven by environmental concerns and consumer preferences for tailored solutions .

By Fuel Type:The fuel type segmentation encompasses Gasoline Powered, Diesel Powered, Electric Powered, Hybrid Powered, and Others. Gasoline-powered vehicles continue to dominate the market due to their widespread availability and established performance metrics. However, there is a growing trend towards electric-powered vehicles, driven by environmental concerns, government incentives, and advancements in battery technology that are making them increasingly viable for consumers. Hybrid and alternative fuel vehicles are also gaining attention as manufacturers focus on sustainability and emissions reduction .

North America ATV and UTV Market Competitive Landscape

The North America ATV and UTV market is characterized by a dynamic mix of regional and international players. Leading participants such as Polaris Inc., Yamaha Motor Corporation, U.S.A., Honda Motor Co., Ltd., Arctic Cat Inc. (a Textron Inc. company), Kawasaki Motors Corp., U.S.A., Can-Am (BRP Inc.), John Deere, Textron Off Road, CFMOTO Powersports Inc., HISUN Motors Corp., U.S.A., KYMCO USA, Suzuki Motor Corporation, KTM AG, ODES Powersports, Taiwan Golden Bee Co., Ltd. (TGB) contribute to innovation, geographic expansion, and service delivery in this space.

North America ATV and UTV Market Industry Analysis

Growth Drivers

- Increasing Outdoor Recreational Activities:The North American outdoor recreation market is projected to reach $887 billion in future, driven by a growing interest in activities such as off-roading and trail riding. This surge in recreational pursuits is fostering demand for ATVs and UTVs, as consumers seek vehicles that enhance their outdoor experiences. The National Park Service reported over 327 million visits in future, indicating a robust interest in outdoor activities that directly correlates with ATV and UTV usage.

- Technological Advancements in Vehicle Design:The ATV and UTV industry is witnessing significant technological innovations, with manufacturers investing approximately $1.5 billion in R&D in future. These advancements include improved fuel efficiency, enhanced safety features, and integration of smart technologies. For instance, the introduction of GPS navigation and advanced suspension systems is attracting consumers looking for high-performance vehicles, thereby driving market growth and expanding consumer interest in these vehicles.

- Rising Demand for Utility Vehicles in Agriculture:The agricultural sector in North America is increasingly adopting ATVs and UTVs for various tasks, including crop management and livestock transportation. In future, the agricultural machinery market is expected to reach $60 billion, with a notable portion allocated to utility vehicles. This trend is fueled by the need for efficient, versatile vehicles that can operate in diverse terrains, thus enhancing productivity and operational efficiency on farms.

Market Challenges

- High Initial Purchase Costs:The average price of ATVs and UTVs ranges from $7,000 to $20,000, which can be a significant barrier for potential buyers. In future, consumer spending on recreational vehicles is projected to be around $50 billion, but high upfront costs may deter entry-level buyers. This challenge is particularly pronounced in regions with lower disposable incomes, limiting market penetration and growth opportunities for manufacturers.

- Regulatory Compliance and Safety Standards:The ATV and UTV market faces stringent regulatory requirements, including safety standards set by the Consumer Product Safety Commission (CPSC). Compliance with these regulations can increase production costs by approximately 10-15%. In future, manufacturers must navigate complex regulations that vary by state, which can hinder market entry and complicate distribution strategies, ultimately affecting overall market growth.

North America ATV and UTV Market Future Outlook

The North American ATV and UTV market is poised for dynamic growth, driven by increasing consumer interest in outdoor activities and technological advancements. As manufacturers focus on sustainability, the introduction of electric models is expected to reshape the market landscape. Additionally, the rise of e-commerce platforms will facilitate easier access to these vehicles, enhancing consumer engagement. Collaborations with tourism companies will further expand market reach, tapping into the growing adventure tourism sector and creating new revenue streams for manufacturers.

Market Opportunities

- Growth in E-commerce for ATV and UTV Sales:The e-commerce sector for recreational vehicles is projected to grow significantly, with online sales expected to reach $10 billion in future. This shift allows manufacturers to reach a broader audience, particularly younger consumers who prefer online shopping. Enhanced digital marketing strategies can further capitalize on this trend, driving sales and increasing brand visibility in a competitive market.

- Increasing Popularity of Electric ATVs and UTVs:The electric ATV and UTV segment is gaining traction, with sales expected to increase by 25% in future. This growth is driven by rising environmental awareness and government incentives for electric vehicle adoption. Manufacturers that invest in electric technology can tap into this expanding market, appealing to eco-conscious consumers and aligning with sustainability trends in the automotive industry.