Region:North America

Author(s):Shubham

Product Code:KRAB0686

Pages:95

Published On:August 2025

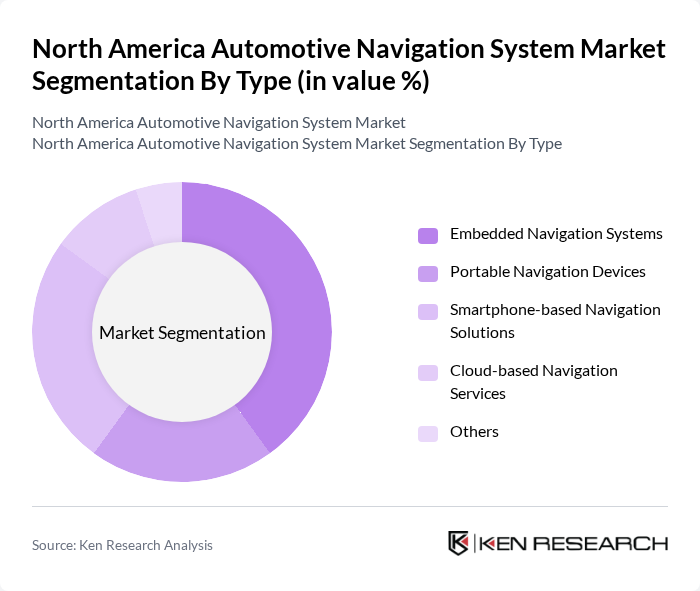

By Type:The market can be segmented into various types, including Embedded Navigation Systems, Portable Navigation Devices, Smartphone-based Navigation Solutions, Cloud-based Navigation Services, and Others. Among these, Embedded Navigation Systems are gaining significant traction due to their seamless integration into vehicles, providing users with a more reliable and user-friendly experience. The adoption of cloud-based and AI-powered navigation services is also increasing, driven by demand for real-time updates and personalized routing .

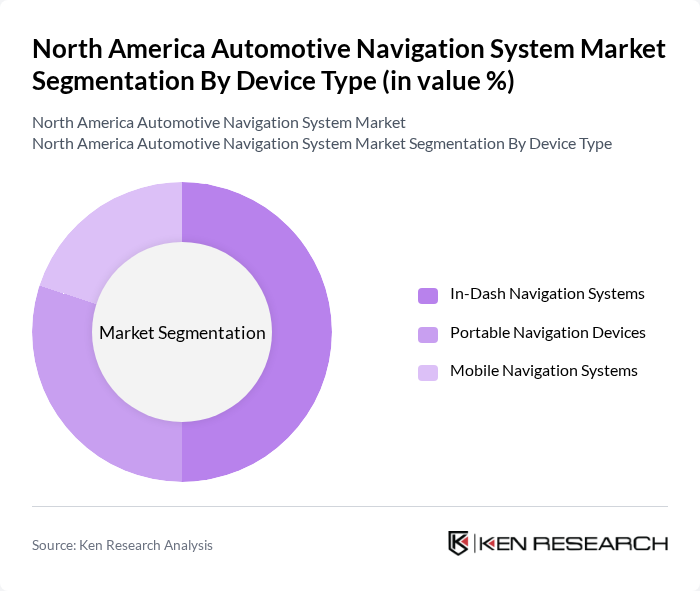

By Device Type:The market is also segmented by device type, which includes In-Dash Navigation Systems, Portable Navigation Devices, and Mobile Navigation Systems. In-Dash Navigation Systems are leading this segment due to their convenience and integration with other vehicle systems, making them a preferred choice for consumers seeking advanced navigation solutions. The growing integration of in-dash systems with infotainment and telematics platforms further supports their dominance .

The North America Automotive Navigation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garmin Ltd., TomTom International B.V., HERE Technologies, Bosch Mobility Solutions, Continental AG, Denso Corporation, Pioneer Corporation, Panasonic Holdings Corporation, Mitsubishi Electric Corporation, Qualcomm Technologies, Inc., Apple Inc., Google LLC, HARMAN International, Ford Motor Company, General Motors Company, Tesla, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American automotive navigation system market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As the demand for connected and autonomous vehicles grows, navigation systems will increasingly incorporate artificial intelligence and machine learning to enhance user experience. Additionally, the shift towards subscription-based services will likely reshape revenue models, allowing for continuous updates and improved functionalities, thereby fostering greater consumer engagement and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Embedded Navigation Systems Portable Navigation Devices Smartphone-based Navigation Solutions Cloud-based Navigation Services Others |

| By Device Type | In-Dash Navigation Systems Portable Navigation Devices Mobile Navigation Systems |

| By Vehicle Type | Passenger Vehicles Luxury Passenger Vehicles Commercial Vehicles |

| By System Type | Pre-Installed Systems Aftermarket Systems |

| By Component | Hardware Software |

| By Sales Channel | OEM Sales Aftermarket Sales Online Sales |

| By Distribution Mode | Direct Sales Retail Sales E-commerce |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Navigation and Routing Traffic Management Location-based Services Fleet Tracking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Navigation Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle Navigation Solutions | 60 | Fleet Managers, Logistics Coordinators |

| Aftermarket Navigation Products | 50 | Retail Managers, Automotive Accessory Buyers |

| Connected Vehicle Technologies | 40 | IT Managers, Software Developers |

| Consumer Preferences in Navigation Systems | 80 | Car Owners, Tech Enthusiasts |

The North America Automotive Navigation System Market is valued at approximately USD 11.8 billion, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and consumer demand for enhanced navigation features.