Region:North America

Author(s):Geetanshi

Product Code:KRAC0086

Pages:98

Published On:August 2025

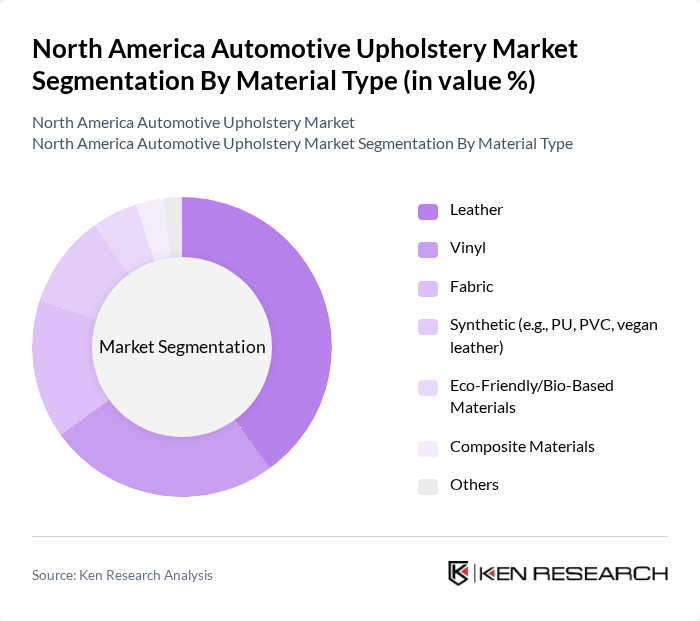

By Material Type:The material type segmentation includes various subsegments such as Leather, Vinyl, Fabric, Synthetic (e.g., PU, PVC, vegan leather), Eco-Friendly/Bio-Based Materials, Composite Materials, and Others. Leather remains the most popular choice due to its premium feel and durability. Eco-friendly materials are gaining traction as consumers and automakers increasingly prioritize sustainability. Synthetic materials, including vegan leather and advanced composites, are also seeing increased adoption due to their cost-effectiveness and performance characteristics .

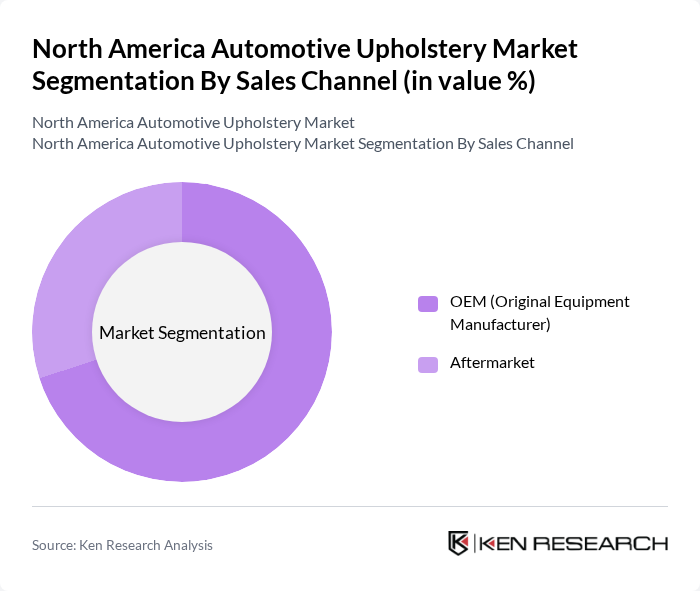

By Sales Channel:The sales channel segmentation includes OEM (Original Equipment Manufacturer) and Aftermarket. The OEM segment leads due to the increasing production of vehicles and the demand for high-quality upholstery directly from manufacturers. The aftermarket segment is also growing as consumers seek to upgrade or replace their vehicle interiors, supported by rising customization trends and the availability of advanced materials .

The North America Automotive Upholstery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lear Corporation, Adient plc, Faurecia S.A., Toyota Boshoku Corporation, Magna International Inc., Alcantara S.p.A., International Automotive Components Group (IAC Group), Grupo Antolin, Johnson Controls International plc, BASF SE, DuPont de Nemours, Inc., Solvay S.A., Covestro AG, Continental AG, Trelleborg AB, Sage Automotive Interiors, Uniroyal Global Engineered Products, Inc., Motus Integrated Technologies, Seiren Co., Ltd., Textron Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The North American automotive upholstery market is poised for significant transformation as consumer preferences shift towards sustainability and technology integration. In future, the demand for eco-friendly materials is expected to rise, driven by both regulatory pressures and consumer awareness. Additionally, the integration of smart technologies into upholstery will likely enhance user experience, making vehicles more comfortable and connected. As manufacturers adapt to these trends, the market will see increased innovation and collaboration, positioning itself for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Leather Vinyl Fabric Synthetic (e.g., PU, PVC, vegan leather) Eco-Friendly/Bio-Based Materials Composite Materials Others |

| By Sales Channel | OEM (Original Equipment Manufacturer) Aftermarket |

| By Product Type | Seats Door Panels/Trims Headliners/Roof Liners Carpets Dashboard Covers Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Luxury Vehicles Electric Vehicles Others |

| By Distribution Channel | Direct Sales Online Retail Automotive Dealerships Specialty Stores Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Region | United States Canada Mexico Rest of North America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Upholstery | 120 | Product Managers, Upholstery Designers |

| Commercial Vehicle Upholstery | 80 | Fleet Managers, Procurement Specialists |

| Luxury Vehicle Upholstery | 50 | Interior Designers, Brand Managers |

| Automotive Upholstery Materials | 40 | Material Suppliers, Quality Assurance Managers |

| Aftermarket Upholstery Services | 60 | Service Center Managers, Automotive Technicians |

The North America Automotive Upholstery Market is valued at approximately USD 1.7 billion, driven by increasing demand for vehicle customization, advancements in upholstery materials, and a focus on passenger comfort and aesthetics.