Region:North America

Author(s):Geetanshi

Product Code:KRAA0083

Pages:85

Published On:August 2025

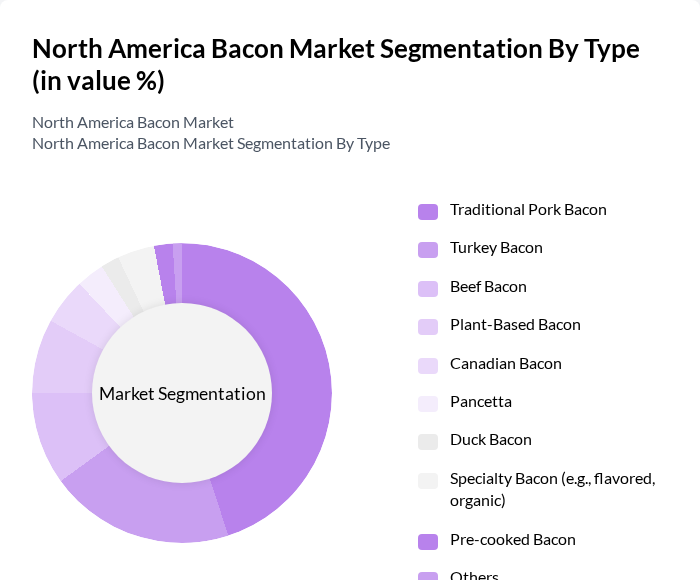

By Type:The bacon market is segmented into various types, including Traditional Pork Bacon, Turkey Bacon, Beef Bacon, Plant-Based Bacon, Canadian Bacon, Pancetta, Duck Bacon, Specialty Bacon (e.g., flavored, organic), Pre-cooked Bacon, and Others.Traditional Pork Baconremains the most popular choice among consumers due to its rich flavor and versatility in cooking. However, demand forPlant-Based Baconis rising, driven by health-conscious consumers and the growing trend toward vegetarian and vegan diets. The market is also witnessing increased interest in premium, organic, and nitrate-free bacon options, as well as convenience-focused products like pre-cooked and ready-to-eat bacon .

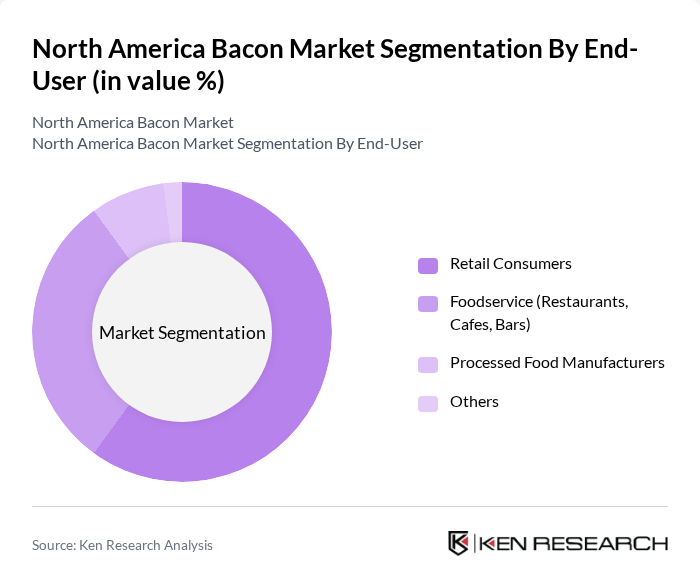

By End-User:The market is segmented by end-user into Retail Consumers, Foodservice (Restaurants, Cafes, Bars), Processed Food Manufacturers, and Others.Retail Consumersrepresent the largest segment, driven by the increasing popularity of bacon in home cooking, breakfast meals, and convenience foods. The Foodservice sector is also significant, as restaurants and cafes incorporate bacon into a broad array of dishes, enhancing flavor and menu appeal. Processed food manufacturers are leveraging bacon as an ingredient in ready meals, snacks, and value-added products .

The North America Bacon Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hormel Foods Corporation, Smithfield Foods, Inc., Tyson Foods, Inc., Oscar Mayer (Kraft Heinz Company), Maple Leaf Foods Inc., Jones Dairy Farm, Bob Evans Farms, Inc., Olymel S.E.C./L.P., Applegate Farms, LLC, Farmland Foods, Inc., Niman Ranch, Pederson's Natural Farms, Wright Brand Bacon (Tyson Foods), Wellshire Farms, Boar's Head Brand, and Organic Prairie contribute to innovation, geographic expansion, and service delivery in this space.

The North America bacon market is poised for a dynamic future, driven by evolving consumer preferences and innovative product offerings. The trend towards premium and gourmet bacon products is expected to continue, appealing to discerning consumers. Additionally, the rise of e-commerce platforms for meat products will facilitate greater accessibility and convenience, allowing consumers to explore diverse bacon options. As health-conscious trends persist, the market may also see a shift towards organic and plant-based alternatives, catering to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Pork Bacon Turkey Bacon Beef Bacon Plant-Based Bacon Canadian Bacon Pancetta Duck Bacon Specialty Bacon (e.g., flavored, organic) Pre-cooked Bacon Others |

| By End-User | Retail Consumers Foodservice (Restaurants, Cafes, Bars) Processed Food Manufacturers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Food Service Butcher Shops Direct Sales Others |

| By Packaging Type | Vacuum-Sealed Packaging Modified Atmosphere Packaging Canned Bacon Others |

| By Region | United States Canada Mexico Others |

| By Product Form | Sliced Bacon Whole Bacon Cooked Bacon Diced Bacon Others |

| By Flavor Profile | Original Flavor Maple Flavor Pepper Flavor Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bacon Sales | 120 | Store Managers, Category Buyers |

| Food Service Industry Insights | 100 | Restaurant Owners, Chefs |

| Bacon Production Insights | 80 | Production Managers, Quality Control Officers |

| Consumer Preferences Survey | 150 | General Consumers, Health-Conscious Shoppers |

| Market Trends Analysis | 100 | Market Analysts, Food Industry Experts |

The North America Bacon Market is valued at approximately USD 17.6 billion, reflecting a robust growth driven by increasing consumer demand for bacon products and the popularity of bacon in various culinary applications.