Region:North America

Author(s):Dev

Product Code:KRAA1632

Pages:89

Published On:August 2025

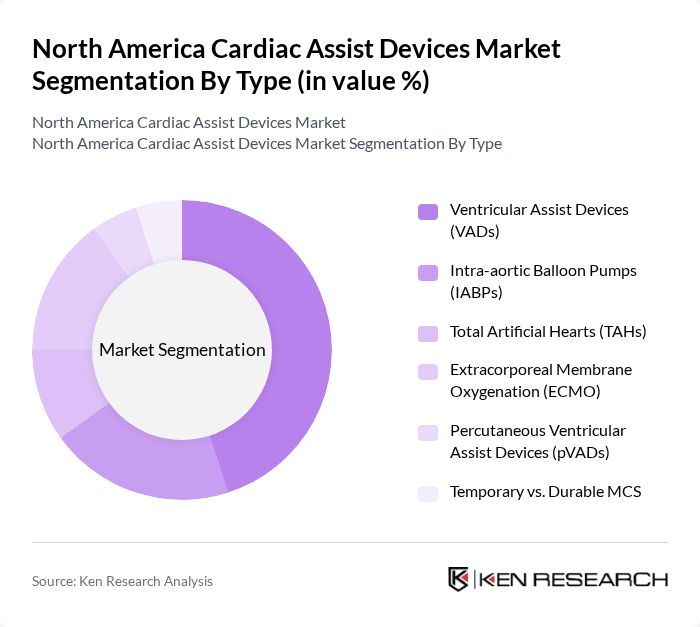

By Type:The market is segmented into various types of cardiac assist devices, including Ventricular Assist Devices (VADs), Intra-aortic Balloon Pumps (IABPs), Total Artificial Hearts (TAHs), Extracorporeal Membrane Oxygenation (ECMO), Percutaneous Ventricular Assist Devices (pVADs), and Temporary vs. Durable Mechanical Circulatory Support (MCS). Among these, VADs, particularly Left Ventricular Assist Devices (LVADs), dominate the market due to their widespread use in advanced heart failure as bridge-to-transplant and destination therapy, supported by continuous-flow designs that reduce rehospitalization versus older pulsatile pumps and by persistent donor-heart scarcity. The increasing adoption of these devices in hospitals and specialty centers is driven by advancements such as magnetically levitated pumps, smaller driveline profiles, and accumulating clinical evidence for improved survival and quality of life.

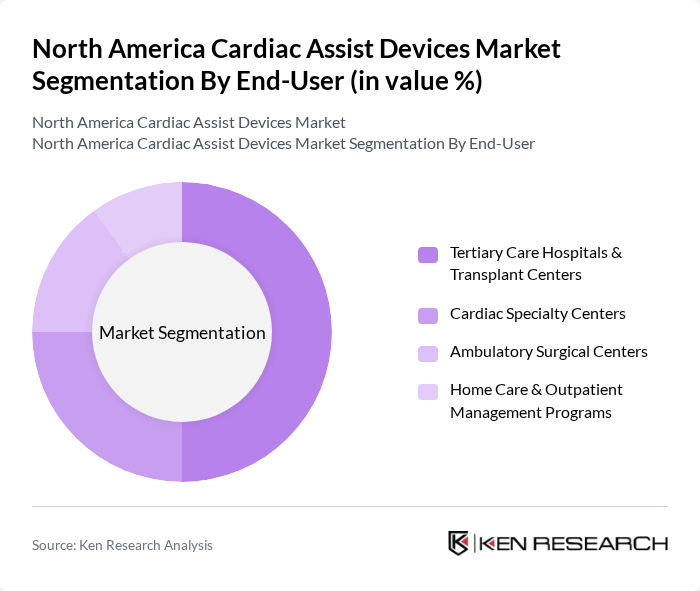

By End-User:The end-user segmentation includes Tertiary Care Hospitals & Transplant Centers, Cardiac Specialty Centers, Ambulatory Surgical Centers, and Home Care & Outpatient Management Programs. Tertiary Care Hospitals & Transplant Centers are the leading end-users, as these centers perform heart transplants and durable MCS implants, operate multidisciplinary advanced heart failure programs, and manage complex long-term follow-up—factors that concentrate VAD and TAH procedures in these facilities.

The North America Cardiac Assist Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (incl. HeartMate LVAD portfolio), Medtronic plc (IABP, ECMO cannulae/oxygenators, perfusion systems), Abiomed, Inc. (a Johnson & Johnson MedTech company) — Impella pVAD, Edwards Lifesciences Corporation (oxygenation/perfusion components), Terumo Corporation (Terumo Cardiovascular — ECMO/perfusion), Getinge AB (Maquet — Cardiohelp ECMO, IABP), LivaNova PLC (perfusion systems, ECMO solutions), SynCardia Systems, LLC (Total Artificial Heart), BiVACOR, Inc. (next?generation Total Artificial Heart), Berlin Heart GmbH (EXCOR Pediatric VAD), CardiacAssist, Inc. (now TandemLife; acquired by LivaNova) — pVAD/ECMO, ReliantHeart, Inc. (HeartAssist5/Maglev LVAD; legacy portfolio), Jarvik Heart, Inc. (Jarvik 2000 LVAD), Fresenius SE & Co. KGaA (Fresenius Medical Care — ECMO/oxygenators), CARMAT S.A. (Aeson Total Artificial Heart) contribute to innovation, geographic expansion, and service delivery in this space.

The North American cardiac assist devices market is poised for significant growth, driven by technological innovations and an increasing patient population. As healthcare providers increasingly adopt minimally invasive procedures, the demand for advanced cardiac assist devices will likely rise. Additionally, the integration of artificial intelligence in device functionality is expected to enhance patient outcomes. These trends indicate a promising future for the market, with ongoing investments in research and development further supporting advancements in device technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Ventricular Assist Devices (VADs) Left Ventricular Assist Devices (LVAD) Right Ventricular Assist Devices (RVAD) Biventricular Assist Devices (BiVAD) Intra-aortic Balloon Pumps (IABPs) Total Artificial Hearts (TAHs) Extracorporeal Membrane Oxygenation (ECMO) Percutaneous Ventricular Assist Devices (pVADs) Temporary vs. Durable MCS (Mechanical Circulatory Support) |

| By End-User | Tertiary Care Hospitals & Transplant Centers Cardiac Specialty Centers Ambulatory Surgical Centers (for temporary/pVAD/IABP) Home Care & Outpatient Management Programs (for durable VAD follow-up) |

| By Distribution Channel | Direct Sales to Hospitals/IDNs & GPO Contracts Authorized Distributors E-Procurement/Online Tenders |

| By Region | United States Canada Mexico |

| By Application | Bridge to Transplant (BTT) Destination Therapy (DT) Bridge to Recovery (BTR) / Post-Cardiotomy Support Bridge to Decision (BTD) / Cardiogenic Shock Management |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients |

| By Price Range | Premium Devices Mid-Range Devices Budget/Value Devices |

| By Modality | Implantable Transcutaneous/External |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologist Insights | 100 | Cardiologists, Electrophysiologists |

| Hospital Procurement Managers | 80 | Procurement Officers, Supply Chain Managers |

| Patient Experience Feedback | 60 | Patients using cardiac assist devices, Caregivers |

| Medical Device Distributors | 70 | Sales Representatives, Distribution Managers |

| Regulatory Insights | 50 | Regulatory Affairs Specialists, Compliance Officers |

The North America Cardiac Assist Devices Market is valued at approximately USD 2.02.4 billion, reflecting a significant share of the global market, which is estimated at around USD 2.3 billion. This growth is driven by increasing heart failure cases and technological advancements.