Region:North America

Author(s):Shubham

Product Code:KRAC0708

Pages:84

Published On:August 2025

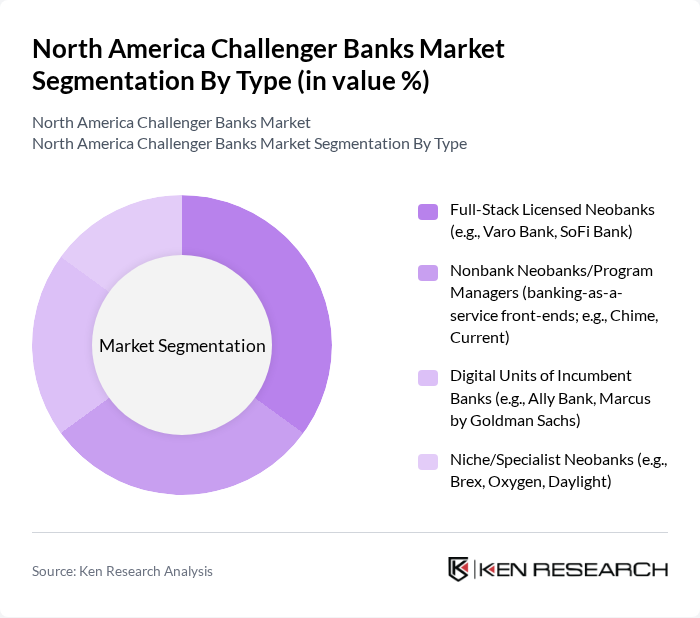

By Type:The segmentation of the market by type includes Full-Stack Licensed Neobanks, Nonbank Neobanks/Program Managers, Digital Units of Incumbent Banks, and Niche/Specialist Neobanks. Full-Stack Licensed Neobanks are gaining traction as more platforms secure bank charters and broaden product suites; Nonbank Neobanks/Program Managers remain popular as front-ends leveraging sponsor banks and BaaS for rapid product rollout and lower fees; Digital Units of Incumbent Banks benefit from established trust and integrated ecosystems; Niche/Specialist Neobanks focus on targeted segments (e.g., SMEs, creators) with tailored features such as expense management, advanced cards, and real-time cash flow tools .

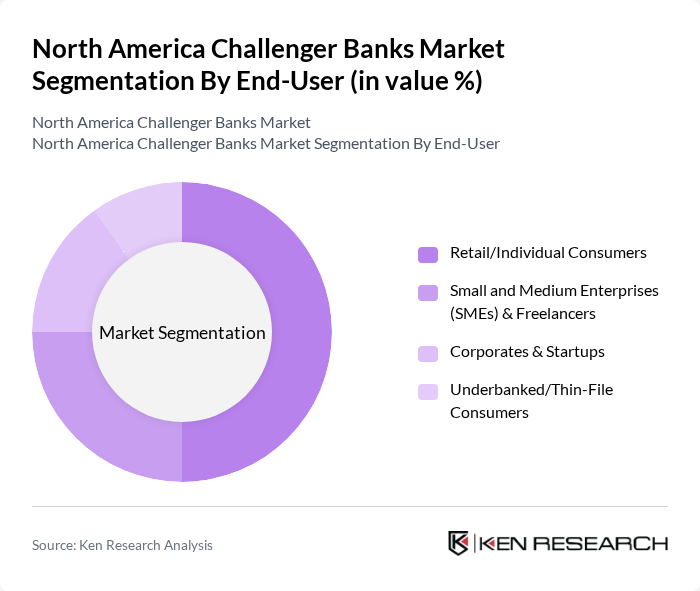

By End-User:The market is segmented by end-user into Retail/Individual Consumers, Small and Medium Enterprises (SMEs) & Freelancers, Corporates & Startups, and Underbanked/Thin-File Consumers. Retail consumers are the largest segment, influenced by convenience, lower fees, and enhanced mobile experiences; SMEs and freelancers increasingly adopt digital banking for faster onboarding, integrated invoicing/payments, and cash-flow tools; corporates and startups use tailored treasury, spend management, and card solutions; underbanked users benefit from accessible accounts, early pay features, and fee transparency improving financial inclusion .

The North America Challenger Banks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chime Financial, Inc., Varo Bank, N.A., SoFi Bank, N.A. (SoFi Technologies), Ally Bank (Ally Financial Inc.), Current (Finco Services, Inc.), MoneyLion Inc., Aspiration Partners, Inc., Oxygen (Oxygen Financial Technology), KOHO Financial Inc. (Canada), Neo Financial (Canada), Tangerine Bank (a Scotiabank subsidiary, Canada), Revolut Holdings Europe UAB — U.S./Canada operations, Monzo Bank Ltd — U.S. operations, Qapital, Inc., Brex Inc. (SMB/Startup-focused) contribute to innovation, geographic expansion, and service delivery in this space .

The North American challenger banks market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital banking becomes increasingly mainstream, challenger banks are expected to leverage artificial intelligence and machine learning to enhance customer experiences and streamline operations. Additionally, the trend towards open banking will facilitate greater collaboration between fintechs and traditional banks, fostering innovation and expanding service offerings to meet diverse consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Stack Licensed Neobanks (e.g., Varo Bank, SoFi Bank) Nonbank Neobanks/Program Managers (banking-as-a-service front-ends; e.g., Chime, Current) Digital Units of Incumbent Banks (e.g., Ally Bank, Marcus by Goldman Sachs) Niche/Specialist Neobanks (e.g., Brex, Oxygen, Daylight) |

| By End-User | Retail/Individual Consumers Small and Medium Enterprises (SMEs) & Freelancers Corporates & Startups Underbanked/Thin-File Consumers |

| By Service Offering | Checking & Savings Accounts Payments & Money Transfers Lending (Personal, BNPL, SME, Credit Builder) Wealth & Investing (Brokerage, Robo, Crypto custody where permitted) Cards & Rewards (Debit, Credit, Cashback) |

| By Customer Segment | Gen Z Millennials Professionals & Affluent Gig Workers & Creators |

| By Distribution Channel | Mobile Apps Web Platforms Embedded Finance/Third-Party Platforms Partnerships & Marketplaces |

| By Geographic Presence | United States Canada Mexico Cross-Border/Multimarket Players |

| By Pricing Model | Subscription/Membership Plans Interchange-Driven/Free-to-User Usage/Transaction-Based Fees Tiered Freemium (Basic vs. Premium) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Banking Services | 150 | Retail Banking Customers, Digital Banking Users |

| Small Business Banking Solutions | 100 | Small Business Owners, Financial Decision Makers |

| Investment and Wealth Management | 80 | Wealth Managers, Financial Advisors |

| Payment Solutions and Fintech Innovations | 120 | Payment Processors, Fintech Entrepreneurs |

| Regulatory Compliance and Risk Management | 70 | Compliance Officers, Risk Management Executives |

The North America Challenger Banks Market is valued at approximately USD 10 billion, reflecting a significant growth trend driven by the increasing adoption of digital banking solutions and consumer dissatisfaction with traditional banking fees and processes.