Region:North America

Author(s):Dev

Product Code:KRAB0433

Pages:92

Published On:August 2025

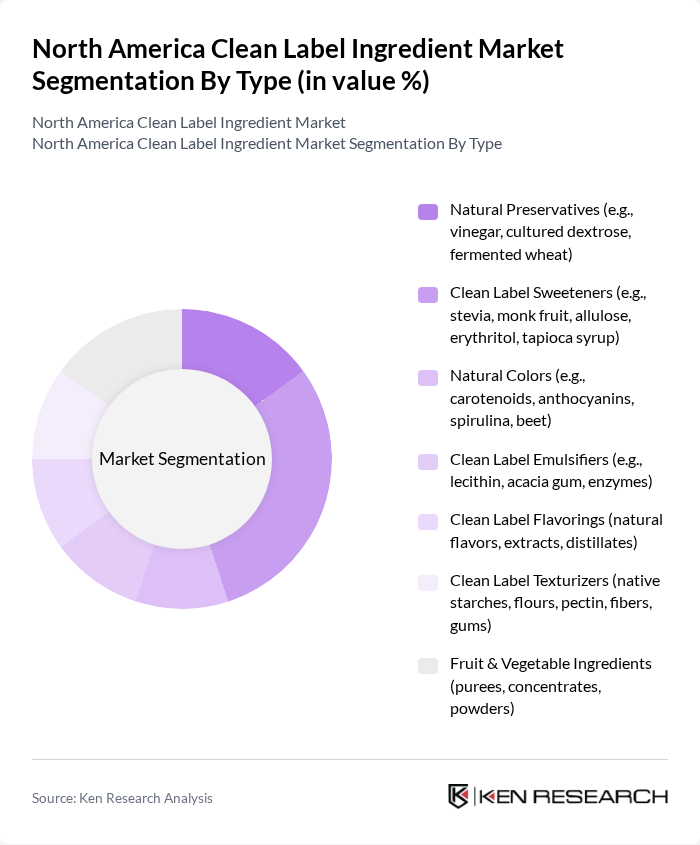

By Type:The clean label ingredient market is segmented into various types, including natural preservatives, clean label sweeteners, natural colors, clean label emulsifiers, clean label flavorings, clean label texturizers, and fruit & vegetable ingredients. Among these, clean label sweeteners are gaining significant traction due to the rising demand for healthier alternatives to sugar. Consumers are increasingly opting for natural sweeteners like stevia and monk fruit, and are also showing interest in allulose and erythritol in reduced-sugar formulations, aligned with reformulation to avoid artificial sweeteners .

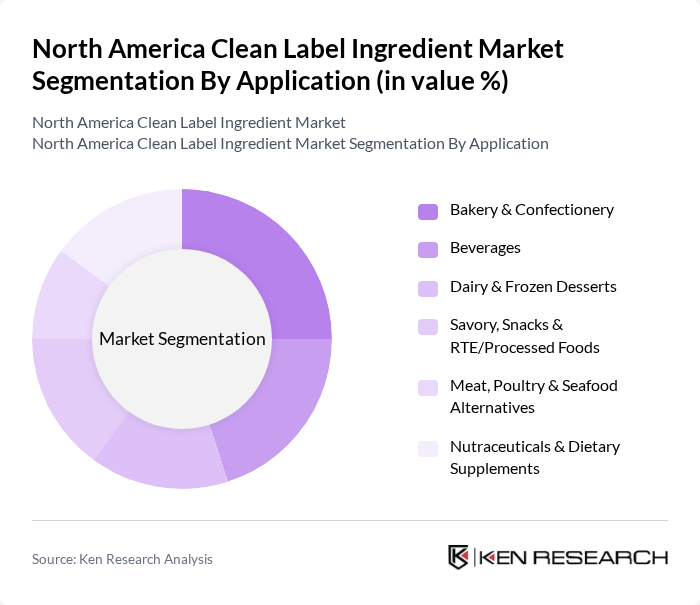

By Application:The clean label ingredient market is segmented by application into bakery & confectionery, beverages, dairy & frozen desserts, savory, snacks & RTE/processed foods, meat, poultry & seafood alternatives, and nutraceuticals & dietary supplements. The bakery & confectionery segment is currently leading the market, driven by increasing consumer preference for recognizable ingredient lists and reduced artificial additives in baked goods and snacks; beverages and dairy also show strong clean-label reformulation activity in North America .

The North America Clean Label Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Tate & Lyle PLC, International Flavors & Fragrances Inc. (IFF), Kerry Group plc, Cargill, Incorporated, Archer Daniels Midland Company (ADM), DSM-Firmenich AG, Givaudan SA, Symrise AG, Chr. Hansen Holding A/S (Novonesis), Sensient Technologies Corporation, Bell Flavors & Fragrances, Inc., Corbion N.V., Puratos Group, DSM Nutritional Products (legacy) ? consolidated under DSM-Firmenich contribute to innovation, geographic expansion, and service delivery in this space.

The North American clean label ingredient market is poised for significant growth, driven by evolving consumer preferences and regulatory support. As health consciousness continues to rise, manufacturers are likely to innovate and expand their clean label offerings. Additionally, the increasing focus on sustainability and ethical sourcing will shape product development. Companies that invest in research and development to create functional clean label ingredients will likely gain a competitive edge, positioning themselves favorably in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Preservatives (e.g., vinegar, cultured dextrose, fermented wheat) Clean Label Sweeteners (e.g., stevia, monk fruit, allulose, erythritol, tapioca syrup) Natural Colors (e.g., carotenoids, anthocyanins, spirulina, beet) Clean Label Emulsifiers (e.g., lecithin, acacia gum, enzymes) Clean Label Flavorings (natural flavors, extracts, distillates) Clean Label Texturizers (native starches, flours, pectin, fibers, gums) Fruit & Vegetable Ingredients (purees, concentrates, powders) |

| By Application | Bakery & Confectionery Beverages Dairy & Frozen Desserts Savory, Snacks & RTE/Processed Foods Meat, Poultry & Seafood Alternatives Nutraceuticals & Dietary Supplements |

| By Distribution Channel | B2B Ingredient Supply (Direct to Manufacturers) Distributors/Blenders Online B2B Marketplaces Retail/Private Label Sourcing |

| By End-User | Food Manufacturers Beverage Companies Dietary Supplement & Nutraceutical Firms Foodservice & QSR Chains Contract Manufacturers (Co-packers) |

| By Region | United States Canada Mexico |

| By Price Range | Economy Mid-Range Premium |

| By Certification Type | Organic Certified Non-GMO Project Verified Gluten-Free Certified Kosher/Halal Certified |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Retailers of Clean Label Products | 100 | Category Managers, Purchasing Agents |

| Health and Wellness Influencers | 80 | Nutritionists, Health Coaches |

| Consumers of Clean Label Products | 140 | Health-Conscious Shoppers, Parents |

| Industry Experts and Analysts | 50 | Market Analysts, Food Scientists |

The North America Clean Label Ingredient Market is valued at approximately USD 14.9 billion, reflecting a significant growth trend driven by consumer demand for transparency and natural ingredients in food and beverages.