Region:North America

Author(s):Rebecca

Product Code:KRAA2189

Pages:85

Published On:August 2025

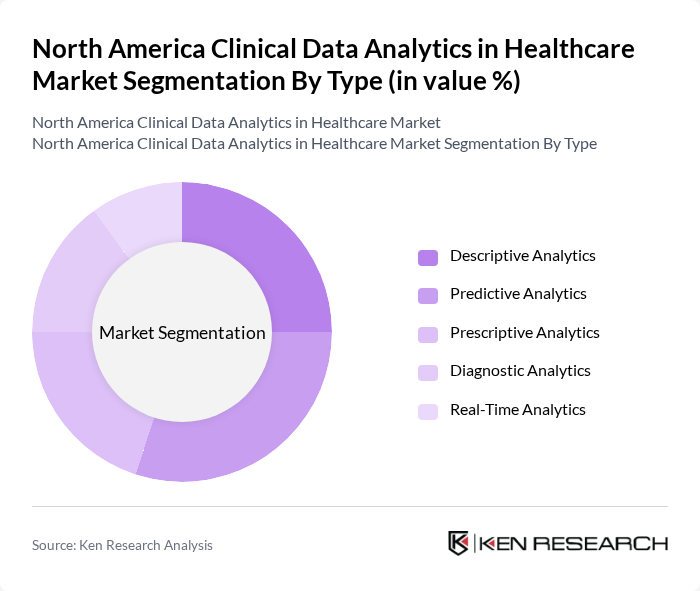

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Real-Time Analytics. Each type serves distinct purposes, from understanding historical data trends to forecasting future outcomes and providing actionable insights for decision-making.

The Predictive Analytics sub-segment is currently leading the market due to its ability to forecast patient outcomes and optimize resource allocation. Healthcare providers increasingly rely on predictive models to enhance patient care and operational efficiency. The growing emphasis on personalized medicine and proactive healthcare management further drives the demand for predictive analytics, making it a critical component in clinical data analytics.

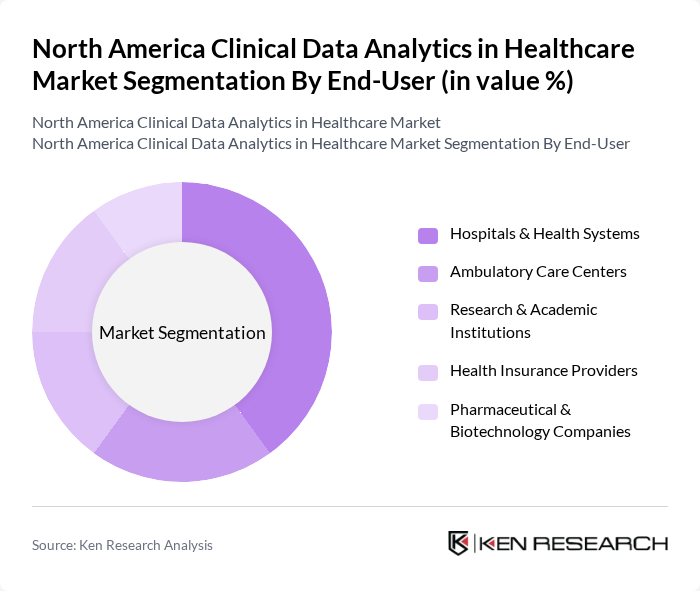

By End-User:The market is segmented by end-users, including Hospitals & Health Systems, Ambulatory Care Centers, Research & Academic Institutions, Health Insurance Providers, Pharmaceutical & Biotechnology Companies, and Others. Each end-user category utilizes clinical data analytics to improve operational efficiency and patient care.

Hospitals & Health Systems dominate the market as they are the primary users of clinical data analytics for improving patient care and operational efficiency. The increasing focus on value-based care and the need for enhanced patient outcomes drive hospitals to invest in advanced analytics solutions. This trend is further supported by the growing volume of patient data generated through EHRs and other digital health technologies.

The North America Clinical Data Analytics in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Optum, Inc. (UnitedHealth Group), Oracle Corporation (Cerner), McKesson Corporation, Veradigm Inc. (formerly Allscripts Healthcare Solutions), Koninklijke Philips N.V. (Philips Healthcare), SAS Institute Inc., Epic Systems Corporation, Medidata Solutions (Dassault Systèmes), Health Catalyst Inc., IQVIA Inc., GE HealthCare Technologies Inc., Siemens Healthineers AG, Verily Life Sciences LLC (Alphabet Inc.), Cognizant Technology Solutions Corp., eClinical Solutions LLC, CareEvolution, LLC, Inspirata, Inc., Altera Digital Health Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of clinical data analytics in North America is poised for significant advancements, driven by technological innovations and evolving healthcare needs. As organizations increasingly adopt AI and machine learning, the ability to analyze vast datasets in real-time will enhance decision-making processes. Furthermore, the shift towards value-based care models will necessitate more sophisticated analytics tools, ensuring that healthcare providers can deliver personalized care while optimizing costs. This evolving landscape presents numerous opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Real-Time Analytics |

| By End-User | Hospitals & Health Systems Ambulatory Care Centers Research & Academic Institutions Health Insurance Providers Pharmaceutical & Biotechnology Companies Others |

| By Application | Patient Care Management Clinical Decision Support Operational & Administrative Analytics Population Health Management Financial Analytics Precision Medicine Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | United States Canada Mexico |

| By Data Source | Electronic Health Records (EHR) Claims & Billing Data Clinical Trials Data Patient-Generated Health Data Genomic Data Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Freemium/Trial |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Analytics Adoption | 120 | Chief Information Officers, Data Analysts |

| Clinical Decision Support Systems | 90 | Clinical Managers, IT Specialists |

| Patient Data Management Solutions | 60 | Healthcare Administrators, Compliance Officers |

| Telehealth Data Analytics | 50 | Telehealth Coordinators, Data Scientists |

| Predictive Analytics in Healthcare | 70 | Healthcare Economists, Research Analysts |

The North America Clinical Data Analytics in Healthcare Market is valued at approximately USD 13.1 billion, driven by the increasing adoption of electronic health records (EHRs) and the demand for data-driven decision-making in healthcare.