Region:North America

Author(s):Dev

Product Code:KRAB0610

Pages:98

Published On:August 2025

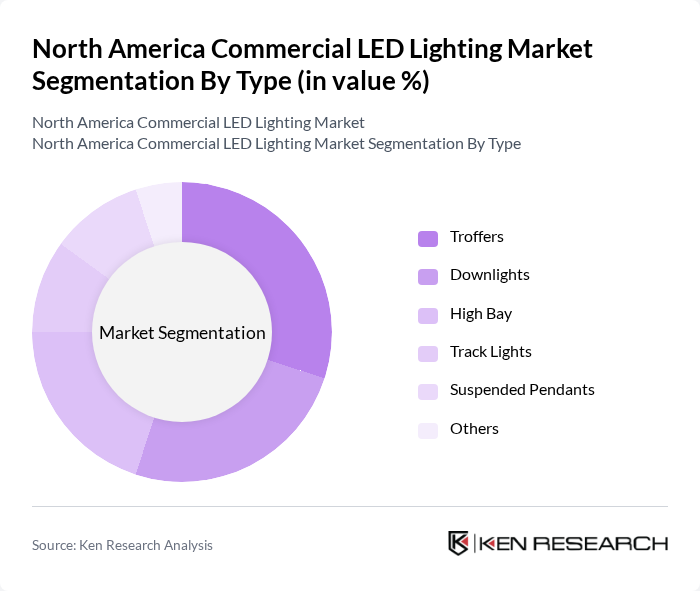

By Type:The market is segmented into Troffers, Downlights, High Bay, Track Lights, Suspended Pendants, and Others. Each type addresses specific commercial applications and user requirements, shaping overall market dynamics .

The Troffers segment leads the market, driven by their extensive use in offices, schools, and retail spaces. Their compatibility with drop ceilings and ease of retrofitting existing fixtures with LED Troffers make them a preferred solution for energy-efficient upgrades. Downlights follow, valued for their versatility and modern design, supporting a wide range of commercial lighting needs .

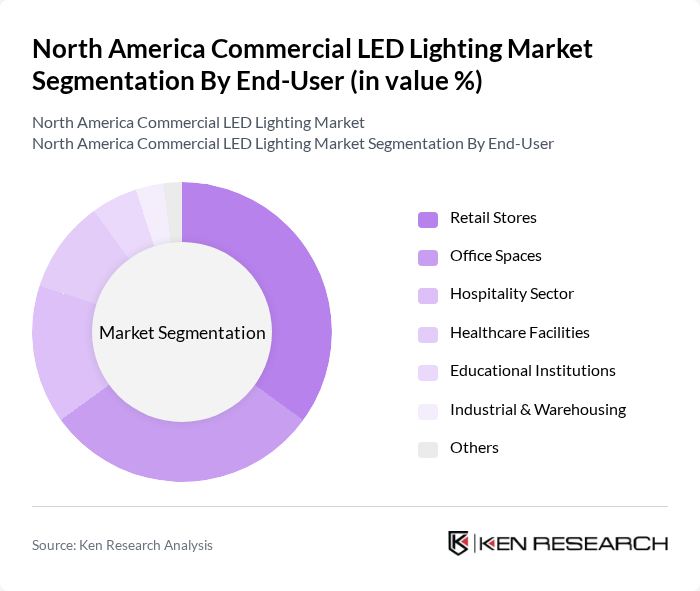

By End-User:The market is segmented by end-user into Retail Stores, Office Spaces, Hospitality Sector, Healthcare Facilities, Educational Institutions, Industrial & Warehousing, and Others. Each segment has distinct lighting requirements influencing procurement and adoption patterns .

Retail Stores represent the largest end-user segment, driven by the need for enhanced product visibility, energy savings, and improved customer experience. Office Spaces are also a major segment, with organizations seeking to optimize energy use and employee productivity through advanced lighting solutions .

The North America Commercial LED Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), Cree Lighting USA LLC, Acuity Brands, Inc., Eaton Corporation plc, General Electric Company (GE Lighting, a Savant company), OSRAM GmbH, Hubbell Lighting, Inc., Cooper Lighting, LLC (a Signify company), Panasonic Corporation, Toshiba Corporation, Lutron Electronics Co., Inc., Zumtobel Group AG, Nichia Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Nora Lighting, Technical Consumer Products, Inc., Votatec Group Corp., Constellation Lighting U.S. contribute to innovation, geographic expansion, and service delivery in this space.

The North America commercial LED lighting market is poised for significant evolution, driven by the increasing integration of smart technologies and sustainability initiatives. As businesses prioritize energy efficiency and environmental responsibility, the demand for advanced lighting solutions will continue to rise. Furthermore, the ongoing development of IoT-enabled lighting systems is expected to enhance operational efficiency and user experience, creating a dynamic landscape for innovation and investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Troffers Downlights High Bay Track Lights Suspended Pendants Others |

| By End-User | Retail Stores Office Spaces Hospitality Sector Healthcare Facilities Educational Institutions Industrial & Warehousing Others |

| By Application | General Lighting Task Lighting Accent Lighting Architectural Lighting Others |

| By Distribution Channel | Direct Sales Wholesale/Retail Online Retail Distributors Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Smart LED Technology Standard LED Technology Energy-Efficient LED Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Lighting | 120 | Facility Managers, Energy Efficiency Coordinators |

| Retail Store Lighting Solutions | 80 | Store Managers, Visual Merchandisers |

| Industrial Facility Lighting | 60 | Operations Managers, Safety Officers |

| Outdoor and Street Lighting | 50 | City Planners, Public Works Directors |

| Hospitality Sector Lighting | 50 | Hotel Managers, Interior Designers |

The North America Commercial LED Lighting Market is valued at approximately USD 8.0 billion, driven by the demand for energy-efficient lighting solutions and advancements in LED technology, alongside sustainability initiatives in commercial environments.