Region:North America

Author(s):Rebecca

Product Code:KRAD0189

Pages:89

Published On:August 2025

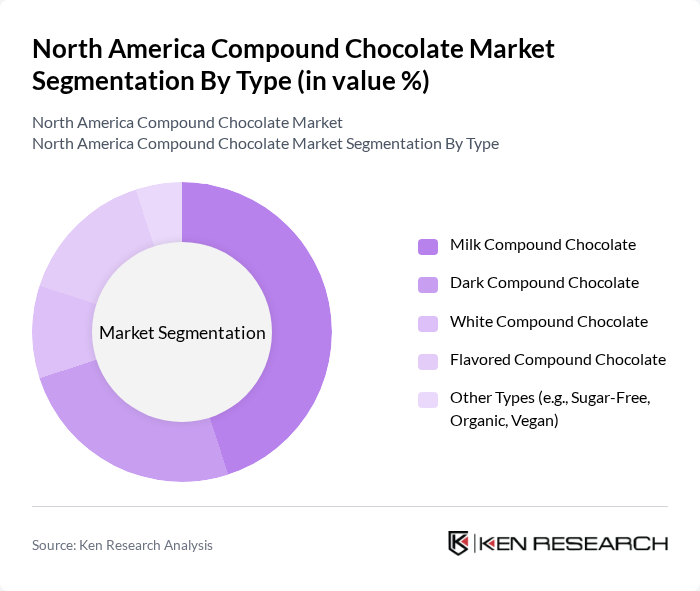

By Type:The compound chocolate market is segmented into various types, including Milk Compound Chocolate, Dark Compound Chocolate, White Compound Chocolate, Flavored Compound Chocolate, and Other Types (e.g., Sugar-Free, Organic, Vegan). Milk Compound Chocolate remains the most popular due to its creamy texture and sweet flavor, appealing to a broad consumer base. Dark Compound Chocolate is gaining traction as health-conscious consumers seek products with higher cocoa content and lower sugar levels. Flavored variants are also on the rise, driven by innovative product development and changing consumer preferences. Clean label and health-positioned compound chocolates are experiencing rapid growth, reflecting a broader trend toward natural ingredients and reduced sugar content .

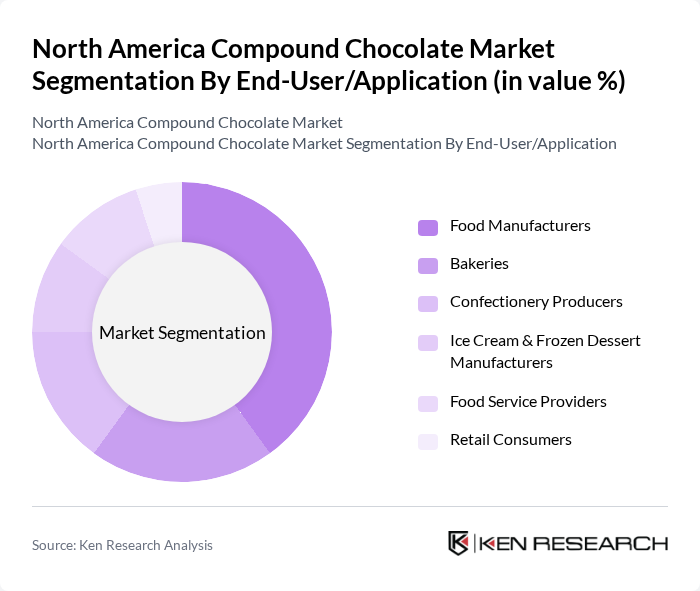

By End-User/Application:The market is further segmented by end-user applications, including Food Manufacturers, Bakeries, Confectionery Producers, Ice Cream & Frozen Dessert Manufacturers, Food Service Providers, and Retail Consumers. Food Manufacturers are the leading segment, utilizing compound chocolate in a wide range of products such as snacks, baked goods, and confectionery. Bakeries and Confectionery Producers also represent significant portions of the market, driven by the demand for affordable chocolate ingredients. The rapid growth of e-commerce and food service providers has further expanded the reach of compound chocolate products, with online chocolate sales in North America growing by over 150% in recent years .

The North America Compound Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut AG, Cargill, Incorporated, Mondel?z International, Inc., The Hershey Company, Nestlé S.A., Fuji Oil Holdings Inc., Blommer Chocolate Company, Archer Daniels Midland Company, Olam International Limited, E. Guittard Chocolate Company, Ghirardelli Chocolate Company, Guittard Chocolate Company, Chocoladefabriken Lindt & Sprüngli AG, TCHO Ventures, Inc., SweetWorks Confections LLC contribute to innovation, geographic expansion, and service delivery in this space.

The North America compound chocolate market is poised for significant growth, driven by evolving consumer preferences and innovative product offerings. As health-conscious consumers increasingly seek alternatives, manufacturers are likely to focus on developing products with natural ingredients and lower sugar content. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing brands to reach a broader audience. Collaborations with food manufacturers may also enhance product visibility and distribution, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Compound Chocolate Dark Compound Chocolate White Compound Chocolate Flavored Compound Chocolate Other Types (e.g., Sugar-Free, Organic, Vegan) |

| By End-User/Application | Food Manufacturers Bakeries Confectionery Producers Ice Cream & Frozen Dessert Manufacturers Food Service Providers Retail Consumers |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Foodservice/Wholesale Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging |

| By Price Range | Economy Mid-range Premium |

| By Region | United States Canada Mexico Rest of North America |

| By Product Form | Chips/Drops/Chunks Coatings Blocks/Slabs Other Forms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 120 | Regular Chocolate Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 60 | Logistics Coordinators, Supply Chain Analysts |

| Market Trend Analysis | 90 | Market Analysts, Industry Experts |

The North America Compound Chocolate Market is valued at approximately USD 7.5 billion, reflecting a significant growth trend driven by the increasing demand for affordable chocolate alternatives in the confectionery and bakery sectors.